Previous Session Recap

The Bench Mark KSE100 Index Opened at 48704.99, posted day high of 48934 and day low of 48642.09 during last trading session. The session suspended at 48713.63 with net change of 8.64 points and net trading volume of 140.67 million shares. Daily trading volume of KSE100 listed companies dropped by 40.64 million shares or 22.42% on DOD bases.

Analytical Review

Asian shares recovered to four-week highs on Friday as a surge in the dollar and its borrowing costs sparked by Donald Trump election eased, with the U.S. 10-year yield slipping to one-month lows. The U.S. dollar stayed near three-week lows against a basket of currencies though it bounced back a tad as the Chinese yuan gave up some of its massive gains made during the previous two days following Friday midpoint fixing by Chinese central bank. The market appears to be on risk-on mode. It could be because of stabilizing U.S. yields. It could be signs of stability in Europe, or a recovery in oil. Anything that has been battered by higher U.S. rates is coming back, Yoshinori Shigemi, global market strategist at JPMorgan Asset Management. MSCI gauge of the world stock markets .MIWD00000PUS hit its highest levels in a year and a half, having risen 1.8 percent since the start of year, helped by this week generally upbeat economic indicators in the U.S. and China.

The government is expected to impose 10-paisa per unit surcharge for all electricity consumers for at least 18 months to finance cost overruns of Rs500 billion Neelum-Jhelum Hydropower Project and extend Rs3 per unit reduction in power tariff for industrial consumers for six months. A senior government official told Dawn on Thursday that a meeting of the Economic Coordination Committee (ECC) of the Cabinet has been called on Friday to approve two proposals moved by the Ministry of Water and Power following green signalled by the Prime Minister Office.

Pakistan will have to foot a bill of around $1.58 billion for the import of 4.5 million bales (170kg each) to bridge the gap between the production and consumption of raw cotton. Cotton production clocked up at 15m bales in 2014-15 and 9.5m bales in 2015-16. It is expected to be around 10.54m bales in 2016-17. Pakistan was the third largest raw cotton exporter, but it has been an importer for the last two years. Last year, Pakistan imported around 2.7m bales from India at a cost of $800m.

The price of sugar has continued to edge higher despite huge stocks. The wholesale price of sugar, which was Rs57 a kilogram when sugarcane crushing began in November 2016, has now risen to Rs62 per kg. The decision of the Economic Coordination Committee (ECC) taken in the last week of December 2016 of allowing sugar exports of 225,000 tonnes has put extra pressure on sugar prices. Retailers, blaming rising wholesale prices, have pushed up the commodity’s price to Rs64-65 per kg from Rs62 two days back.

The federal government is likely to grant blanket exemption from levy of billions of rupee sales tax on construction and related services for hydropower projects being constructed under the China Pakistan Economic Corridor (CPEC) arrangements. China Three Gorges South Asia Investment Ltd (CSAIL), a subsidiary of China Three Gorges Corporation, currently developing two hydropower projects in Pakistan, which are under the CPEC ie 720 MW Karot Hydropower project and 1124 MW Kohala Hydropower project, has approached PPIB for resolution of sales tax issue which, according to the firm, is the most critical impediment hampering the progress of hydropower projects by CSAIL under the CPEC.

Overall Refineries (specifically ATRL, NRL) and TRG can lead market in positive direction.

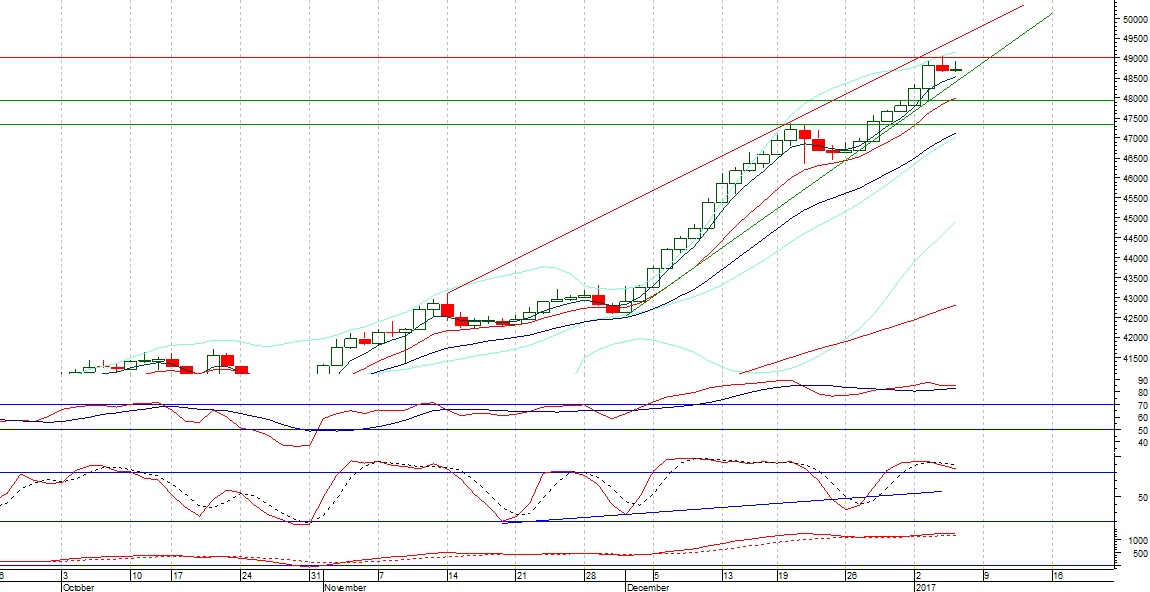

Technical Analysis

The Bench Mark KSE100 Index is capped by a resistant trend line on daily chart at 49274, as it has penetrated its bullish hourly trend channel in upward direction so a corrective move can be expected for it to come back in said price channel. Trading with strict stop losses is recommended in current scenario. Crude Oil prices have dropped in international market which can put some pressure on oil sector.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.