Previous Session Recap

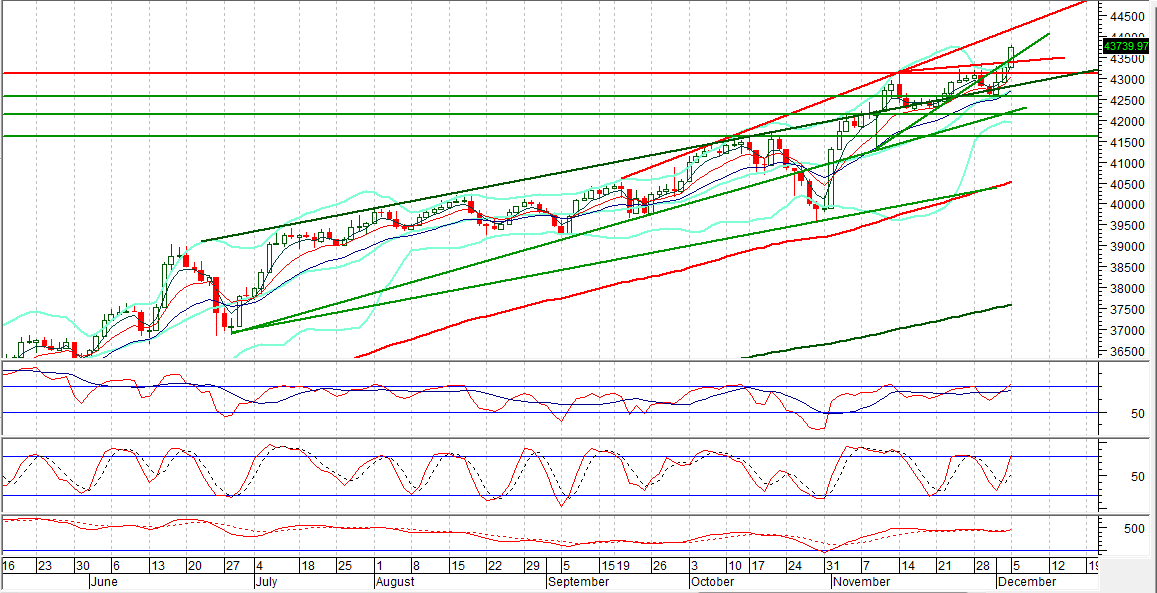

The Bench Mark KSE100 Index Opened at 43270.90, posted day high of 43797.69 and day low of 43270.90 during last trading session while session suspended at 43739.97 with net change of 469.07 points and and net trading volume of 128.82 million shares. Daily trading volume of KSE100 listed companies increased by 40.51 million shares or 45.86% on DOD bases.

Foregin Investors turned back to net buying after a few days and they remain in net buying of 11.80 millioin shares while net value of Foreign Inflow increased by 0.83 million US Dollars during last trading session. Categorically Foreign Corporates and Overseas Pakistanis remain in net buying of 9.42 and 2.58 million shares but Foreign Individuals remain in net selling of 0.2 million shares. While on the other side Local Individuals and Banks remain in net selling of 24.44 and 1.86 million shares but Local Companies, Mutual Funds and Brokers remain in net buying of 6.99, 10.33 and 6.38 million shares respectively.

Analytical Review

Asian stocks posted their biggest rise in two weeks on Tuesday and the euro steadied as investors judged the selloff after Italian referendum was overdone, with robust U.S. economic data also helping sentiment. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS bounced 0.8 percent, its biggest daily rise since Nov. 22, breaking two days of falls. Korea .KS11 climbed 1.2 percent while Japan .N225 rose 0.8 percent. Global risk sentiment roared back after falling prey to the initial Renzi fallout and whatever negatives Italy creates for the eurozone, yesterday was not the time for a euro implosion, said Stephen Innes, senior trader at online FX platform, OANDA. Wall Street rose on Monday, with the Dow Jones industrials setting fresh record highs following a services sector report that showed further strength in the domestic economy.

Cement sales rose 11 per cent year-on-year to 3.749 million tonnes in November thanks to a continued rise in local despatches. The figure suggests the cement industry achieved its highest-ever capacity utilisation of 98.6pc during the month. Domestic sales of cement jumped 15pc to 3.27m tonnes during the month, according to data released by the All Pakistan Cement Manufacturers Association (APCMA) on Monday. However, exports fell 10.4pc to 478,000 tonnes.

The Cotton Crop Assessment Committee (CCAC) on Monday revised cotton production estimates downward for the third time in the current season to 10.54 million bales against the initial estimates of 14.1 million bales ie by over 25 percent for the current season (2016-17). The country had missed the crop production target by around 30 percent in 2015-16 and it remained around 10 million bales which, according to the finance minister, caused 0.5 percent to the GDP growth.

Shanghai Electric Power Co Ltd said on Monday that it had received approval from the Competition Commission of Pakistan (CCP) to acquire K-Electric Limited. The Abraaj Group announced in October that one of its companies, KES Power, had reached an agreement to divest its stake in K-Electric, the country’s largest and only vertically integrated power utility, to Shanghai Electric. Abraaj owns 66.4 per cent of K-Electric’s total shares, along with management control. The deal, when closed, will be worth $1.77 billion.

A high level Italian delegation led by Ivan Scalfarotto, Italian Minister for Economic Development called on Federal Minister for Petroleum and Natural Resources, Shahid Khaqan Abbasi, here on Monday. Matters related to energy issues were discussed in the meeting, a statement said. The delegates appreciated the vision of Government of Pakistan. Both the leaders pledged to further enhance the bilateral ties between the two countries and enhance co-operation in the field of energy.

TRG, ASTL and ATRL can lead market in positive direction.

Technical Analysis

The Bench Mark KSE100 Index is capped by a resistant trend line on daily and Intraday chart on its double top which is a very strong indication for a pullback as Intraday Stochastic also have created a crossover which can push KSE100 index back towards 43155 points and further more. But a postive hope on technical side is still there as on daily chart KSE100 index have generate a bullish crossover along with a crossover of MAORSI and these both can push index upward in comming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.