Previous Session Recap

The Bench Mark KSE100 Index Opened at 48155.93, posted a day high of 48384.02 and a day low of 48120.93 during last trading session whereas the session suspended at 48227.75 with net change of 71.82 points and net trading volume of 64.96 million shares. Daily trading volume of KSE100 listed companies dropped by 71.38 million shares or 52.35% on DoD basis.

Foreign Investors remained in net buying position of 5.62 million shares and net value of Foreign Inflow increased by 5.52 million US Dollars. Categorically Foreign Individual, Corporate and Overseas Pakistani Investors remained in net buying position of 0.065, 4.58 and 0.98 million shares respectively. whereas on the other side Local Companies remained in net buying position of 1.79 million shares but Local Individuals, Banks, Mutual Funds and Brokers remained in net selling position of 2.79, 0.66, 3.05 and 0.28 million shares respectively.

Analytical Review

Asian share markets were down in skittish early trade on Tuesday as investors held their breath ahead of a potentially tense meeting between U.S. President Donald Trump and his Chinese counterpart Xi Jinping later this week. The dollar inched lower as investors sold stocks in Europe and on Wall Street overnight to seek shelter in safe havens as political uncertainty overshadowed positive U.S. economic data and solid growth in global manufacturing. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.2 percent in early trade. Japanese Nikkei .N225 was down 0.4 percent as investors sought out the safe-haven yen. China, Hong Kong, Taiwan and India are closed for holidays. We head into Tuesday on a distinct risk-off vibe, although the moves in equities are probably best described as drift, rather than a spike lower, Chris Weston, chief market strategist at IG in Melbourne, wrote in a note. Overnight, U.S. stock indexes closed in the red after Trump held out the possibility of using trade as a lever to secure Chinese cooperation against North Korea in an interview with the Financial Times on Sunday.

Re-gasified Liquefied Natural Gas (RLNG) supply to CNG stations in Punjab was suspended at 7am this morning (Tuesday morning), as the government has diverted RLNG to power generation plants to cope with the loadshedding. The CNG sector is number four on the priority list therefore the supply of RLNG was suspended to gas stations across Punjab, an official source told The Nation here on Monday. Although the CNG association was informed by the Sui Northern Gas Pipelines Limited (SNGPL) that due to maintenance of the LNG terminal RLNG supply has been discontinued but in reality the gas was diverted to cover the reduction in hydel power generation, the official said. In December 2016, gas supply to CNG stations in Punjab was suspended and it was told that it was due to maintenance. Maintenance takes place once a year and not every four months, the official said.

Pakistan Textile Exporters Association Chairman Ajmal Farooq has said that the prime minister export package would prove ineffective in boosting exports as extreme cash flow crunch is gradually eroding the biggest job providing textile export sector. In a statement here on Monday, he said that textile exporters are badly deprived of liquidity as major portion of their working capital has been blocked in refund cycle and under such extreme financial stress it seems impossible to achieve target of enhancing the country export by 2 to 3 billion by June 2018. He said the Prime Minister Trade Enhancement Initiatives is a right move but inadequate funding would result in failure of getting desired results. Giving example, he said that due to short releases of funds, half of the incentives of Textile Policy (2009-14) are still yet to be disbursed. Giving details, he said that claims of Rs10,300 million are still outstanding against export finance mark-up support, Rs1,500 million against Mark-up Rate Support, Rs19,405 million against Technology Up-gradation Fund Rs7,431 million are outstanding against Drawback of Taxes & Levies (DLTL).

Pakistan inflation rate has sharply increased to 4.9 percent in March due to hike in prices of food commodities as well as fuel. The inflation measured through consumer price index (CPI) has recorded at 4.9 percent in March as against same month of the previous year, Pakistan Bureau of Statistics (PBS) said on Monday. Inflation is continuously enhancing from last few months due to visible impact of the recent increase in petroleum prices as well as rising food prices. The State Bank of Pakistan (SBP) in its recent report has noted that average CPI inflation has risen from 2.1 percent in first half (July-December) FY16 to 3.9 percent as in the same period of the FY17 which reflects higher domestic demand and an increase in global commodity prices. However, it highlights that on year-on-year basis, the CPI inflation has fluctuated in a narrow range during this period. However, the Monetary Policy Committee of SBP has decided to keep the policy rate unchanged at 5.75 percent.

