Previous Session Recap

The Benchmark KSE100 Index Opened with a positive gap of 66 points at 49706.37, posted day high of 49920.26 and day low remain same as opening during last trading session. The session suspended at 49859.39 with net change of 229.35 points and net trading volume of 120.47 million shares. Daily trading volume of KSE100 listed companies increased by 22.94 million shares or 23.525 on DOD bases.

Foreign Investors remained in net buying position of 3.84 million shares but net value of Foreign Inflow dropped by 2.15 million US Dollars. Categorically Foreign Individuals and Overseas Pakistanis remained in net buying position of 0.026 and 6.81 million shares but Foreign Corporate Investors remained in net selling position of 3 million shares. While on the other side Local Individuals, Companies and Banks remained in net selling position of 2.59, 12.27 and 2.4 million shares respectively. NBFCs, Mutual Funds and Brokers remained in net buying position of 2.73, 9.32 and 0.039 million shares respectively.

Analytical Review

Asian shares dipped from four-month highs on Wednesday and the euro was pressured as lingering political and economic uncertainty in the United States and Europe sapped investor confidence. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS ticked down 0.2 percent, slipping further from Monday four-month high. South Korean shares .KS11 fell 0.6 percent, leading the losses in early trade. Japanese Nikkei .N225 bounced back 0.3 percent a day after it hit a two-week low. On Wall Street, the S&P 500 .SPX ended barely higher while the Nasdaq .IXIC managed to scratch out a new record as gains in big tech names countered energy declines. With more than half of the S&P 500 having reported results, fourth-quarter earnings are on track to have climbed 8.2 percent, which would be the best performance since the third quarter of 2014, according to Thomson Reuters I/B/E/S.

With the multi-billion-dollar China-Pakistan Economic Corridor (CPEC) already under way, Pakistan has engaged the services of the Asian Development Bank (ADB) to prepare a master plan for the transport sector and a scheme for development of clean energy. The federal government and ADB signed an agreement on Tuesday, with Finance Minister Ishaq Dar in attendance. Under the agreement, the Manila-based agency would provide a $325 million loan to facilitate the Access to Clean Energy Investment Programme. The plan would mostly finance off-grid renewable energy sources in Khyber Pakhtunkhwa and Punjab.

The Central Development Working Party (CDWP) on Tuesday approved 15 projects worth Rs172.1 billion, including seven projects costing Rs162.9bn which were referred to the Executive Committee of the National Economic Council (Ecnec). Major projects included Kacchi Canal Project (worth Rs80.3bn), dualisation of old Bannu road and Indus Highway (Rs48bn), and integration of health services delivery with a special focus on nutrition programme (Rs14bn).

Parliamentary Secretary Chaudhary Jaffar Iqbal on Tuesday informed the National Assembly that a tariff petition for overcharging consumers of Karachi Electric (KE) was pending before National Electric Power Regulatory Authority (NEPRA) and relief would be passed on the consumers in light of the Authority decision. Responding to a Calling Attention Notice moved by Sheikh Salahuddin and others regarding approval granted by National Electric Power Regulatory Authority to Karachi Electric to increase price of electricity 25 paisas per unit and over charging of Rs 62 billion from the consumers, he said the government itself took notice into the matter and filed a petition with NEPRA. He said if additional amount was collected from the consumers, it would be paid back to them. He said Rs 12 billion had already been returned to the consumers in 2012-13 which was over charged on account of fuel adjustment.

Pakistani high quality and value added textile products were showcased at the 3- day 40th edition of Texworld show held from 6th to 9th of this month in Paris. In all twenty six renowned Pakistani companies participated in the exhibition and displayed variety of high end fabrics, sundries, accessories and sophisticated cotton wears including knit Embroidery Lace and trims suited to the taste and preferences of European children, men and women, private news channel reported. The Ambassador of Pakistan to France Moin un Haque who visited Pakistani pavilion met with the Pakistan exhibitors and appreciated their participation in this premier European Textile exhibition. He said the Pakistani Textile products are known internationally for their high quality and innovative designs. Participation in the texworld textile would not only help in introducing Pakistan prowess in the textile fashion industry but will provide much need boost to the Pakistani textile exports to the lucrative European market.

NML, EPCL, MCB, ESBL and SSGC can lead market in positive direction.

Technical Analysis

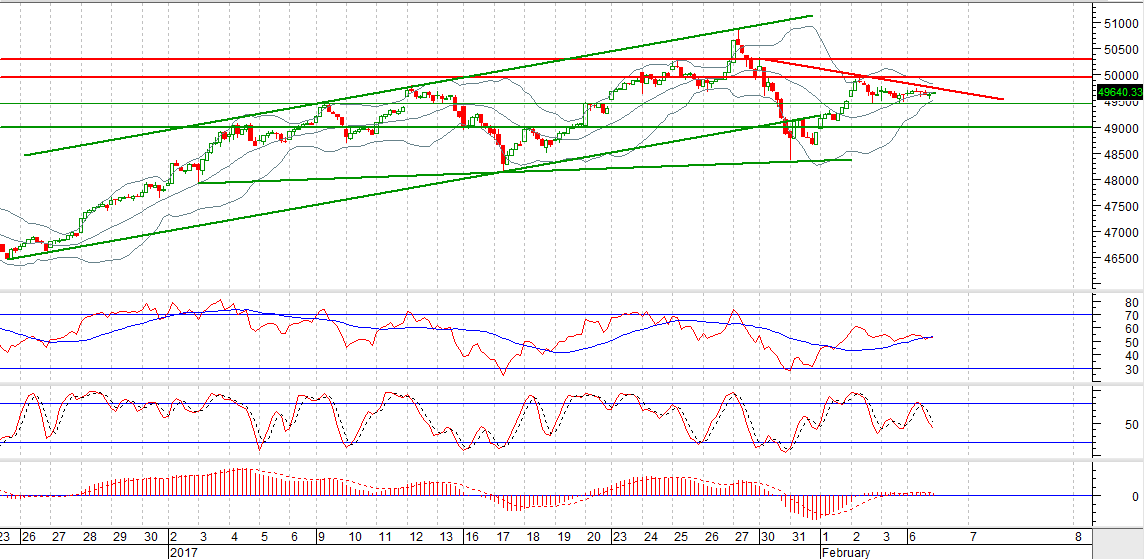

The Benchmark KSE100 Index has penetrated its resistant trend line in upward direction on hourly chart but it is still capped by its 61.8% correction region which is becoming last stone unturned in start of a bullish rally. If, during current trading session, index opens with a positive gap above that correction level then index will get some fresh breeze to touch 50035. Whereas, hourly closing above 50035 will call for 50302. Right now, Index has supportive regions around 49700 and 49426. 49426 region is a strong support and market will remain range bound until it closes above 49947 or below 49426. Breakout of either side will call for a new rally which will set a new trend for index. For current trading session, trading with strict stop loss of 49700 is recommended. While on breakout of 49947 new buying could be initiated for profit taking but initiating new positions for long term or mid-term trading are not recommended on current levels.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.