Previous Session Recap

The Bench Mark KSE100 Index Opened at 44494.99, posted day high of 44836.10 and day low of 44447.89 during last trading session. The session suspended at 44741.98 with net change of 246.99 points and net trading volume of 135.93 million shares. Daily trading volume of KSE100 listed companies dropped by 109.04 million shares or 44.51% on DOD bases.

Foreign Investors remained in net buying position of 1.57 million shares but net value of Foreign Inflow dropped by 1.94 million US Dollars. Categorically, Foreign Individuals remained in net buying position of 6453 shares along with Overseas Pakistanis who increased their holdings by 2.65 million shares but Foreign Corporate Investors remained in net selling of 1.09 million shares. While on the other side, Local Individuals, Banks and Mutual Funds remained in net buying of 7.59, 6.03 and 4.09 million shares respectively. Local Companies and Brokers remained in net selling of 16.83 and 6.61 million shares respectively.

Analytical Review

Asian shares flatlined on Friday but were on track for robust weekly gains, while the euro caught its breath after sliding when the European Central Bank trimmed the size of its asset purchase program and also extended it for longer than many had expected. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS wobbled close to the previous session close in early trading, poised for a weekly gain of 2.2 percent. Japanese Nikkei stock index .N225 was up 0.6 percent, up 2.4 percent for the week in which the dollar gained 0.6 percent against the yen. The dollar was up 0.1 percent at 114.18 yen JPY=. The euro was licking its wounds at $1.0615 EUR=. It had been as high $1.0875 before collapsing when markets realized the ECB actions were actually very dovish.

Lucky Cement will invest up to Rs12 billion to set up an assembly plant for Kia vehicles, a stock notice said on Thursday. Lucky Cement will invest by way of equity in the proposed associated company to manufacture, assemble, distribute and export all types of Kia vehicles, parts and accessories. This is the second time that Kia, a South Korean company, will roll out vehicles in Pakistan. Its previous joint venture agreement was with Dewan Motors, which produced a limited number of vehicles following an unenthusiastic response from consumers.

Apropos the news items circulating in various sections of national media about Competition Commission of Pakistan (CCP) imposing penalty on PSO on an alleged complaint of deceptive marketing, PSO would like to clarify that the issue under consideration requires retrospective implementation, as PSO has already discontinued its Premier XL brand and is already in the process of introducing new brand for diesel. PSO is considering to challenge the CCP order, for which its legal team is currently reviewing the matter.

A kind of confusions and uncertainties prevailed on the cotton market, regarding conditional import of cotton from India, dealers said on Thursday. The official spot rate was up by Rs 50 to Rs 6300, dealers said. In Sindh, seed cotton prices were at Rs 2600-3250, they said that in Punjab, phutti rates were at Rs 2800 and Rs 3500, as per 40 kg, they added.

Pakistan has shared with Iran amendments to gas sale and purchase agreement (GSPA) to extend implementation schedule and revise pricing under the $1.35-billion gas pipeline project. A senior government official on Thursday told Dawn that the Economic Coordination Committee (ECC) of the Cabinet has not yet allowed the Ministry of Petroleum and Natural Resources to start formal negotiations with Iran over fresh pricing. He said the ministry requested the ECC in July this year to revive a committee to start formal talks and we are still waiting for the approval.

Technical Analysis

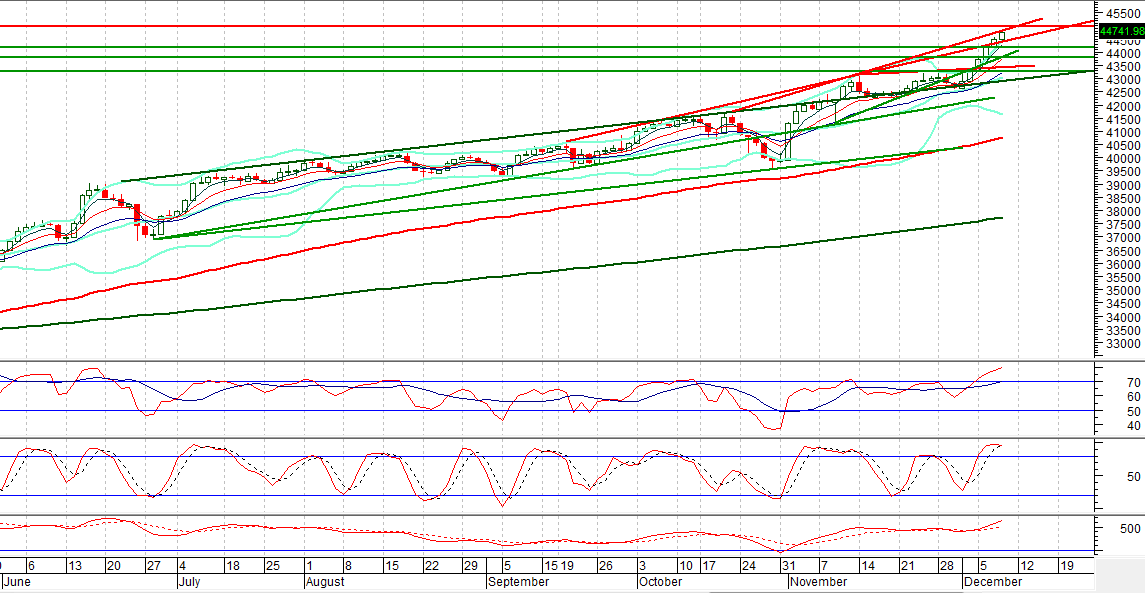

The Bench Mark KSE100 Index is trying to penetrate its cap of a trend line on Intraday chart on its double top which is a very strong indication for a pullback as Intraday Stochastic also has created a crossover which can push KSE100 index back towards 43805 and further more. Daily Stochastic and MAORSI also have reached required level for a pullback. On daily chart Stochastic is trying to create a crossover which can be an end for current bullish rally. For current trading session, market has a gap till 44960 points. Trading with strict stop loss is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.