Previous Session Recap

The Bench Mark KSE100 Index Opened at 48541.91, posted a day high of 48636.35 and a day low of 48146.68 during last trading session whereas session suspended at 48534.23 with net change of 13.48 points and net trading volume of 87.72 million shares. Daily trading volume of KSE100 listed companies dropped by 7.28 million shares or 7.66%, DoD basis. Index has dropped by 223.44 points during month of Feburary 2017. During the month of Feburary Index opened at 48757.67, posted a month high of 50322.55 and a month low of 48146.68. Trading volume of KSE100 listed companies squeezed to 2.8 billion shares during Feburary which was comparatively lower of about 1.54 billion or 35.5% than January 2017

Foreign investors remained in net selling position of 16.18 millon shares and net value of Foreign Inflow dropped by 9.2 million US Dollars during the last trading session. Categorically Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling position of 0.03, 15.45 and 0.7 million shares respectively. While on the other hand Local Companies, Banks, NBFCs and Brokers remained in net buying position of 0.69, 10.13, 0.14 and 9.18 million shares respectively,but Local Individuals and Mutual Funds remained in net selling position of 8.64 and 2.16 million shares.

Analytical Review

The dollar and Treasury yields jumped on Wednesday after Federal Reserve officials jolted traders by suggesting an interest rate rise may be imminent even as markets remained on tenterhooks ahead of a looming speech by U.S. President Donald Trump. Stock markets in Asia were also pulled lower on concerns Trump address to a joint session of Congress may lack the details investors are seeking, though those worries were partially offset by official data showing Chinese manufacturing sector expanded faster than expected in February. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS were down about 0.2 percent, while Chinese stocks .CSI300 .SSEC were little changed. Japanese Nikkei .N225 soared 1.2 percent, buoyed by a weaker yen and data showing manufacturing activity expanded in February at the fastest pace in almost three years. Australian shares were off 0.2 percent, paring losses as gross domestic product data confirmed the economy returned to growth in the fourth quarter.

Expressing displeasure over imprudent financial policy and management practices in power companies, the National Electric Power Regulatory Authority (Nepra) on Tuesday directed all the distribution companies of Water and Power Development Authority (Wapda) to refund Rs3.23 per unit to consumers for overcharging them in January. At a public hearing presided over by Nepra chairman Tariq Saddozai, the Central Power Purchasing Agency (CPPA) sought a cut of Rs1.62 per unit in tariff because of lower-than-estimated fuel prices in January. The regulator, however, did not allow an 11-year-old claim of Rs9.8 billion filed by the CPPA on behalf of power companies and partial load charges for some private producers in violation of power-purchase agreement.

Iran has temporarily lifted a ban on kinno imports from Pakistan after a break of almost six years, but has restricted the imports to the land route only, i.e. via the Sistan and Baluchestan province. Pakistan’s embassy in Tehran, through a letter, has informed the Ministry of Commerce that Iran has lifted the ban for only 21 days (until April 20). Waheed Ahmed, patron-in-chief of Pakistan Fruit and Vegetables Exporters, Importers and Merchant Association (PFVA), said exporters would try their best to capitalise on this opportunity despite the fact that the lifting of the ban was limited and came at a time when the season of kinno in Pakistan was drawing to a close.

Repatriation of profits and dividends on foreign investments increased further in the first seven months of this fiscal year. The State Bank of Pakistan (SBP) reported on Tuesday that the foreign companies repatriated $1.090 billion during the July-January period as against $1.058bn in the corresponding period last year, a rise of over three per cent. The inflow of foreign direct investment (FDI) also improved during the period to $1.161bn, but the outflow of dollars was higher by $71m. The rising outflow of dollars in recent years is creating problems compelling the government to borrow short-term loans from the commercial market amid declining inflows. The country’s reserves have also dropped sharply in recent months.

The Federal Board of Revenue (FBR) has protested against a waiver of withholding tax (WHT) on dividends allowed last week by the government to a Chinese company for setting up of $1.5 billion Matiari-Lahore Transmission Line Project. Informed sources said another transmission line of the size and length of 878-kilometre Matiari-Lahore line was being envisaged by the power ministry to evacuate future power generation from Thar-based plants and the same tax breaks would need to be extended to that line, too.

ATRL,NMLandOverAll Oil and Marketing Companies(PSO and SHEL)can lead the market in the positive direction.

Technical Analysis

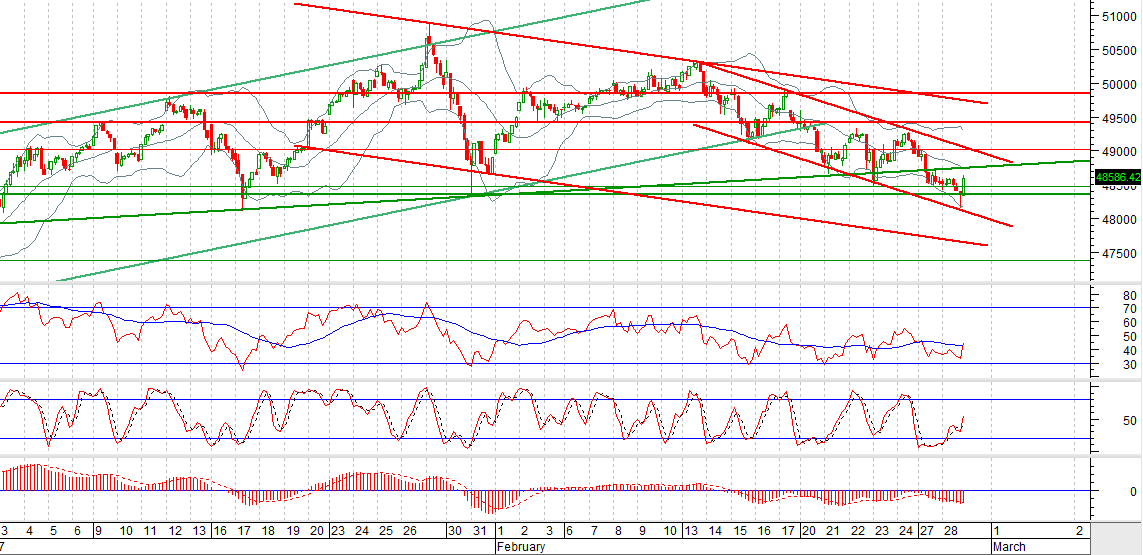

The Bench Mark KSE100 Index has breached its supportive region in bearish channel but it did not close below this region. As of now it has a supportive region ahead where double bottom is forming from where it might have a chance of bouncing back on intraday basis but trend would still be in bearish channel. This bearish channel is capped by two major resistant trend lines at 49105 and 49723. It is expected that it will still remain in bearish channel until it closes above49960. For Current trading session it may bounce back from 48300 or 48100 and towards 48747 or 49049, where it might face a strong resistance. Daily closing below 48300 will call for 47900 and 47400 in coming sessions. Considering current trading session, if it closes above 48765 then it will call for 49021. But if index closes above 49049, a major correction of the whole bearish rally is expected at 49440 from where a new trend could be initiated. If KSE100 index fails to recover from its bearish rally trading with stop loss is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.