PSX Trading Activity Overview:

The Bench Mark KSE100 Index Opened at 40295.52, posted day high of 40580.33 and day low of 40245.47 points while session suspended at 40541.81 with net change of 246.29 points and trading volume of 176.79 million shares during last trading session. Daily trading volume of KSE100 listed companies dropped by 58.07 million shares or 24.73% on DOD bases. Market Capitalization of KSE100, ALLSHR and KSE30 Indices increased by 12.86, 63.35 and 5.33 billion Rs or 0.61, 0.78 and 0.38 percent respectively on DOD bases.

Foreign Investors remain in net selling of 12.21 million shares and net value of foreign inflow dropped by 8.43 million US Dollars during last trading session. Categorically Foreign Individuals, Corporate and Overseas Pakistanis remain in net selling of 52000 shares, 11.71 million shares and 0.45 million shares respectively. While on the other hand Local Companies, Mutual Funds and Brokers remain in net buying of 23.95, 0.13 and 1.89 million shares respectively but Local Individuals and Banks remain in net selling of 5.08 and 8.15 million shares.

PSX have not become sucessful in attracting foreign investors during month of sep. 2016 as foreign inflow dropped by 39.93 million US Dollars during the month and they remaiin in net selling of 61.67 million shares. Weekly and monthly Net trading volume of Foreign Investors remain in selling as during last week foreign investors remain in net selling of 10.98 million shares while during whole month of Sep. 2016 Foreign Investors remain in net selling of 61.67 million shares. Categorically Local Individual Investors remain in net buying of 124.54 million shares during Sep. but Banks and Brokers remain in net selling of 67.25 and 69.91 million shares respectively.

Foreign Investors remain in net selling of 12.21 million shares and net value of foreign inflow dropped by 8.43 million US Dollars during last trading session. Categorically Foreign Individuals, Corporate and Overseas Pakistanis remain in net selling of 52000 shares, 11.71 million shares and 0.45 million shares respectively. While on the other hand Local Companies, Mutual Funds and Brokers remain in net buying of 23.95, 0.13 and 1.89 million shares respectively but Local Individuals and Banks remain in net selling of 5.08 and 8.15 million shares.

PSX have not become sucessful in attracting foreign investors during month of sep. 2016 as foreign inflow dropped by 39.93 million US Dollars during the month and they remaiin in net selling of 61.67 million shares. Weekly and monthly Net trading volume of Foreign Investors remain in selling as during last week foreign investors remain in net selling of 10.98 million shares while during whole month of Sep. 2016 Foreign Investors remain in net selling of 61.67 million shares. Categorically Local Individual Investors remain in net buying of 124.54 million shares during Sep. but Banks and Brokers remain in net selling of 67.25 and 69.91 million shares respectively.

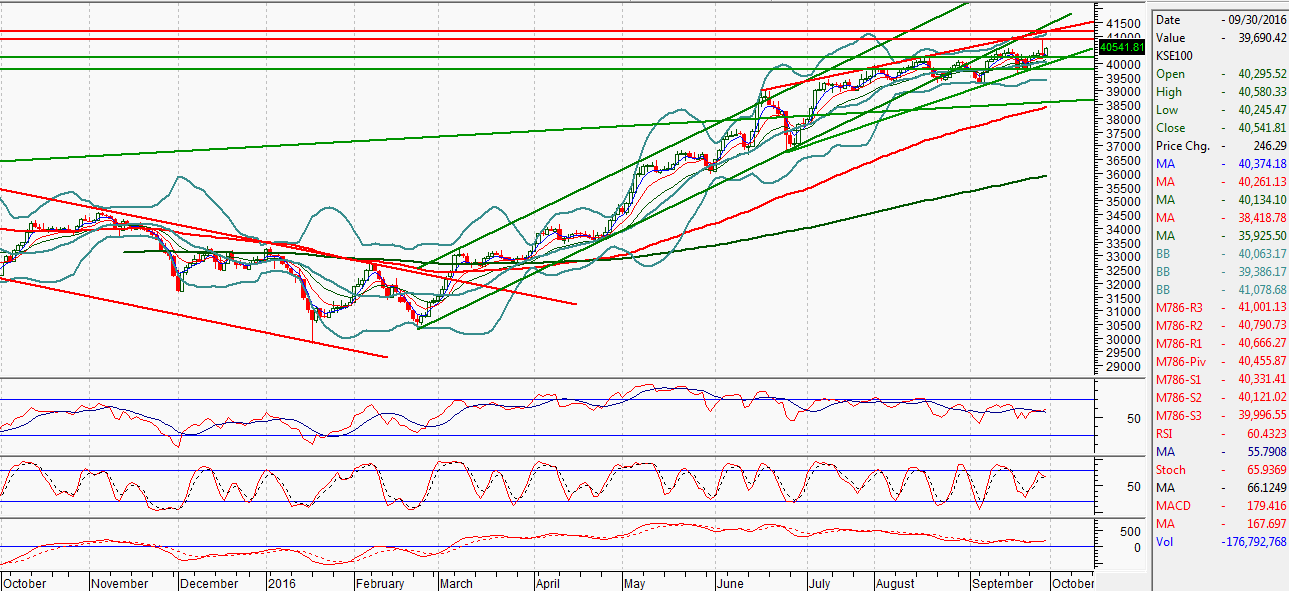

PSX Daily Technical Overview

The Bench Mark KSE100 Index was moving in an upward price channel on daily and weekly charts but right now it have penetrated its daily chart in bearish direction. Its also capped by a resistant trend line on Daily Chart which can push it back from 40879 points while first suportive region after this pullback would be 40113 points and second one would be 39336 points. On bases of Technical Analysis its not recommended to intiate massive new buying at PSX as its expected that it can start a correction from upcoming 400 points, but right now some selective shares are looking attractive as they already have completed their corrections and they will support index from massive crash during correction so new buying could be initiated in only selective shares. PAEL, BYCO,DGKC, ENGRO, SING, SNGP, QUICE, TPL and FFBL are lookig attractive on current prices as they already have completed their corrections.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

PSX Weekly Technical Overview

On Weekly Charts KSE100 Index have generated a bullish engulfing pattern but negative effects of last evening start still have not been disappeared. It also have penetrated its bullish trend channel in negative direction and right now its cagged in a bullish wedge. Downward penetration of that wedge will call for a downfall of around 1000 Points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

PSX Comparison with Int. Indices:

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.