Previous Session Recap

The Bench Mark KSE100 Index Opened at 47526.46 with a gap of 101.83 points, posted day high of 47713.34 and day low of 47495.66 during last trading session. The session suspended at 47666.66 with net change of 242.03 points and net trading volume of 197.64 million shares. Daily trading volume of KSE100 Index Increased by 56.79 million shares or 40.32% on DOD bases. The Bench Mark KSE100 Index has gained 14850.35 points or 45.25% on Year till Date bases in 2016.

Analytical Review

After a late-year rally fueled by the U.S. election pushed stocks to surprising new peaks, investors are wary that the market could be primed for a spill to start 2017. The benchmark S&P 500 .SPX is set to post a roughly 10 percent price gain for 2016 and around 12 percent on a total return basis, including reinvested dividends. That tops the single-digit increase expected by market participants polled by Reuters a year ago, with more than half of the advance coming after Donald Trump Nov. 8 presidential victory. The Dow Jones Industrial Average .DJI was on pace to rise more than 13 percent for 2016, with a total return above 16 percent. From here, though, investors expect the S&P 500 to rise by mid-single-digits in 2017, according to a Reuters poll earlier this month.

Economic Co-ordination Committee (ECC) of the Cabinet has reportedly set aside the objections of Finance Ministry on the award of 660 KV HVDC( 4000 MW) Matiari-Lahore transmission line contract amounting to $1.5 billion to a Chinese company without technical and financial evaluation which is a violation of Transmission Line Projects Policy 2015.

The national exchequer is facing billions of rupee loss due to theft of crude oil through illegal extraction from the main oil transmission line, use of water bowzers and through connivance with public officials. According to an inquiry report prepared by Federal Investigation Agency (FIA), the subject enquiry has been registered... under the directions of the competent authority. The matter had previously been probed by National Crises Management Cell, Ministry of Interior, Islamabad as well as the energy department of the Khyber Pakhtunkhwa (KP) government. In both the previous enquiries, it has been concluded that oil worth billions of rupees had been stolen by the culprits and the national exchequer has been caused huge losses whereas the provincial government has been deprived of millions of rupees under the head of royalty.

While rejecting the requests of existing sugar mills for an upward revision of bagasse- fired electricity, National Electric Power Regulatory Authority (Nepra) has formally approved upfront tariff of Rs 7.82 per unit for sugar mills which is already applicable under Nepra Interim Power Procurement (Procedure & Standards) Regulations - 2005.

The federal and provincial data pertaining to crude oil production/supplies, petroleum products and effective sales tax rate on POL products would be used to finalise an equitable mechanism or formula for sales tax collection on the services of inter-city transportation of POL products. According to the letter of Member Tax Reforms Commission (TRC) Ashfaq Tola, who has been assigned to submit a comprehensive report on this issue, he sought data pertaining to 2015-16 and 2014-15 from the Ministry of Petroleum for finalisation of the equitable mechanism or formula for sales tax collection on the services of inter-city transportation of petroleum (POL) products. The exercise is aimed at resolving issue between the Federal Board of Revenue (FBR) and provincial sales tax authorities regarding input tax adjustment on provincial sales tax on the services of inter-city transportation of POL products.

SMBL, ISL, DSL, GAIL and DFML can lead market in positive direction.

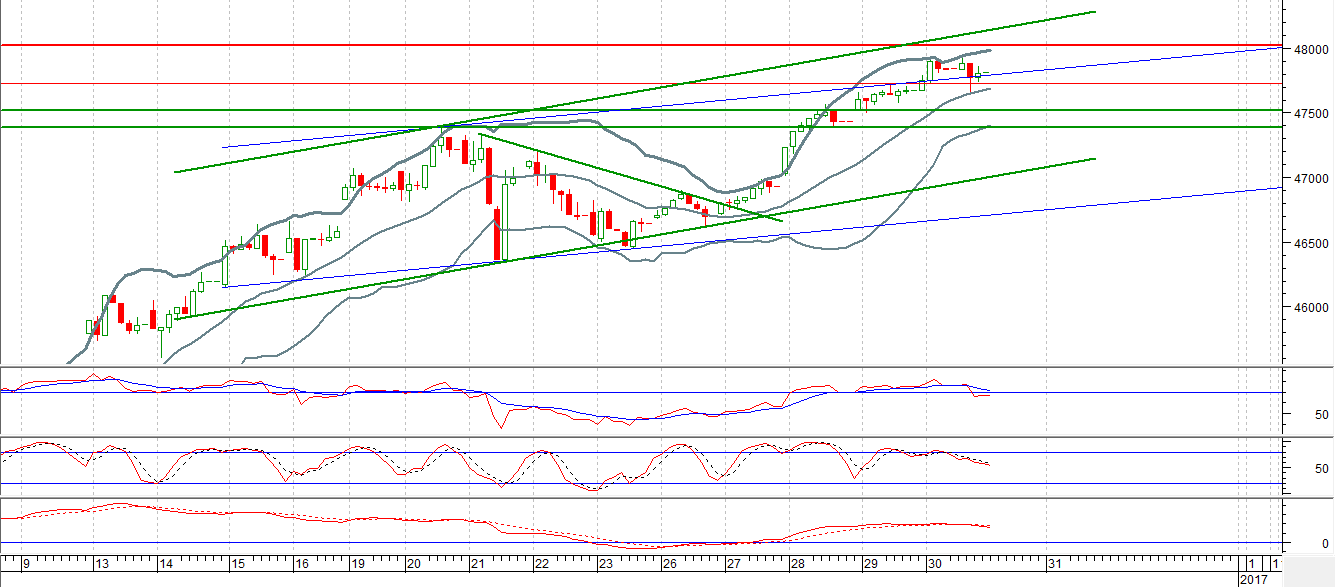

Technical Analysis

The Bench Mark KSE100 index has formed a new bullish trend channel on hourly chart after breakout of its triangle and right now its heading towards 48021, it has a resistant region at 47940 where it can face a slight resistance from its previous high but after breakout of that level index can target 48021 to complete 100% expansion of said correction. Crude Oil prices are inching up which can pump some fresh air in oil sector which may result in shape of a spike in Index.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.