Previous Session Recap

The Bench Mark KSE100 Index Opened at 48769.07 with a gap of 56 points, posted day high of 49104.04 while day low remained the same as the opening price during last trading session. The session suspended at 49038.23 with net change of 324.60 points and net trading volume of 153.15 million shares. Daily trading volume of KSE100 listed companies increased by 12.48 million shares or 8.87% on DOD bases.

Foreign Investors remained in net selling position of 5.62 million shares and net value of Foreign Inflow dropped by 4.15 million US Dollars. Categorically Foreign Corporate and Overseas Pakistani Investors remained in net selling position of 4.67 and 0.98 million shares respectively but Foreign Individuals remained in net buying position of 22000 shares. While on the other side, Local Individuals and Mutual Funds remained in net selling position of 13.52 and 0.83 million shares but Local Companies, Banks, NBFCs and Brokers remained in net buying position of 9.45, 5.56, 1.73 and 6.1 million shares respectively.

Foreign Investors remained in net selling position of 17.8 million shares during first week of current year and net value has dropped by 2.04 million US Dollars. Overseas Pakistanis lead the selling sentiment by offloading 9.3 million shares and they were followed by Foreign Corporates with net selling of 7.71 million shares but net cash flow from Foreign Corporate investors remained positive as their net inflow increased by 0.9 million US Dollars.

Analytical Review

Asian stocks edged higher on Monday, helped by a strong Wall Street, and the dollar stood tall against rivals after the latest U.S. payrolls data indicated strong underlying wage growth, strengthening the case for more rate increases in 2017. Underlying sentiment was increasingly cautious as investors grew wary of the corrosive effects of a stronger greenback on some Asian markets such as Hong Kong and before a news conference by President-elect Donald Trump on Wednesday where his views on global trade and China will be carefully scrutinized for future policy implications. MSCI ex-Japan Asia-Pacific shares index .MIAPJ0000PUS rose 0.3 percent after posting a rare loss in the previous session. Australian S&P/ASX200 rose 1 percent while Hong Kong shares .HSI rose 0.4 percent. Trading was light because Japan is shut for a holiday.

Continuing its leadership role in transforming quality of fuels in the country, Pakistan State Oil (PSO) has imported the first vessel of the country foremost low-sulfur diesel product that ensures a healthier environment and better performance of vehicles. The move comes just two months after PSO successfully launched higher-grade RON petrol for the first time in Pakistan. Bringing the fuel revolution that it triggered and spearheaded to a full-circle, PSO has received the first 55,000 MT low-sulfur diesel vessel from Kuwait, heralding a new era of premium quality diesel in the country with more to follow in the coming weeks and months. PSO new low-sulfur diesel product with 500ppm (as opposed to 10,000ppm that the existing local diesel products from Karachi-based refineries contain), is the first and the only EURO II compliant diesel to be shortly available in the Pakistani market.

Oil and Gas Development Company Limited (OGDCL) is likely to go into a joint venture with Poly-GCL Petroleum Group of China to expedite exploration of potential oil and gas in Balochistan province. The largest oil and gas exploration company, OGDCL, has already awarded several contracts to a Chinese firm in Balochistan to conduct seismic surveys to expedite oil and gas recovery.

Federal Investigation Agency (FIA) has made significant progress in investigation into embezzlement, worth billions of rupees, allegedly committed by oil marketing companies (OMCs) in collection of petroleum levy and recovered Rs 440 million. According to an official, the OMCs have deposited Rs 440 million in the national exchequer.

The Oil and Gas Regulatory Authority (Ogra) recently issued the first-ever private sector distribution licence for natural gas sales in Sindh to a company incorporated just one day before the licence was granted. The Karachi-based firm — Gaseous Distribution Company (GDC) — will be the first company ever to share the decades-old pipeline network of Sui Southern Gas Company Limited (SSGCL) and challenge its distribution and sales monopoly.The SSGCL had not given a No Objection Certificate (NOC) for network-sharing or signed any covenant with the GDC for network capacity-sharing when the distribution licence was issued by the regulator.

Overall Textile Sector (specifically ANL), Overall Steel Sector (specifically ASTL, CSAP), PACE and DCL can lead market in positive direction.

Technical Analysis

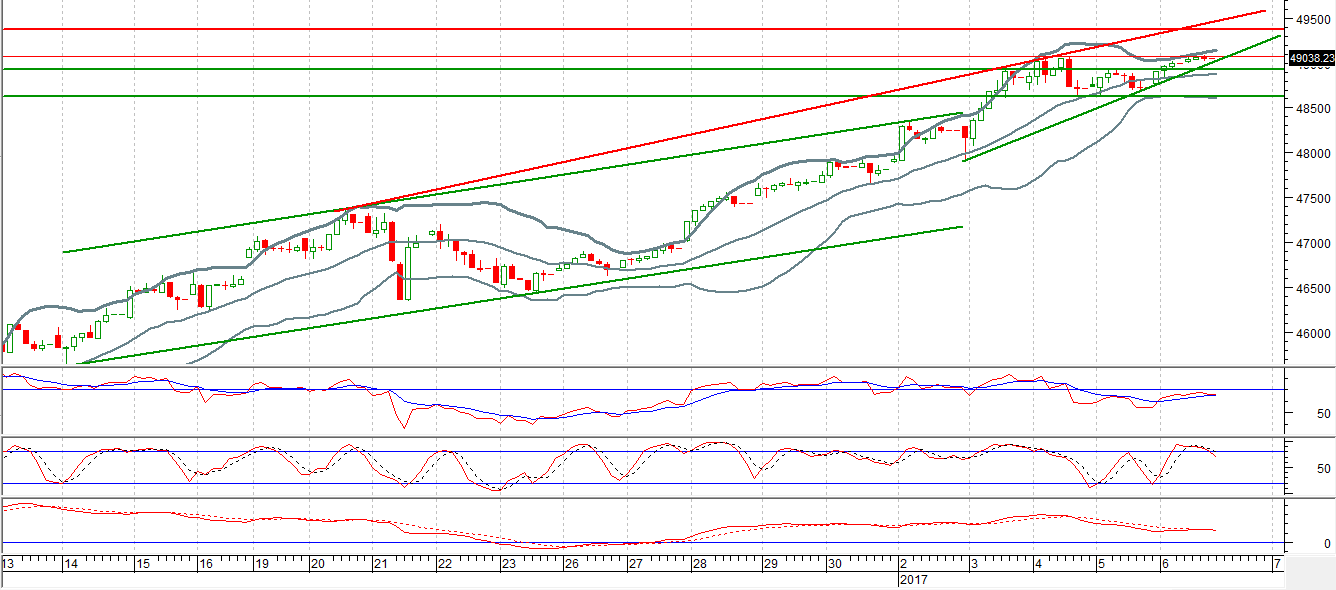

The Bench Mark KSE100 Index is capped by a resistant trend line on daily chart at 49274, but it is getting support from a rising trend line on hourly chart which is pushing it towards new ever high and both resistant and supportive trend lines are creating a wedge which is shrinking with every upcoming hour. Breakage of said wedge on either side could push index for a further 500 points. Right now index is cagged between supportive region of 48860 and resistant region of 49274, so trading with strict stop loss in selective items is recommended. A slight pressure on intraday bases can be witnessed on KSE100 Index.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.