Previous Session Recap

The Benchmark KSE100 Index Opened at 48963.60 with a positive gap of 69 points, posted day high of 49514.10 and day low of 48963.60 during last trading session. The session suspended at 49455.86 with net change of 698.19 points and net trading volume of 180.49 million shares. Daily trading volume of KSE100 listed companies increased by 18.39 million shares or 11.35% on DOD bases.

Foreign Investors remained in net selling position of 7.73 million shares and net value of Foreign Inflow dropped by 8.35 million US Dollars. Categorically Foreign Corporate and Individuals remained in net selling position of 9.69 million shares and 9700 shares respectively but Overseas Pakistanis remained in net buying position of 1.97 million shares. While on the other side, Local Individuals, Banks, Mutual Funds and Brokers remained in net buying position of 9.85, 3.51, 7.41 and 14.59 million shares respectively but Local Companies and NBFCs remained in net selling position of 26.42 and 2.65 million shares respectively.

Analytical Review

Asian shares ticked up while the dollar was capped on Thursday after the U.S. Federal Reserve stuck to its mildly upbeat economic view but gave no hint of any immediate rate hike. While strong economic data from the United States and elsewhere underpinned risk assets, uncertainty and concerns over U.S. President Donald Trump policies are leaving markets on edge. With many of his cabinet members still not approved, including (incoming Treasury Secretary Steven) Mnuchin, Trump occasional remarks and tweets are the only guidance markets can get from the new U.S. administration at the moment, said Shuji Shirota, head of macro strategy group in Tokyo at HSBC. For the time being, markets will continue to be driven by what Trump will say. It is Trump-on, Trump-off, rather than risk-on, risk-off, he added. MSCI broadest index of Asia-Pacific shares outside Japan gained 0.2 percent while Japanese Nikkei also ticked up 0.05 percent.

Inflation rate eased to 3.66 percent year-on-year in January, a touch lower from 3.70 percent in December, the Bureau of Statistics said on Wednesday. On a month-on-month basis, prices increased by 0.18 percent in January compared with December, the bureau said. The rise in month-on-month inflation was mostly due to higher prices of food items such as cucumber, pomegranate and oranges, as well as the cost of house rent, petrol and diesel.

Pending an inquiry sought by the government, the National Electric Power Regulatory Authority (Nepra) has overturned its decision taken more than two years ago that held the K-Electric Ltd (KEL) top hierarchy involved in overbilling its consumers and issuing unjustified and inflated bills to maximise revenue. The authority (Nepra) modifies the impugned decision dated June 10, 2014 to the extent that KEL must ensure that no such kind of incident takes place in the future, said an order signed by all the four members including chairman of the regulator. Having said that, further proceedings on the show-cause initiated under Nepra (Fines) Rules, 2002 on this cause of action have been closed.

Prime Minister Nawaz Sharif said on Wednesday Pakistan strategic location has potential to make it Asia’s premier trade, energy and transport corridor. We believe this transaction (Engro FrieslandCampina deal) will be instrumental in positioning Pakistan as an attractive investment destination. The partnership will allow consumers more choice in segment of high quality dairy products. It will also support the farming community of the country, he said.

The five-member bench of Supreme Court (SC) on Wednesday has adjourned the Panama Leaks case hearing till Monday due to heart ailment of Justice Sheikh Azmat Saeed. According to latest reports, the decision was taken due to the illness of Justice Azmat Saeed, who is part of the Supreme Court bench hearing the Panama Leaks case. Head of the bench Justice Asif Saeed Khosa said that doctors have removed blockage in Justice Azmats vessels while he has also underwent successful angiography without any stenting.

PSO, APL, TREET, ATRL and DSL can lead market in positive direction.

Technical Analysis

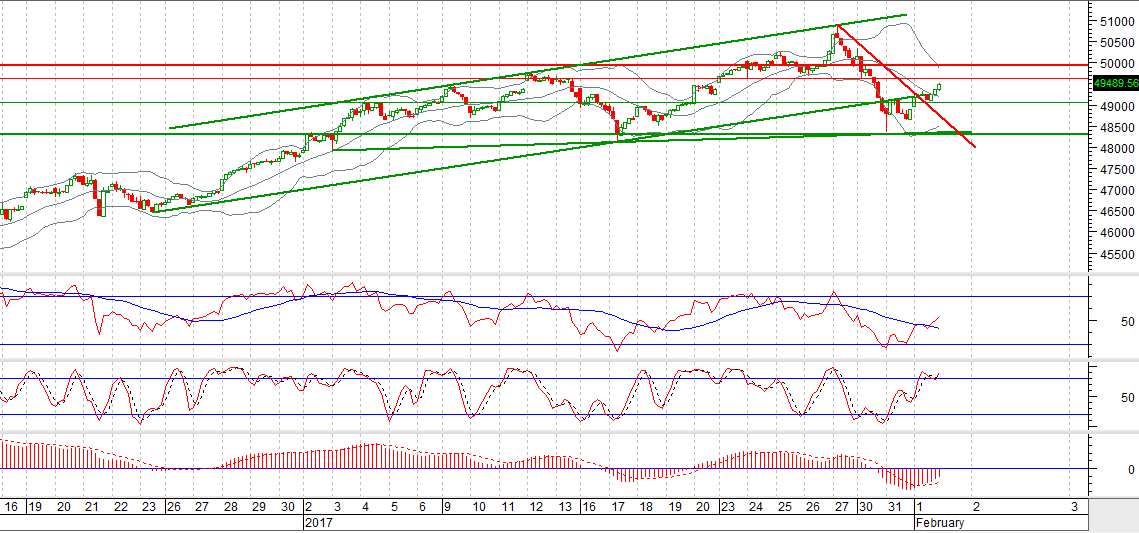

The Benchmark KSE100 Index is trying to recover from its last bearish dropdown of around two thousand points, during last two days it still has recovered less than 50% of that rally. Therefore, current trading session means a lot for Index as 50% and 61.8% correction levels of said rally are ahead at 49630 and 49948 which will react as strong resistances for current bullish sentiment. Its expected that Index will try to go ahead with a gap opening beyond its 50% correction but if it does not close above its 50% correction then a new bearish rally for expansion of current correction will be witnessed. Major Index participants are also standing at 50% to 61.8% correction levels so a gap could pump some fresh air in market for further upward spike to complete fifth wave of its intraday Elliot wave. Trading with strict stop loss is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.