Previous Session Recap

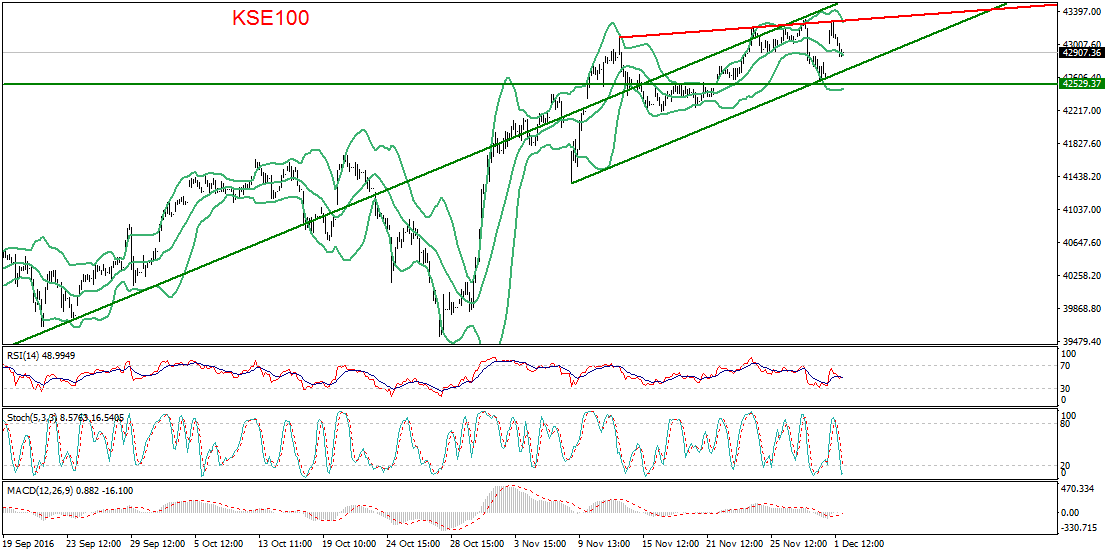

The Bench Mark KSE100 Index Opened at 42622.37, posted day high of 43280.43 and day low of 42622.37 during last trading session while session suspended at 42907.36 with net change of 284.99 points and net trading volume of 175.75 million shares. Daily trading volume of KSE100 listed companies increased by 37.54 million shares or 27.16% on DOD bases.

Foreign Investors remain in net selling of 18.63 million shares and net value of Foreign inflow dropped by 8.63 million US Dollars. Categorically Foreign Individuals, Corporate and Overseas Pakistani Investors remain in net selling of 111, 15.11 and 2.41 million shares respectively. While on the other side Local Individuals and Brokers remain in net selling of 1.14 and 6.6 million shares but Local Companies, Banks and Mutual Funds remain in net buying of 5.6, 9.56 and 8.28 million shares respectively.

Analytical Review

Asian shares lost some of their recent gains on Friday, after lackluster sessions on Wall Street and Europe, while 10-year U.S. Treasury yields and crude futures pulled back from multi-month highs hit overnight. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dropped 0.6 percent, but remained on track to end the week up 0.6 percent. Japanese Nikkei .N225, which jumped to an 11-month high on Thursday, slipped 0.6 percent on Friday. It is set for a weekly gain of 0.1 percent. South Korean shares .KS11 dropped 0.7 percent, extending weekly losses to 0.25 percent, after opposition parties said they would propose a motion later on Friday to impeach President Park Geun-hye over an influence-peddling scandal, with the intention of holding a vote on her impeachment on Dec. 9. Chinese CSI 300 index .CSI300 retreated 0.5 percent, shrinking gains for the week to 0.3 percent. Hang Seng index .HSI, which gave up 0.9 percent, is heading for a 0.2 percent weekly loss.

Annual inflation fell to 3.81 per cent in November from 4.21pc in the preceding month on the back of decline in perishable food prices, the Pakistan Bureau of Statistics said on Thursday. The main inflation measured by Consumer Price Index (CPI) has been on rise since August 2016. The index rose 0.2pc month-on-month in November as compared to 0.8pc in October and 0.6pc in November 2015. CPI tracks prices of nearly 500 commodities every month across the country. Annual inflation target was projected at 6pc for the year 2016-17. In the previous fiscal year, average annual inflation was recorded at 2.86pc.

Federal Minister for Commerce Khurram Dastgir Khan Thursday said that despite diplomatic tension between Pakistan and India trade regime has not been changed. "The government is working to make every input items, including machinery import, zero rated for export sector from the next fiscal year while the proposed package for exports-oriented sector is still in field and may be announced anytime soon," the minister said while briefing the Senate Standing committee on Textile Industry which met with Mohsin Aziz in the chair.

Federal Minister for Petroleum and Natural Resources, Shahid Khaqan Abbasi has said that oil production of Pakistan has increased to over 0.1 million barrel per day (bpd) for the first time in the history while the state owned Oil and Gas Development Company (OGDC) is producing over 50,000bpd.

Pakistan exported 626,289 metric ton wheat flour worth $198 million, to 27 different countries and 450 metric ton of wheat, worth $158,000, to Afghanistan and Malaysia in financial year 2015-16. A total of 229 metric ton of wheat has been exported from Pakistan, worth $77,000, in the first 2 months of current financial year 2016-17, according to official documents.

PSO, POL, MUREB and GATM can lead market in positive direction.

Technical Analysis

The Bench Mark KSE100 Index Opened with a gap of 407.24 points or 0.96% at 43029.61 points on Intraday or Hourly chart and faced a resistance at 43280.43 from a resistant trend line on intraday chart which pushed it back towards Intraday correction of 61.8% at 42860.97 points. Right now it have completed its 61.8% Intraday correction during last trading session but it still have not filled its gap, for current trading session it have supportive region around 42693 and 42529 points.While resistant regions stands around 43307 points on Intraday Chart. Hourly Chart is trying to generate a bullish crossover while Daily MOARSI is also ready for a bullish pullback. Swing trading with strict stop loss could be beneficial on PSX for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.