Previous Session Recap

The Bench Mark KSE100 Index opened at 47982.55, posted a day high of 48210.74 and a day low of 47678.83 during last trading session, whereas session suspended at 48155.93 with a net change of 206.60 points and net trading volume of 136.34 million shares. Daily trading volume of KSE100 listed companies increased by 32.07 million shares or 30.76% on DoD basis.

Foreign Investors remained in net selling position of 7.71 million shares and net value of Foreign Inflow dropped by 2.91 million US Dollars. Categorically Foreign Corporate and Overseas Pakistani investors remained in net selling position of 6.23 and 1.58 million shares but Foreign Individuals remained in net buying position of 0.1 million shares. While on the other side Local Individuals and Banks remained in net selling position of 13.91 and 8.86 million shares but Local Companies, NBFCs, Mutual Funds and Brokers remained in net buying position of 23.5, 2.09, 2.32 and 2.7 million shares respectively.

Analytical Review

Asian shares started the week modestly higher on Monday after a bumper quarter as investors look to the shape of U.S. trade and economic policies and how they could affect global growth. MSCI broadest index of Asia-Pacific shares outside Japan rose 0.3 percent, while Japanese Nikkei gained 0.4 percent after hitting a seven-week low on Friday. Ex-Japan Asia MSCI had gained 12.3 percent in the last quarter, its biggest quarterly gain in 6-1/2 years and almost double the 6.4 percent rise in MSCI broadest gauge of the world stock markets covering 46 markets. The rally was primarily underpinned by signs of a pickup in momentum in the global economy, led by China. South Korean trade data for March released over the weekend added to the evidence of improving global demand, with exports rising more than expected. While a private survey on Chinese manufacturing on Saturday came in below market expectations it still showed a healthy expansion after a similar survey by the government on Friday pointed to strong growth in the sector.

THE government raised 156.18bn Rupees from the auction of MTBs of various tenors last Thursday, smaller against the received bids of 197.52bn Rupees. It was however, higher against the auction target of 100bn Rupees. Of the total raised amount, three month T-bills fetched the highest 90.06bn Rupees at a cut off yield of 5.99pc, followed by six month T-bill 66.12bn Rupees at 6.01pc. Six month T-bill attracted the highest amount of 102.04bn Rupees. six month T-bill 95.48bn Rupees. No bids were received for 12 month T-bills. The government raised 28.56bn Rupees from the auction of PIBs on March 24, smaller against the received bids of 70.83bn Rupees.

Funding from the Islamic Development Bank (IDB) for development projects in Pakistan under the country partnership strategy has almost come to a halt because the bank currently has no such programme for the country in place. The previous partnership strategy covering a four-year period ended in 2015, and the Jeddah-based Islamic bank has not yet finalised a fresh strategy, according to official sources. After completion of the 2012-15 partnership strategy, the government had requested the IDB to undertake the repeater strategy in line with the country’s five-year development plan and ‘Vision 2025’.

PUNJAB plans to revive its cotton area and production to its historical level this season seems to be running aground. Normally, the province cultivates cotton on 6m acres, harvesting around 10m bales. Over the last few years, however, the acreage has dropped sharply and hit a historically low of 4.3m acres. Last year production fell to 6.9m bales, which alarmed the officials, industrial and farming sectors. Punjab made a serious effort to restore the crop output to the previous record level in a single year — 6m acres and 10m bales. The basis of this optimism, as stated by the officials, was the price recovery of around 25pc over the last year and a plan to combat — what had become a limiting factor — the pink bollworm attack on the crop.

