Previous Session Recap

The Bench Mark KSE100 Index Opened at 48827.55, posted day high of 49069.05 and day low of 48635.87 during last trading session while session suspended at 48704.99 with net change of -122.56 points and net trading volume of 181.32 million shares. Daily trading volume of KSE100 listed companies dropped by 28.74 million shares or 13.68% on DOD bases.

Analytical Review

The U.S. dollar held firm on Tuesday as the prospect of rising U.S. interest rates this year kept sentiment bullish, while a surprisingly upbeat reading on Chinese manufacturing gave the Aussie dollar a lift. A holiday in Japan made for quiet early trade, leaving the dollar steady around 117.40 yen JPY= but well up on Friday trough of 116.05. Against a basket of currencies, the dollar was up 0.5 percent at 102.720 .DXY. The euro was sulking at $1.0475 EUR despite strong manufacturing data for the single currency bloc, having surrendered all of Friday brief spike to $1.0700.

Ministry of Finance (MoF) has opposed restricting unutilized gas volume at HRL reservoirs to fertilizer plants and recommends that it to be open for generation companies as well. Petroleum Ministry in comments submitted to the Economic Co-ordination Committee (ECC) of the Cabinet on allocation of unutilized gas recommended that preference may be given to fertilizer sector in pursuance of dedication of Mari Petroleum Company Limited (MPCL) shallow gas reservoirs under Fertilizer Policy 2001.

The Pakistan International Airlines (PIA) has accumulated liabilities of over Rs300 billion and an additional loss of over Rs5.6bn is being added to this amount every month, the PIA management told a Senate committee at a briefing on Wednesday. The panel was informed that the airline earned around Rs7.5 billion a month while its expenses were over Rs 13.14bn. Major monthly expenses are over Rs 4.4bn in loan and mark-up repayment, over Rs 2.6bn over fuel and over Rs 1.6bn over salaries. The accumulated loss / liabilities of over Rs300bn include over Rs186bn of bank loans, Rs40bn of Civil Aviation Authority charges/ dues, over Rs13. 5bn to be paid to the Pakistan State Oil and over Rs 4.5bn to the Federal Bureau of Revenue, etc.

The government is likely to incur a financial loss of around Rs10 billion for divestment of Pakistan Steel Mills (PSM), National Assembly’s Standing Committee on Industries and Production was informed on Wednesday. The committee witnessed serious debate between members and officials over the uncertain future of the mill. The committee, chaired by Asad Umar of PTI, expressed concern over the daily losses incurred by the PSM. Many members opined that if the government could not make the mill operational and financially viable, then it should privatise or sell it.

State Bank of Pakistan on Wednesday sold Government of Pakistan Market Treasury Bills (MTBs) worth Rs 251.186 billion through its primary dealers.According to SBP statement the maturity periods of these MTBs are 3, 6 and 12 months.The face value of these bills is Rs 259.2 billion.

Overall Refineries (specifically ATRL, BYCO), Overall Textile Sector (specifically GATM, NCL) and EFERT can lead market in positive direction.

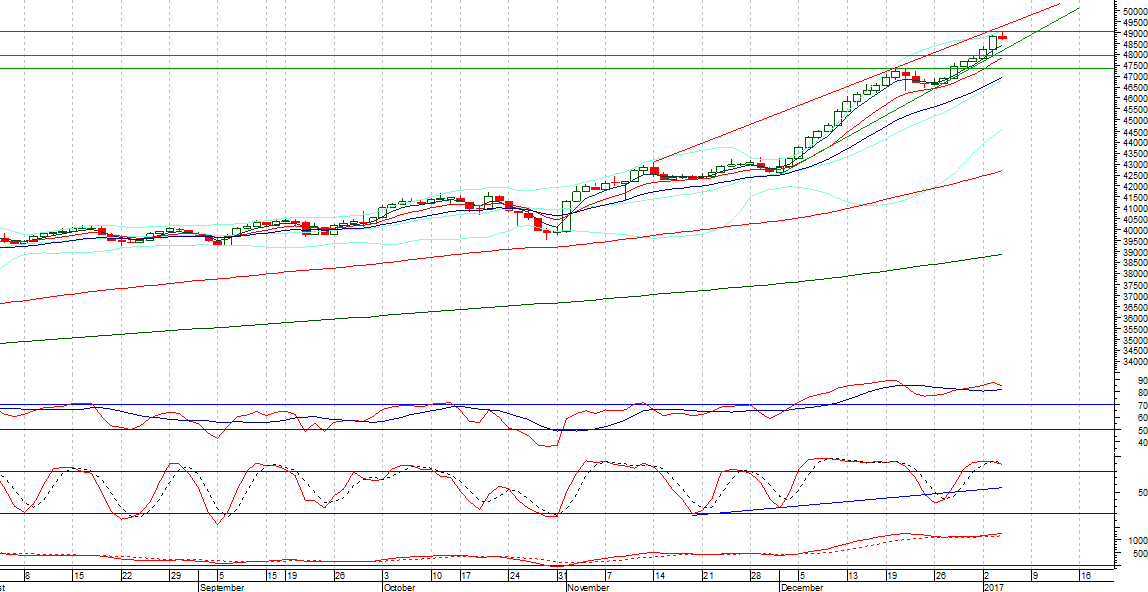

Technical Analysis

The Bench Mark KSE100 Index is capped by a resistant trend line on daily chart at 49274 points, as it has penetrated its bullish hourly trend channel in upward direction so a corrective move can be expected for it to come back in said price channel. Trading with strict stop losses is recommended in current scenario. Crude Oil prices have dropped in international market which can put some pressure on oil sector.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.