Previous Session Recap

The Bench Mark KSE100 Index opened at 49448.87, posted a day high of 49525.48 and a day low of 49216.32 during last trading session whereas session suspended at 49452.17 with a net change of 17.82 points and net trading volume of 100.77 million shares. Daily trading volume of KSE100 listed companies increased by 23.62 million shares or 30.62% on DoD basis.

Foreign Investors remained in net selling position of 8.3 million shares and net value of Foreign Inflow dropped by 0.15 million US Dollars. Categorically Foreign Individuals, Corporate and Overseas Pakistani Investors remained in net selling position of 0.02, 5.36 and 2.91 million shares respectively. While on the other side Local Individuals, Companies, Banks and Mutual Funds remained in net buying position of 1.02, 27.64, 0.86 and 9.94 million shares respectively but Local NBFCs and Brokers remained in net selling position of 20.42 and 9.26 million shares.

Analytical Review

Asian shares edged lower on Wednesday after a strong start of week as investors took profits in the wake of a weak Wall Street and in anticipation that U.S. interest rates will rise next week for the second time in three months. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS eased 0.1 percent in early trade, a day after posting its biggest single-day rise in more than two weeks. Australian markets led early losers. The Federal Reserve has a policy meeting on March 14-15. Unless the (U.S.) February payrolls report due on March 10 is an unmitigated disaster, an outcome we do not expect, a March 15 hike is on the way, Societe Generale strategists said. Markets have quickly boosted bets of a rate hike at the meeting after recent hawkish comments by U.S. policymakers. Investors have turned increasingly cautious on the outlook for pricey stock markets, despite recent encouraging data from emerging markets, particularly China.

The Executive Committee of the National Economic Council (ECNEC) on Tuesday approved three development projects including Kachhi Canal project, which cost has been enhanced to Rs80.5 billion from initial cost of Rs31.2 billion. The projects were approved in a meeting chaired by Finance Minister Senator Ishaq Dar. Federal Minister for Planning and Development Prof Ahsan Iqbal, Federal Minister for Food Security Sikandar Hayat Bosan, provincial ministers and senior officials of federal and provincial governments also attended the meeting. The government in 2003 had approved the project at a cost of Rs31.2 billion for irrigating 713,000 acres of land in Balochistan. However, the project suffered since the beginning, as its cost increased twice. The government first revised the cost to Rs57.6 billion in December 2013. However, the ECENC yesterday gave approval for Kachhi canal project (phase-I) at a cost of Rs80,352 million. The project aims at development of water and land resources within the less developed areas of Balochistan covering districts of Dera Bugti, Naseerabad, Bolan, Kachhi and Jhal Magsi. Kachhi canal off takes at Taunsa Barrage from river Indus with peak discharge of 6,000 cusecs and will ultimately irrigate an area of 713,000 acres.

The contract for the main civil works of the 2,160MW Dasu Hydel power project between the government of Pakistan and China Gezhouba Group Company (CGGC) will be signed today (Wednesday). The agreement for the main civil work of the Dasu Hydle power project which includes spillways, power house, penstock, tailgate etc will be signed today, it is learnt reliably here. The run-of-river hydro power project is being developed in two stages, stage-I include the installation of six hydro power units rated at 360MW each while stage-II will also have the same capacity. According to the details, the first phase of the project was suppose to start this year and is scheduled for completion by 2021. The total cost of the 4,320MW Dasu Hydle power project is about $4.5 billion.

Pakistan has become the first country to benefit from duly validated, high-quality solar maps under a global initiative, allowing it to tap into its renewable energy resources more effectively, the World Bank said in a press release on Tuesday. The new solar maps for Pakistan were unveiled Tuesday at a workshop hosted by the Alternative Energy Development Board (AEDB) and the World Bank in Islamabad. According to the World Bank, Pakistan is now part of a small group comprising mainly developed countries with access to sustainable and affordable sources of indigenous energy.