Baluchistan produces 17 percent of the total natural gas in the country; however, the province consumed only 2 percent natural gas during 2015-16, according to the Oil and Gas Regulatory Authority (Ogra) report. The gas consumption in all the provinces have increased during the year 2015-16; however, it was decreased in Baluchistan where the gas consumption was reduced by 4 mmcfd from 55 mmcfd in 2014-15 to 51 mmcfd in 2015-16, said the Ogra report on the State of the Regulatory Petroleum Industry 2015-16. In Punjab, the consumption increased from 1035 mmcfd in 2014-15 to 1154 mmcfd in 2015-16, Sindh consumption from 1139 mmcfd to 1256 mmcfd while KP consumption increased from 241 mmcfd to 266 mmcfd, the report maintained. The report said that Sindh and Punjab are the biggest gas consumers with 46 percent and 42 percent share respectively, followed by Khyber Pakhtunkhwa and Baluchistan using 10 percent and 2 percent gas, respectively.

DSL, TRG, NML and Overall Automobile Sector (INDU and PSMC) can lead the market in the positive direction.

Technical Analysis

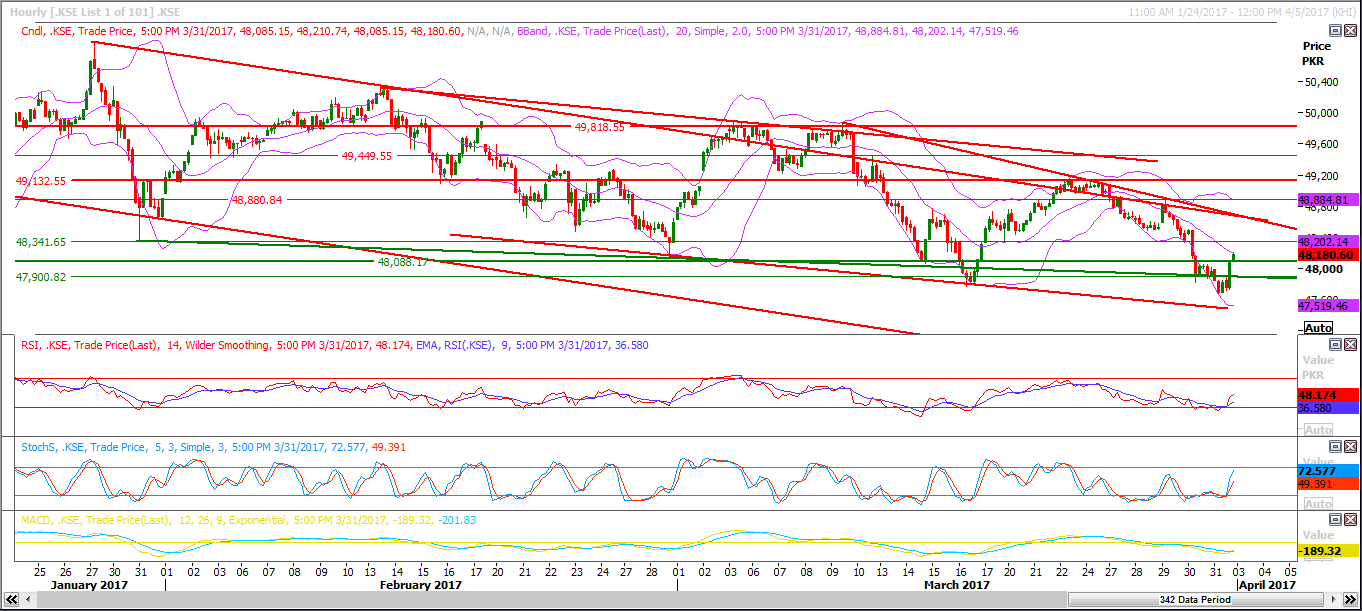

The Bench Mark KSE100 Index has bounced back after completing its Elliot wave on hourly chart for a correction and right now it has supportive regions around 48088 and 47900 while resistant regions are standing at 48351 and 48436 where it can face resistance. For current trading session buying on dips is recommended with strict stop losses as market seems bullish during next few trading sessions as it has to complete its correction of its Elliot wave. New buying could be initiated for very short term basis. Market is still not bullish on mid and long term basis until it closes above 49960 therefore posting stop losses on buyings could be beneficial.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.