Previous Session Recap

The Benchmark KSE100 Index Opened at 49555.83, posted day high of 49739.89 and day low of 49534.07 during last trading session. The session suspended at 49630.04 with net change of 74.21 points and net trading volume of 97.53 million shares. Daily trading volume of KSE100 listed companies dropped by 49.91 million shares or -33.85% on DOD bases.

Analytical Review

Appetite for stocks and the euro ebbed on Tuesday as political and economic uncertainty sent investors sheltering in the Japanese yen and gold, while expectations Chinese foreign exchange reserves had fallen for a seventh month added to nervousness. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was little changed in early trade. Japanese Nikkei .N225 dropped 0.6 percent as a stronger yen depressed stocks. Investors expected China to say on Tuesday that its foreign exchange reserves fell for the seventh straight month by about $10.5 billion to $3 trillion in January. But some said reserves may have actually risen due to tighter controls on moving money out of the country, as well the impact of a weaker dollar. Nevertheless, as reserves remain at around $3 trillion, concerns linger over the speed at which China has depleted its resources to defend the currency. Overnight, both U.S. and European stocks dropped.

Net public debt has crossed the Rs18.28 trillion mark, rising about 35pc during the tenure of the ruling Pakistan Muslim League-Nawaz (PML-N). This was reported by the ministry of finance, in response to a question from Pakistan Peoples Party (PPP) MNA Shahida Rehmani in the National Assembly last week. The volume of net public debt as on Sept 30, 2016 was Rs18,277.6 billion, the ministry response said. Total public debt stood at Rs13.48tr at the end of fiscal year 2012-13 — almost three years ago. The major contribution to the increase in net public debt came from an almost 40pc rise in domestic debt, which rose from Rs8.686tr at the end of 2013 to Rs12.14tr at the end of the first quarter of the current fiscal year (FY 2016-17).

Net consumer financing that remained negative not long ago is now soaring to new heights. It is just about higher demand, says the president of one of the top five banks, explaining a phenomenal net increase of Rs46.5bn in consumer financing in the first half of this fiscal year (July-Dec 2016). This amount is far higher than that of consumer financing — Rs33bn — in FY16. And, it is quite a record as percentage of total lending to private sector businesses as well (see table). Banks are more open and confident now in accommodating consumer loan demands, says the head of another, mid-tier, bank.

Most assemblers of heavy commercial vehicles (HCV) are using old technology engines while claiming Euro II compliance, an assertion hard to believe keeping relevant international standards in view. Market sources said assemblers have introduced turbocharger and intercooler models, which were not Euro-II compliant. Only one Japanese heavy vehicles assembler said it has introduced common rail smart engine (CRSE) in Pakistan. The international truck market is far ahead of Pakistan in engine technology. It is expected that by June 2017, the share of Euro II diesel (low-sulphur diesel) will reach 85 per cent in Pakistan. In 2012, Hinopak, Ghandhara Nissan Ltd (GNL), Master Motors and Ghandhara Industries Ltd (GIL) took stay order from the Sindh High Court due to non-availability of Euro II diesel. After several extensions, the current deadline has been set at June 30.

Hyundai Motor Company plans to set up a car assembly plant in Pakistan in a joint venture with Pakistani textile giant Nishat Mills, a Nishat Mills official said on Friday. Hyundai, South Korean largest automaker, has been seeking a local partner to set up an assembly line in Pakistan, Nishat Mills company secretary Khalid Chauhan told Reuters. Today we have signed a memorandum of understanding between the two companies and we will set up a ... project for the assembly and sales of both passenger and commercial vehicles, Chauhan said. The project will be subject to statutory and regulatory approval.

PSO, ATRL, ASC and EPCL can lead market in positive direction.

Technical Analysis

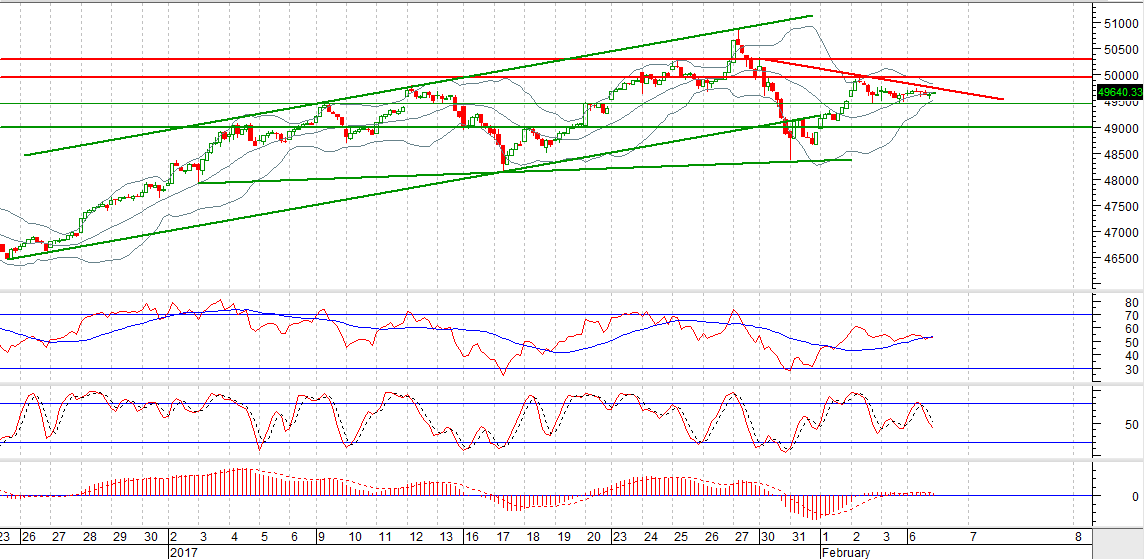

The Benchmark KSE100 Index is in correction and has not been able to close above its 61.8% Fibonacci level during last trading session. This can exert some pressure for current trading session. The Index has not been able to close above 50000 psychological level since last two weeks on weekly chart which is alarming. As of now, KSE100 is capped by a resistant trend line on hourly chart while it is getting support from a horizontal supportive region at 49400. Index may start a bearish rally any time until it closes above 49939. Therefore, trading with strict stop loss is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.