Previous Session Recap

The Benchmark KSE100 Index Opened at 48909.78 with a positive gap of 59 points, posted day high of 49142.77 and day low of 48349.36 during last trading session. The session suspended at 48757.67 with net change of -214.57 points and net trading volume of 162.09 million shares. Daily trading volume of KSE100 listed companies dropped by 22.06 million shares or 11.98% on DOD bases.

Foreign Investors remained in net selling position of 4.16 million shares and net value of Foreign Inflow dropped by 6.66 million shares. Categorically Foreign Individuals and Overseas Pakistani Investors remained in net buying position of 0.012 and 1.59 million shares respectively but Foreign Corporate Investors remained in net selling of 5.76 million shares. While on the other side Local Individuals, Companies and NBFCs remained in net buying position of 18.35, 10.02 and 0.27 million shares respectilvey but Local Banks Mutual Funds and Brokers remained in net selling position of 2.86, 4.37 and 21.28 million shares respectively.

Analytical Review

Japanese Nikkei share average posted the biggest daily decline since November on Tuesday as uncertainty over U.S. President Donald Trump policies weighed on investor sentiment. The Nikkei fell 1.7 percent to 19,041.34 points, posting the biggest daily percentage drop since Nov. 9, after Trump was elected as U.S. president. Global stocks had their biggest loss in six weeks after Trump signed an executive order on Friday to ban travel to the United States from seven Muslim-majority countries, including legal residents and visa holders, and temporarily halted the entry of refugees. Over the weekend, thousands of people rallied in major U.S. cities and at airports in protest.

In a long and detailed rejoinder to his critics, Finance Minister Ishaq Dar says that the country debt profile is in fact improving, and predictions of doomsday scenario for Pakistan regarding public debt are overblown. To highlight the point, he provides a comparison in growth of debt between his government and that of his predecessor. The previous government contracted net debt of around Rs7,833 billion during its term (2008-13), he says, which averages out to an annual compounded growth rate of 19.0 per cent. By contrast, the same figure for the three years of his own government is 9.75pc, he says, providing detailed breakdowns of the figures for each of the periods.

A new report by the World Bank reveals that politically connected firms in Pakistan received 45 per cent more credit than others between 1996 and 2002. Such loan recipients were less productive and had 50pc higher default rates, says World Development Report 2017. Based on the productivity gap between firms, the annual cost of this credit misallocation could have been as high as 1.6pc of GDP, the report says.

The much-publicized September, 14, 2015 Prime Ministers Kissan Package has failed to benefit small farmers as the government has released only Rs 25 billion out of the envisaged Rs 40 billion cash assistance while progress on other aspects of the package has been slow. An official of Ministry of National, Food, Security and Research - monitoring and implementing entity of the Prime Ministers Kissan Package of Rs 341 billion - acknowledged that there were major hiccups in implementation of the package. Procedure is very difficult for small farmers and only influential people have been able to benefit from it, he added.

Three LNG-based power plants in public sector would add 2400 MW to the national grid by September this year and would achieve full potential of 3600 MW by January next year. According to Radio Pakistan, these include two funded by Government of Pakistan at Haveli Bahadur Shah and Balloki and one by Punjab Government at Bhikki, Three gas turbines have already reached site and three more would reach by April this year. Bhikki Plant has already been connected to national grid and expected to generate first 800 MW by March this year. Work on installation, testing and grid connection is going on in full speed on all the three sites.

CSAP and Overall Oil and Gas Sector (specifically PSO, ATRL, APL) can lead market in positive direction.

Technical Analysis

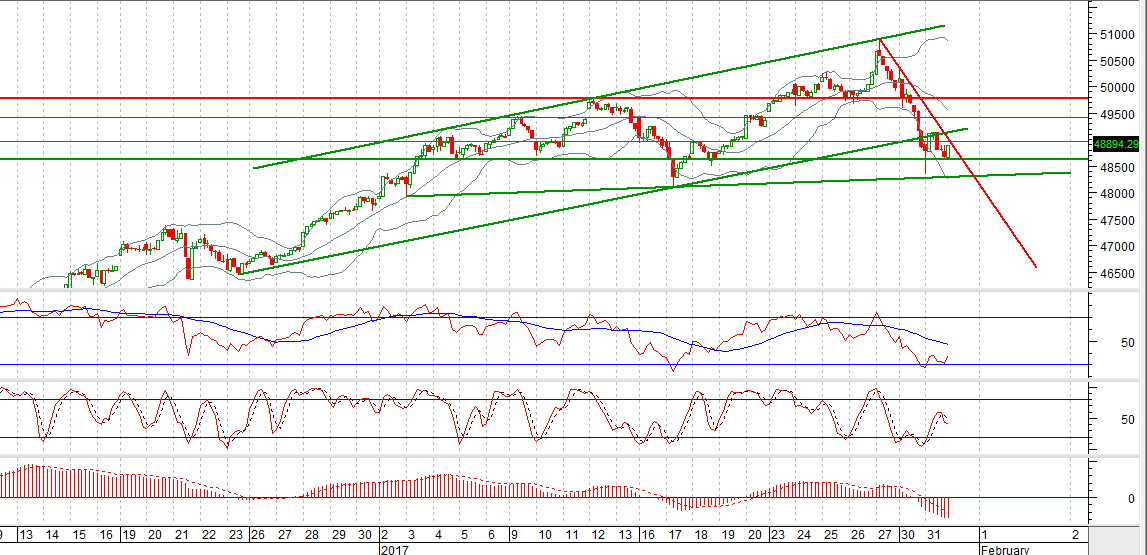

The Benchmark KSE100 Index is moving in an upward price channel on hourly chart and right now it is trying to get support from supportive trend line of said channel and 100% expansion of its last bearish correction. It is capped by a resistant trend line at correction levels of its last 2000 points bearish rally and major resistant regions stand at 49426 and 49770, it may continue its bearish momentum until it closes above 49770. For current trading session, it may try to bounce back from 48632 but momentum will remain bearish as ultimate target on charts seems 48105. If it is able to bounce back from its supportive region then a new history high would be witnessed while completing its 5th wave of Elliot wave but trading with strict stop loss is recommended until index closes above 49770. For Current trading session index seems to open with a positive gap.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.