Previous Session Recap

The Benchmark KSE100 Index Opened at 49594.14 with a positive gap of 105 points, posted day high of 49933.91 and day low of 49426.87 during last trading session. The session suspended at 49665.97 with net change of 210.11 points and net trading volume of 177.99 million shares. Daily trading volume of KSE100 listed companies dropped by 2.5 million shares or 1.38% on DOD bases.

Foreign Investors remained in net selling position of 5.69 million shares and net value of Foreign Inflow dropped by 6.21 million US Dollars. Categorically Foreign Individuals, Corporate and Overseas Pakistani Investors remained in net selling position of 0.53, 3.47 and 1.68 million shares respectively. While on the other side, Local Companies, Banks, NBFCs and Mutual Funds remained in net buying position of 0.48, 1.51, 7.57 and 2.53 million shares respectively but Local Individuals and Brokers remained in net selling position of 4.43 and 2.05 million shares respectively.

Analytical Review

Asian stocks got off to a tentative start on Friday, as investors await the outcome of a key U.S. monthly jobs report that will set the tone for the Federal Reserve policy outlook and as Chinese markets reopen after a week-long break. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was flat after touching its highest level since mid-October in the previous session. Morning trade in markets such as Australia was broadly steady, while Japanese Nikkei share average was up 0.6 percent. A strong reading in the payrolls data above 200,000 coupled with a rise in wage growth could put the March 15th (Federal Reserve) meeting in serious contention for a hike despite uncertainty around the potential flow on effects from Trump stated economic policies, James Woods, global investment analyst at Rivkin Securities in Sydney.

First dry bulk terminal of Pakistan will open next month and is expected to handle three million tonnes a year of coal imports, rising to 20 million tonnes over the next five years, the port’s chief executive said on Thursday. The $285 million Muhammad Bin Qasim Port, which was built with support from the World Bank, will also be used to export cement and clinker, Mr Sharique Siddiqui, chief executive for Pakistan International Bulk Terminal, told Reuters at a coal conference in Cape Town. Pakistani cement factories and a growing number of coal-fired power plants are expected to provide most of the demand at the new port, Mr Siddiqui said.

The Oil and Gas Regulatory Authority (Ogra) has opened floodgates to oil marketing companies (OMCs) by granting 21 fresh licences in just six months compared to only 20 over the past 70 years. The new 21 companies given licences between July-December 2016 are expected to invest about Rs10.5 billion over the next few years to set up storages and filling stations in various parts of the country. This comes at a time Ogra has been struggling for effective monitoring and enforcement of the existing oil marketing companies mainly because of workforce and technological constraints. This was one of the reasons behind a nationwide petrol crisis about two years ago.

Secretary Water and Power Dr Muhammad Younis Dhaga on Thursday said that 6500 megawatts electricity will be added to the National grid by October this year. In an interview with Radio Pakistan, he said that the government will focus on generation of Thar coal and hydle electricity as the electricity generated from fuel is costly. He said the provision of cheap electricity to all is the vision of Prime Minister under whose leadership the government is taking all measures for generation of electricity through cheaper sources. Dr Younis Dhaga said in the second phase 9000 megawatts of electricity will be added in the National Grid by March next year after which load shedding will end forever.

The five-member bench of Supreme Court (SC) on Wednesday has adjourned the Panama Leaks case hearing till Monday due to heart ailment of Justice Sheikh Azmat Saeed. According to latest reports, the decision was taken due to the illness of Justice Azmat Saeed, who is part of the Supreme Court bench hearing the Panama Leaks case. Head of the bench Justice Asif Saeed Khosa said that doctors have removed blockage in Justice Azmats vessels while he has also underwent successful angiography without any stenting.

Market is expected to remain volatile today.

Technical Analysis

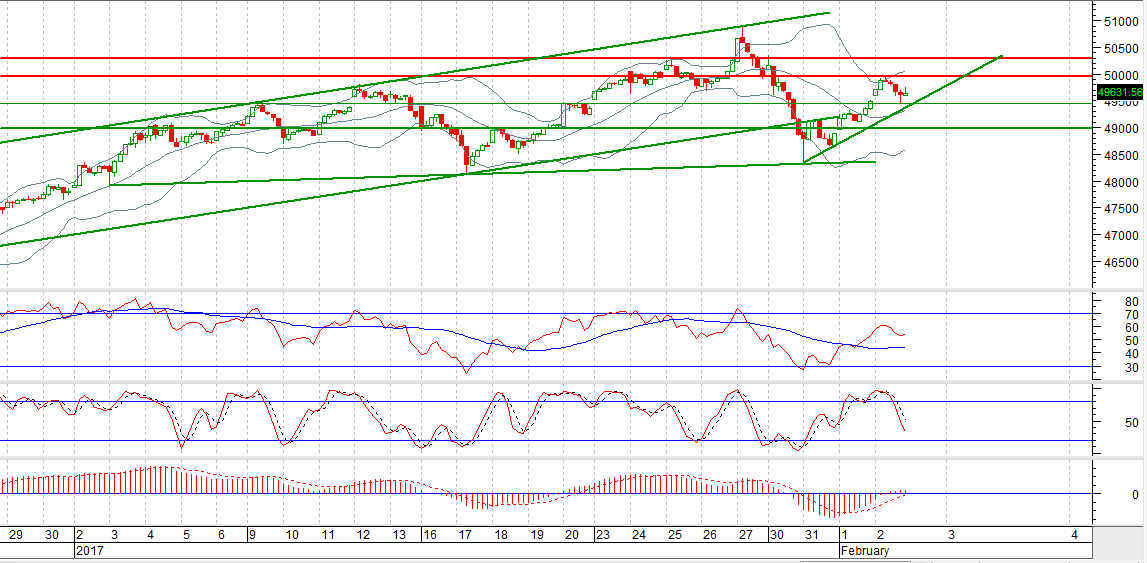

The Benchmark KSE100 Index is resisting at 61.8% Fibonacci level while completing fifth wave of its bullish Elliot pattern. The index is finding support by a rising trend line along with a strong horizontal supportive region around 49400. It may attempt to close above its corrective levels today. However, being the last trading day of the week, traders must stay cautious as failure to sustain 61.8% level may trigger a Bear run leading to 48000 in the coming sessions. On the other hand, closing above 61.8% Fibonacci level will call for a new Historical high. Trading with strict stop loss is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.