Previous Session Recap

The Bench Mark KSE100 Index Opened at 41841.56, posted day high of 42204.53 and day low of 41804.14 while session suspended at 42133.54 points with net change of 291.98 points and net trading volume of 169.36 million shares. Daily trading volume of KSE100 listed companies dropped by 44.27 million shares or 20.72% on DOD bases.

Foreign Investors remain in net buying 2.19 million shares but net value of Foreign inflow dropped by 2.20 million US Dollars. Categorically Foreign individuals and Corporates and Overseas Pakistanis remain in net buying of 0.89, 0.37 and 0.92 million shares respectively. While on the other hand Local Individuals and Mutual Funds remain in net buying of 11.54 and 4.63 million shares but Local Companies, Banks Brokers remain in net selling of 5.0, 6.9 and 5.38 million shares respectively.

Foreign Investors are trying to stay on buying side as net volume of Foreign Investors Portfolio Investment (fipi) remain in net buying with 72.07 million shares and net value of Foreign inflow increased by 16.36 million US Dollars on Month till Date bases.

Analytical Review

Crude Oil prices are trying to find supportive region around 43 USD/bbl but it will not be considered that crude oil prices have bottom out untill unless it close above 45.90 USD/bbl so a fresh breath from Oil Sector could not be expected on immediate bases.

American Sotcks Traders are showing a positive attitude towards US Presidential Elections as DJIA (US30) and S&P500 soar by 152 and 18 points or 0.84% and 0.85% respectively on Eve of Presidential Elections. US Dollar have bounced back from bottom after FBI decided that U.S. Democratic presidential nominee Hillary Clinton will not face criminal charges which pushed Major Commodities in bearish zone and stocks have started bullish rally on Monday and covered losses of last week in a single day.

The cement industry has posted a growth of 11.26 percent in local despatches during the first four months of current fiscal year compared with local despatches during same period of last fiscal year.According to data released by All Pakistan Cement Manufacturers Association on Monday, the exports also recorded a growth of 1.73 percent compared with the same period of last year.

FLYNG, KAPCO, BOP, NRL, NCPL and ATRL are looking attractive and can lead the market in positive direction but on the other side MUGHAL, CSAP, UBL and JSBL can breath after a bullish run for some positive corrections.

Technical Analysis

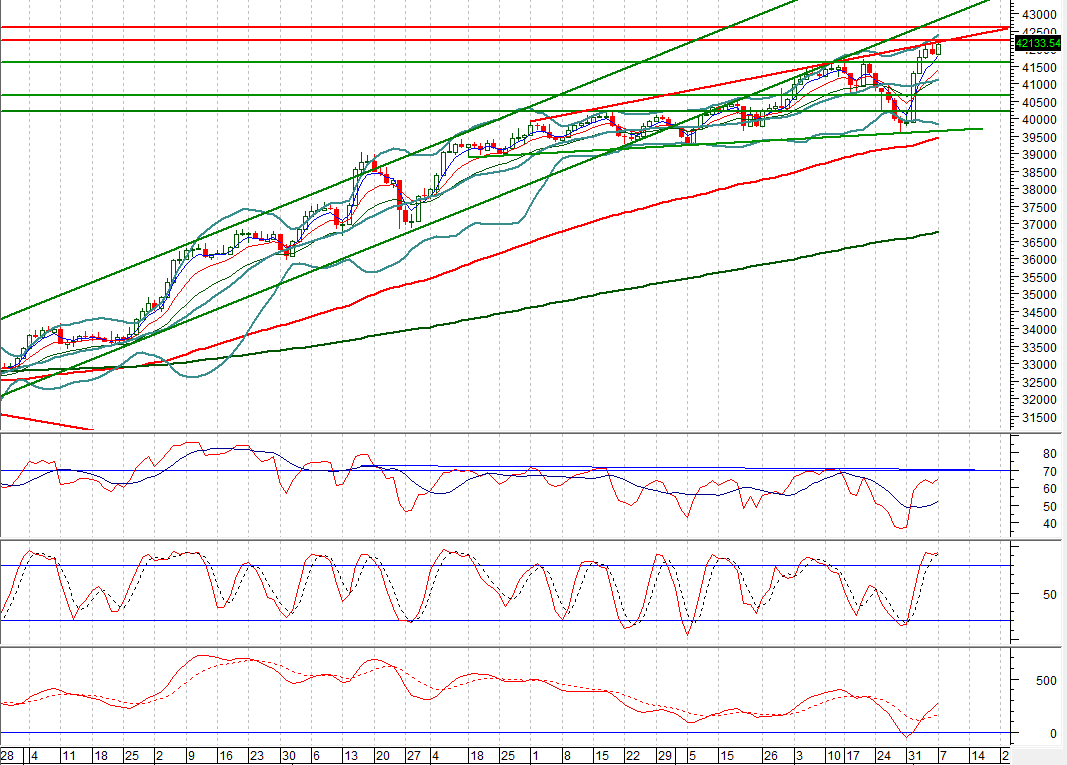

Technically KSE100 Index is capped by a negative trend line on daily chart around 42228 points and daily stochastic is trying to generate a bearish crosover which can push Index in negative zone in coming days, Daily RSI is moving around 65 while its capped by a resistant trend line around 70 from where it will get a hard pullback, while Supportive region stands around 41619 points where KSE100 Index will get a support from its previous resistant area.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.