Previous Session Recap

The Bench Mark KSE100 Index Opened at 47577.31, posted day high of 47634.87 and day low of 47254.65 during last trading session. It suspended at 47356.60 with net change of -220.71 points and net trading volume of 63.04 million shares. Daily trading volume of KSE100 listed companies dropped by 14.46 million shares or 18.66% on DoD basis.

Foreign Investors remained in net selling position of 3.46 million shares and net value of Foreign Inflow dropped by 0.65 million US dollars. Categorically Foreign Individual and Overseas Pakistani investors remained in net selling position of 0.12, 4.06 million shares but Foreign Corporate investors remained in net buying position of 0.72 million shares. While on the other side Local Individuals, Companies and Mutual Funds remained in net buying position of 1.7, 2.95 and 3.65 million shares respectively but Local Banks and Brokers remained in net selling position of 2.9 and 0.12 million shares.

Analytical Review

Stocks slumped and safe haven bonds and the yen jumped in Asia on Friday after the United States launched cruise missiles against an air base in Syria, potentially escalating the conflict and spooking investors globally. The response was immediate with the U.S. dollar dropping over half a yen in currency markets, while sovereign bonds, gold and oil prices rallied hard. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS shed 0.5 percent in short order, and S&P 500 futures ESc1 lost 0.3 percent. The U.S. military launched cruise missile strikes ordered by President Donald Trump against a Syrian air base controlled by President Bashar al-Assad forces in response to a deadly chemical attack in a rebel-held area, a U.S. official said. Facing his biggest foreign policy crisis since taking office in January, Trump took the toughest direct U.S. action yet in Syrian six-year-old civil war, raising the risk of confrontation with Russia and Iran, Assad two main military backers. Investors had already been on edge as Trump met Chinese leader Xi Jinping for talks over flashpoints such as North Korea and Chinese huge trade surplus with the United States.

The Asian Development Bank (ADB) has projected Pakistan economic growth at 5.2 percent for the current fiscal year due to better security, macroeconomic stability and investment under the China-Pakistan Economic Corridor (CPEC) projects. “The GDP growth is expected to edge up to 5.2% in FY2017 and 5.5% in FY2018, underpinned by higher growth in the major industrial economies,” the ADB new Asian Development Outlook (ADO) 2017 stated. Higher growth in FY2018 reflects accelerated infrastructure investment through CPEC, which is steadily lifting consumer and investor confidence and thereby further catalysing economic activity.

Cement despatches reached historic heights in March 2017, touching almost 4 million tons with capacity utilisation crossing 101 percent on the strength of robust domestic demand though exports continued to decline. The All Pakistan Cement Manufacturers Association (APCMA) said that the ever increasing domestic market has vindicated the manufacturers thrust on adding new capacities. He said Pakistan needs sustained infrastructure activities for at least a decade to close the infrastructure gap with competing economies. The cement industry is playing its due role to get the momentum going and in March 2017 the industry despatched 3.964 million tons of cement against 3.583 million tons despatched during the corresponding month of last year.

The Senate Standing Committee on Finance on Thursday approved the Limited Liability Partnership (LLP) Bill, 2017. The proposed LLP framework possesses limited liability, active member management, simplicity and ease of doing business. The LLP Bill provides for establishment of new corporate vehicle to enable professional expertise and entrepreneurial initiative to combine, organise and operate in an innovative and efficient manner having benefit of limited liability on account of incorporation. In Pakistan, this need has long been recognised for businesses, requiring a framework that provides flexibility suited to requirements of small and medium enterprises and service sector in particular.

The total liquid foreign reserves held by the country stood at $21,550.5m on March 31, 2017. The weekly break-up of the foreign reserves position released on Thursday showed that foreign reserves held by the State Bank of Pakistan (SBP) stood at $16,466.1m, net foreign reserves held by commercial banks are $5,084.4m, thus total liquid foreign reserves reached at $21,550.5m. During the week ending March 31, 2017, the SBP reserves decreased by $264m to $16,466 million. The decrease is mainly attributed to external debt servicing and other official payments.

Today TRG, SSGC and Overall Steel Sector (DSL and ISL) can lead the market in the positive direction.

Technical Analysis

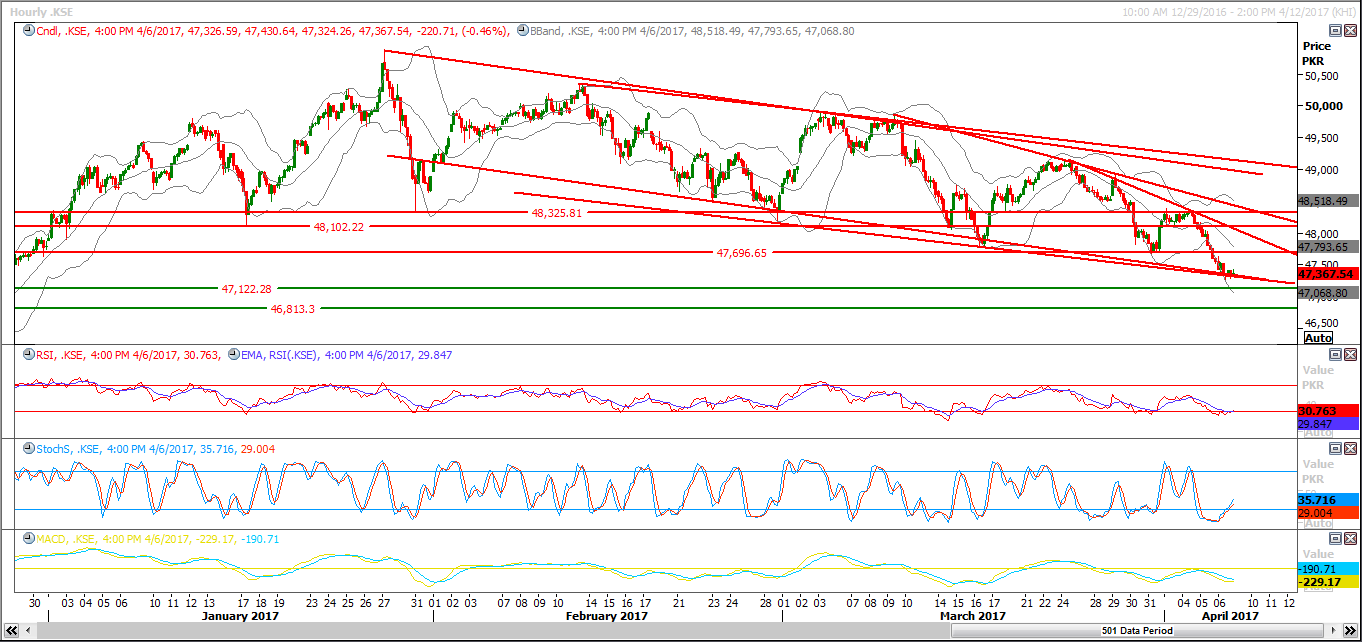

The Bench Mark KSE100 Index is moving in a bearish trend channel on daily chart and as of now it is expanding on its daily and hourly correction level towards 47128 and 46886. Next major supportive region stand around 46886 where index can bounce back for a new bearish channel after completing its last expansion. Index has a lot of resistances ahead till 49960 to turn back towards bullish trend therefore trading with stop loss and selling on spike is recommended. New buying could be initiated only around 47000 region with strict stop loss of 46886. For current trading session index may resist ahead at 47776 and 47900. To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.