Previous Session Recap

The Bench Mark KSE100 Index Opened at 42811.27, posted day high of 42865.59 and day low of 42583.10. The session suspended at 42622.37 with net trading volume of 138.21 million shares. Daily trading volume of KSE100 listed companies dropped by 36.57 million shares or 20.93% on DOD bases.

Foreign Investors remained in net selling position of 12.60 million shares and net value of Foreign Inflow dropped by 11.15 million US Dollars during last trading sessiion. Categorically, Foreign Individuals and Corporate Investors remained in net selling position of 0.25 and 14.64 million shares respectively. Overseas Pakistanis remained in net buying position of 2.29 million shares. While on the other side, Local Individuals and Mutual Funds remained in net buying position of 14.47 and 6.86 million shares respectively but Local Companies, Banks and Brokers remained in net selling position of 4.98, 2.12 and 5.52 million shares respectively.

During the Month of Nov. 2016, Foreign Investors remained in net selling position of 43.18 million shares and Foreign Inflow dropped by 117.05 million US Dollars. Foreign Investors have offloaded 0.61 million extra shares in Nov. 2016 then their net buying in month of Oct. 2016 as in Oct. They remained in buying position of 42.57 million shares but in Nov. they remained in net selling position of 43.18 million shares.

Analytical Review

Oil prices, and energy shares swept higher on Thursday after OPEC agreed to cut crude output to clear a glut, while the dollar and bond yields rose sharply on prospects that resulting inflationary pressures will lead to higher interest rates. The Organization of the Petroleum Exporting Countries on Wednesday agreed to its first output cut since 2008, finally taking action having seen global oil prices fall by more than half in the last two years. Non-OPEC Russia will also join output reductions for the first time in 15 years. U.S. crude oil CLc1 soared more than 9 percent overnight to a one-month high just shy of $50.00 a barrel. The contracts were a fraction lower at $49.42 a barrel early on Thursday. Brent crude LCOc1 was just below $52.00 a barrel after rallying to a six-week peak of $52.37.

The world largest oil exporters agreed on Wednesday to cut output for the first time in eight years to erode a global supply overhang that has persisted for two years and halved the value of a barrel of crude. The Organization of the Petroleum Exporting Countries said it would agree to limit crude oil output to a maximum of 32.5 million barrels per day starting Jan.1 for six months. The cut was at the low end of production of a preliminary agreement struck in Algiers in September, and reduces production from a current 33.64 million bpd

The Investment and Savings Investment is targeted to grow at 17.7 per cent of the Gross Domestic Product (GDP) during the ongoing fiscal year (2016-17) to promote sustained, indigenous and inclusive growth.The fixed investment is expected to grow at 16.1 per cent of the GDP in 2016-17 whereas the national savings, as percentage of the GDP, is targeted at 16.2 per cent, official sources said.The investment under the China Pakistan Economic Corridor (CPEC) is expected to improve the overall investment climate in the country, they added.According to official data, improvement in the investment- friendly environment as a result of affordable energy, increased profitability, high capacity utilization rate, finance availability and reduced political and economic uncertainty will help attain the investment target for 2016-17.

The government has announced an increase of Rs 2 per litre in the price of petrol to be effective from today (Thursday) and stated that RON 92 would be available across the country against RON 87. Addressing a news conference, Finance Minister Ishaq Dar also disclosed that the government would also collect Rs 100 GST on one MMBTU price of gas reduced for industry from Rs 600 to Rs 400. Price of one MMBTU gas for industry would in fact be Rs 500 ie Rs 400 basic price and Rs 100 GST.

Pakistan has suspended cotton imports from its top supplier, India, saying shipments failed to fulfil phyto-sanitary certification, threatening the $822 million-a-year trade, government and industry officials told Reuters. Traders say rising hostility between the neighbours might have prompted Pakistan to restrict imports. The decision will help other cotton suppliers such as Brazil and the United States to increase exports to Pakistan.

PSO, POL, MUREB and GATM can lead market in positive direction.

Technical Analysis

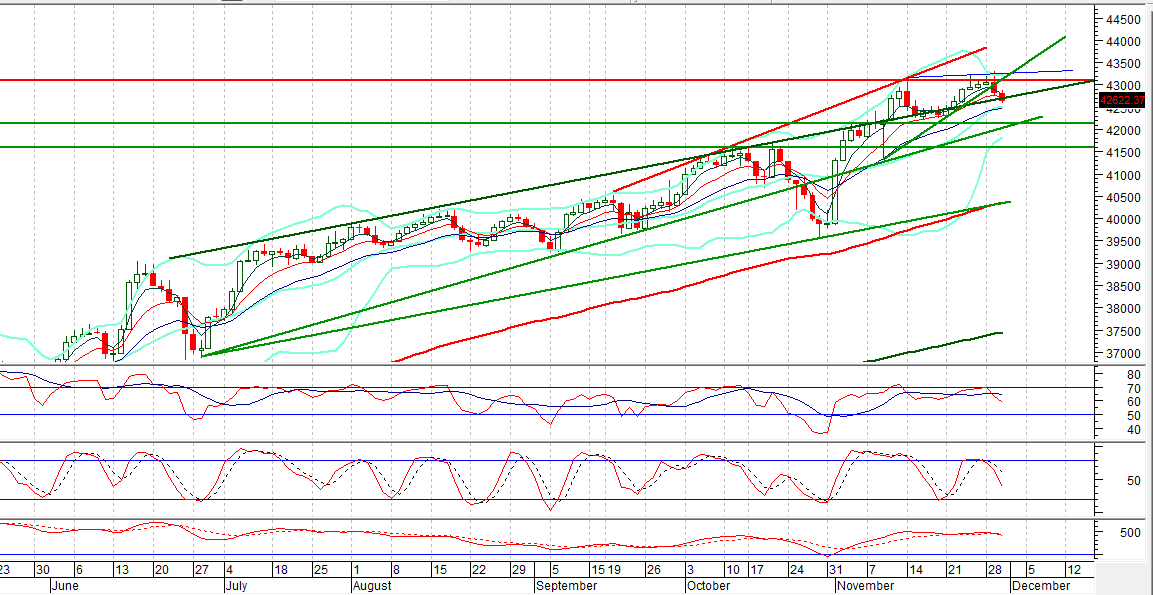

The Bench Mark KSE100 Index is coming back after getting resistance from a resistant trend line at 43267 points, next upcoming supportive regions from where a bounce back can be expected are 42460 and 42128 points. For fresh buying, 42128 region could be attractive if market would not be able to close below that level. WTI Crude Oil prices have spiked towards 49.80 USD/bbl in reaction to OPEC and Russian production cut announcements which is a supportive indicator for Oil and Gas sector along with a price increment in Petroleum products. For current trading session, Oil & Gas sector can change market sentiment. Buying in selective scripts with strict stop loss can be initiated on dip.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.