Previous Session Recap

The Bench Mark KSE100 Index Opened at 42133.54, posted day high of 12413.46 and day low of 42009.91 while session suspended at 42113.91 with net change of -19.63 points and trading volume of 289.24 million shares during last trading session. Daily trading volume of KSE100 listed companies increased by 119.87 million shares or 70.78% on DOD bases.

Foreign Investors turned back to net selling and they remain in net selling of 24.02 million shares and net value of Foreign inflow dropped by 8.38 million US Dollars. Categorically Foreign individuals and Corporates remain in net selling of 0.18 and 25.29 million shares respectively but Overseas Pakistanis remain in net buying of 1.45 million shares. While on the other hand Local Individuals, Companies and Mutual Funds remain in net buying of 14.32, 11.71 and 17.84 million shares but Banks and Brokers remain in net selling of 6.2 and 9.8 millon shares.

Analytical Review

Crude Oil prices are under pressure after results of US presidential elections have started appearing in favour of Donald Trump so a fresh breeze from Oil sector is also losing hope as it was expected that if crude oil will get a bounce back from supportive region of 43.02 USD/bbl then Oil sector will try to pump some more life in Index but as Safe Heaven (Gold) is becoming ultimate beneficiery of US Presidential Elections so last supportive aspect is also dying.

American Stocks have gone under serious pressure after a day of healthy recovery as results of presidential elections are appearing in favour of Donald Trump and till 8:50 AM Pakistan time Donald is leading with 197 electoral votes while Hillary is far away with 131 votes and Dow Jones (US30) have lost around 803 points or 4.37% in last three hours.

Senior Vice President, Federation of Pakistan Chambers of Commerce and Industry (FPCCI) Shaikh Khalid Tawab has emphasized on easy and maximum availability of finance to small and medium enterprises (SMEs), which are the backbone of economy of a country.

PIBTL, OGDC, BOP, MLCF, DGKC and ATRL are looking attractive and can lead the market in positive direction but on the other side ENGROand ASTL,will remain under pressure.

Technical Analysis

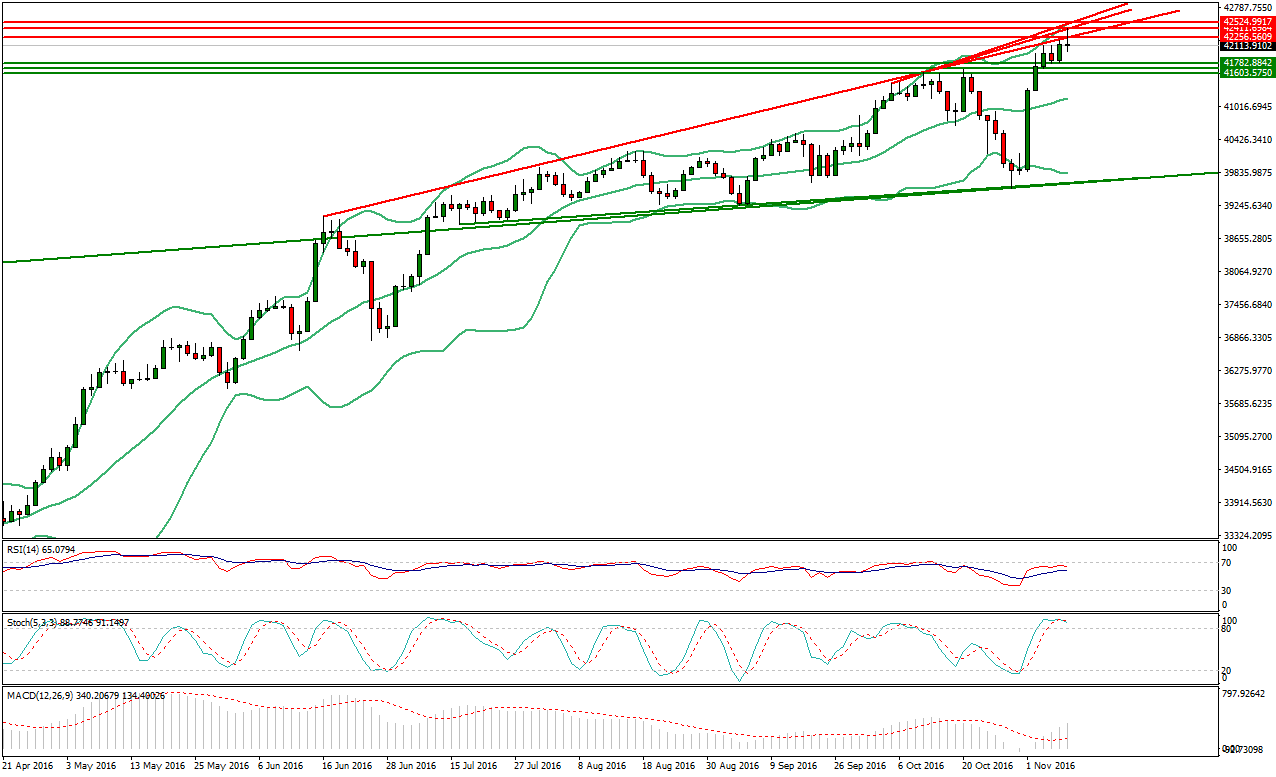

KSE100 Index have confirmed its resistant region at daily chart by penetrating a resistant trend line but closing below it now its expected that KSE100 is going to face a pressure below 42260 and 42460 points with effective supports at 41800 and 41700 regions. KSE100 Index is capped by Consective three resistant trend lines at 42260, 42460 and 42620 points, along with all these resistant regions Daily Stochastic have generated a bearish crossover and RSI is ready for a bearish crossover which are also supportive for a bearish pull back on KSE floor so its clear from technical that a bearish momentum can be witnessed on KSE towards 41800 points in shape of a health correction.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.