Previous Session Recap

The Bench Mark KSE100 Index opened with a positive gap at 48297.93 but in first hour dropped towards day low of 47906.38 and then recovered towards day high of 48924.08 during last trading session but session suspended at 48824.55 with net change of 587.27 points and net trading volume of 210.06 million shares. Daily trading volume of KSE100 listed companies increased by 28.63 million shares or 15.78% on DOD bases.

Foreign Investors remained in net selling position of 6.71 million shares but net value of Foreign Inflow increased by 1.34 million US Dollars. Categorically Foreign Individuals, Corporates and Overseas Pakistani Investors remained in net selling position of 0.07, 5.23 and 1.41 million shares respectively. While on the other side Local Individuals, Mutual Funds and Brokers remained in net selling position of 10.27, 3.15 and 2.0 million shares respectively but Local Companies, Banks and NBFCs remained in net buying position of 15.4, 3.56 and 2.89 million shares respectively.

Analytical Review

The U.S. dollar held firm on Tuesday as the prospect of rising U.S. interest rates this year kept sentiment bullish, while a surprisingly upbeat reading on Chinese manufacturing gave the Aussie dollar a lift. A holiday in Japan made for quiet early trade, leaving the dollar steady around 117.40 yen JPY= but well up on Friday trough of 116.05. Against a basket of currencies, the dollar was up 0.5 percent at 102.720 .DXY. The euro was sulking at $1.0475 EUR despite strong manufacturing data for the single currency bloc, having surrendered all of Friday brief spike to $1.0700.

The Prime Minister Secretariat has shown serious concerns over the slow progress of RLNG 1200 MMCFD Pipeline Augmentation Project being undertaken by gas utilities - Sui Northern Gas Pipeline Limited (SNGPL) and Sui Southern Gas Company Limited (SSGCL) and has directed the Ministry of Petroleum and Natural Resources to expedite the work which is critical for 3600 MW LNG based power projects.

The price of compressed natural gas (CNG) has been increased in Punjab after CNG Association has announced its decision, according to private news channels. A channel claimed that Rs 2.20 per kilo increase in the CNG price but another channel quoted CNG Association as saying that Rs 1.50 per kilo increase was made.

The Federal Board of Revenue (FBR) witnessed a shortfall of more than Rs127 billion in collection for the first half of the current fiscal year. The government faces the challenge of achieving a fiscal deficit target of 3.8 per cent of the GDP for 2016-17 owing to its lower-than-expected revenue collection so far. Tax officials believe the situation will not be any different in January and February because of uncertainty prevailing in the economic ministries. Incumbent FBR Chairman Nisar Khan and Finance Secretary Dr Waqar Masood Khan are set to retire this month.

State Bank of Pakistan (SBP) Governor Ashraf Mahmood Wathra said on Tuesday the central bank will extend all kinds of support to the stakeholders of the textile industry. He said this at a meeting of the Senate Standing Committee on Textiles that took place at the SBP headquarters to discuss the problems faced by the textile industry and seek proposals for its sustainability.

Overall Refineries (specifically ATRL, BYCO), Overall Textile Sector (specifically GATM, NCL) and EFERT can lead market in positive direction.

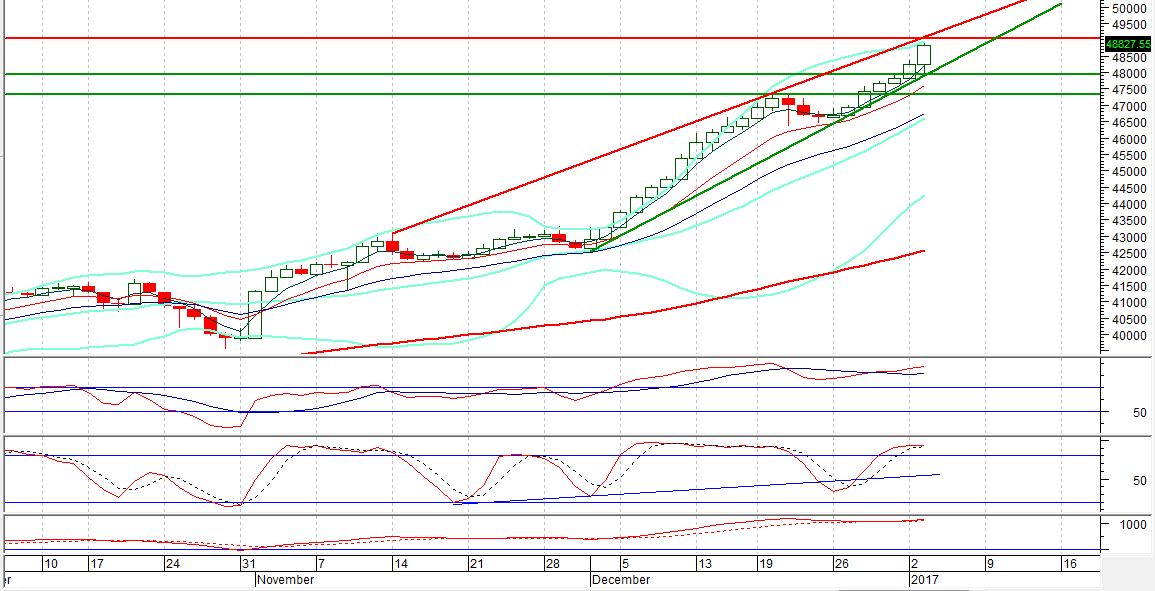

Technical Analysis

The Bench Mark KSE100 Index is capped by a resistant trend line on daily chart at 49274 points, as it has penetrated its bullish hourly trend channel in upward direction so a corrective move can be expected for it to come back in said price channel. Trading with strict stop losses is recommended in current scenario. Crude Oil prices have dropped in international market which can put some pressure on oil sector.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.