The World Trade Organisation Monday set up a panel to examine the so-called "surrogate country" approach used by the European Union to calculate anti-dumping measures applied to Chinese exports, following a request from Beijing. When China joined the WTO in 2001, it was agreed that other member states could treat it as a non-market economy for 15 years. The deadline passed late last year, but the EU still wants to operate on rules that protect it from cheap Chinese products flooding its markets.

NML,NCL, and Overall Steel Sector (ISL and ASL) can lead the market in the positive direction.

Technical Analysis

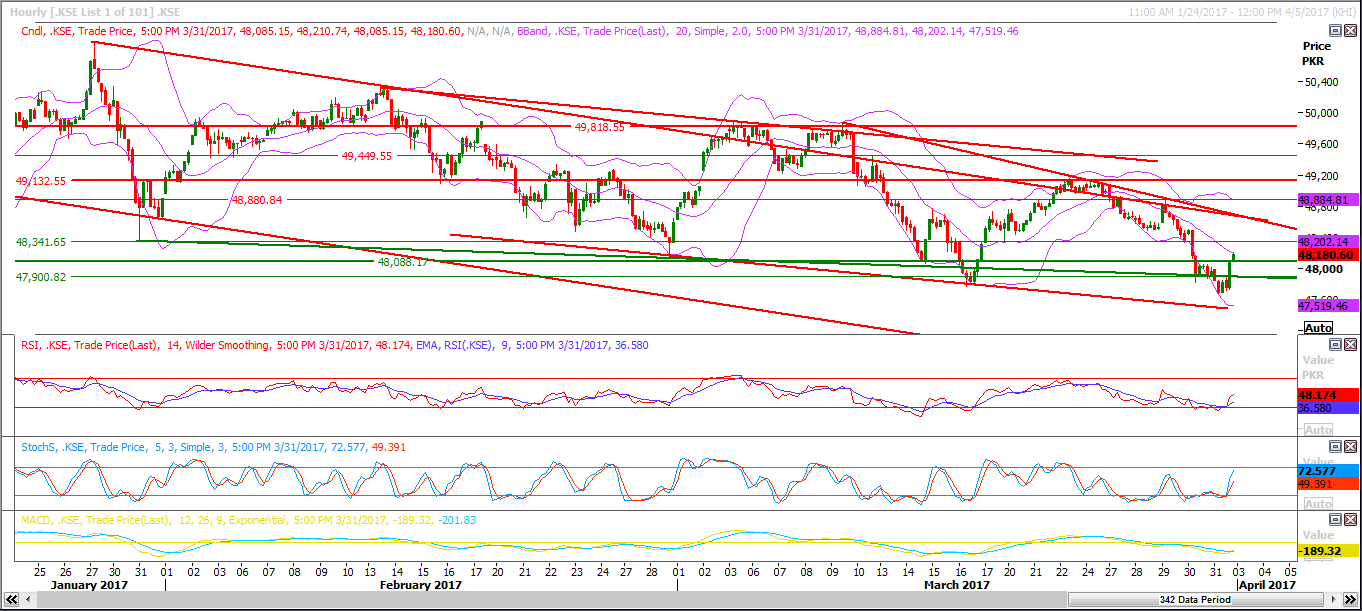

The Bench Mark KSE100 Index has bounced back after completing its Elliot wave on hourly chart for correction and right now it has supportive regions around 48088 and 47900 whereas resistant regions are standing at 48351 and 48436 where it can face resistance. For current trading session buying on dips is recommended with strict stop losses as market seems bullish during next few trading sessions as it has to complete its correction of its Elliot wave. so that new buying could be initiated for very short term basis. Market is still not bullish on mid and long term basis until it closes above 49960 therefore posting stop losses on buyings could be beneficial.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.