Federal Minister for Planning, Development and Reform Ahsan Iqbal has said that not even a single dollar of China Pakistan Economic Corridor (CPEC) investment is being processed through the government of Pakistan’s accounts. While briefing the Senate Forum for Policy Research (SFPR) at Pakistan Institute of Parliamentary Services (PIPS), under the chairmanship of Syed Nayer Hussain Bokhari, the minister said that CPEC would enlist Pakistan among top 25 economies of the world by 2025. He said that $50 billion investment under the framework of CPEC has integrated Pakistan’s economy with the world for the first time.

SSGC ,NML , GTYR and DSL can lead the market in the positive direction.

Technical Analysis

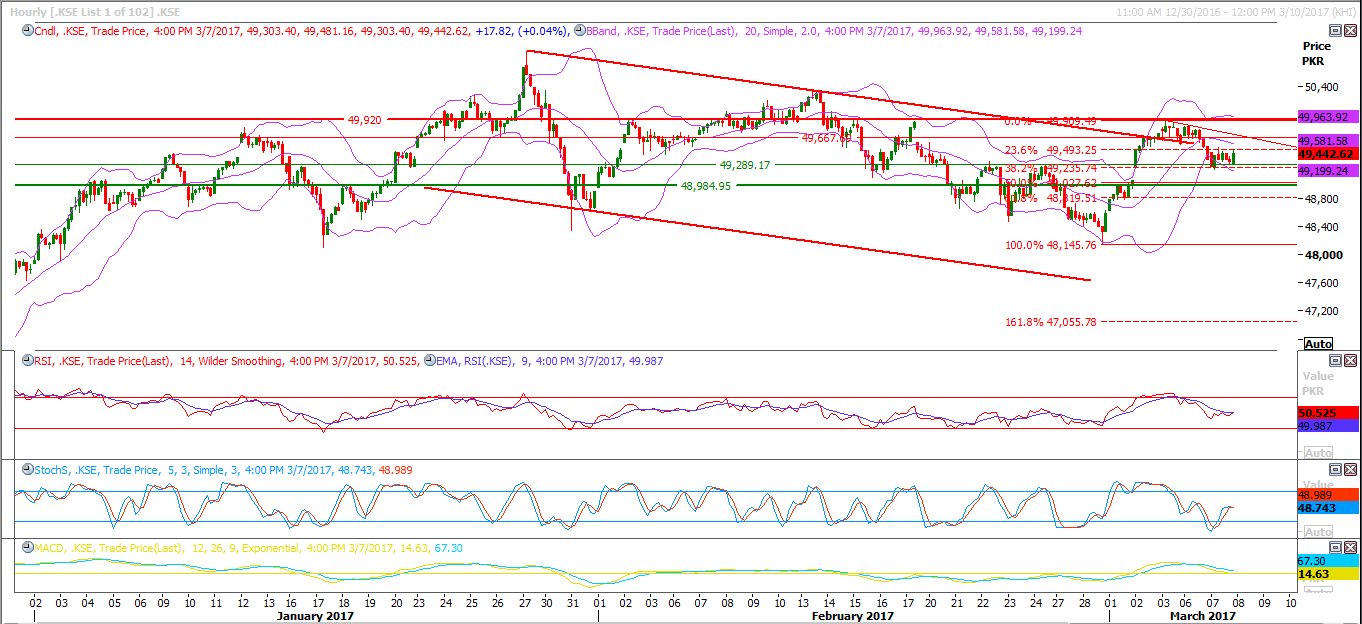

The Bench Mark KSE100 Index is trying to bounce back into its short term bullish trend after getting support from its 38% correction on hourly chart but it is still capped by two major resistant trend lines along with a strong horizontal resistant region at 49506 and 49960. Daily Stochastic have generated a bearish crossover which can push index into a new bearish trend towards 47900 once it will close below 49300 and 48984. Trading with strict stop loss is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.