Previous Session Recap

The Benchmark KSE100 Index Opened at 49896.54, posted day high of 50196.83 and day low of 49784.33 during last trading session. The session suspended at 49908.15 with net change of 33.19 points and net trading volume of 245.85 million shares. Daily trading volume of KSE100 listed companies increased by 71.00 million shares or 44.61% on DOD Bases.

Foreign Investors remained in net selling position of 22.81 million shares but net value of Foreign Inflow increased by 1.83 million US Dollars. Categorically Foreign Individual and Corporate Investors remained in net selling position of 0.027 and 25.06 million shares but Overseas Pakistanis remained in net buying position of 2.28 million shares. While on the other side, Local Individuals, NBFCs and Mutual Funds remained in net buying position of 21.35, 0.037 and 26.91 million shares respectively. Local Companies, Banks and Brokers remained in net selling position of 10.69, 4.56 and 8.87 million shares respectively during last trading session.

Analytical Review

Asian shares were close to 18-month highs on Friday, tracking a rally on Wall Street after U.S. President Donald Trump promised to unveil a major tax announcement to lower the burden on businesses. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.1 percent, testing its loftiest level since July 2015 touched a day earlier, and was on track to gain 1.1 for the week. Japanese Nikkei stock index .N225 surged 1.8 percent as it got a tailwind from a weaker yen, poised to added 1.8 percent for the week. Wall Street three main indexes notched record highs on Thursday after President Donald Trump said he would make a major tax announcement in a few weeks, though he offered no details.

The controversy between the power ministry and the National Electric Power Regulatory Authority (Nepra) on alleged over-billing worth Rs62 billion to people of Karachi deepened on Thursday when the ministry directly accused the regulator of perpetually siding with privatised power utility to the disadvantage of consumers for times to come. The use of unprofessional language in the fore-mentioned communication (letter written by the Nepra registrar) is regretted, wrote the power ministry to the regulator on Thursday saying Nepra was trying to take refuge behind “national interest” instead of addressing core defects identified in the K-Electric’s power determination.

Trade deficit of Pakistan in merchandise rose nearly 29 per cent year-on-year to $17.428 billion in the first seven months of the current fiscal year because of falling exports and increase in imports. The deficit stood at $2.957bn in January, a rise of 75pc compared to $1.688bn a year ago, the Pakistan Bureau of Statistics said on Thursday. The drop in export proceeds, along with fall in remittances, has contributed to the rising current account deficit this fiscal year.

The total liquid foreign reserves held by the country stood at $22,031.3 million on February 3, 2017. The break-up of the foreign reserves position released on Thursday showed that foreign reserves held by the State Bank of Pakistan stood at $17,217.8 million, net foreign reserves held by commercial banks are $4,813.5 million, therefore total liquid foreign reserves reached at $22,031.3 million. During the week ending February 3, 2017, SBP’s reserves decreased by $376 million to $17,218 million.

The apex regulator of capital markets asked the Pakistan Stock Exchange (PSX) on Thursday to immediately rescind the public notice issued on Feb 7 regarding the interest shown by Bahria Town in acquiring a majority stake in Escorts Investment Bank (EIB), a non-banking finance company. AKD Securities had stated on behalf of Bahria Town that the real estate company was interested in buying up to 71.16 per cent shares in the relatively small investment bank along with management control. No requisite approval has been obtained by EIB or its sponsors with regard to the potential acquirer/investor, the Securities and Exchange Commission of Pakistan (SECP) said in its communication to the PSX. Any potential acquirer of a non-banking finance company has to obtain prior approval of the SECP under the NBFC Regulatory Framework, including compliance with the fit and proper criteria.

SSGC, TRG, NBP, DCL and HIRAT can lead market in positive direction.

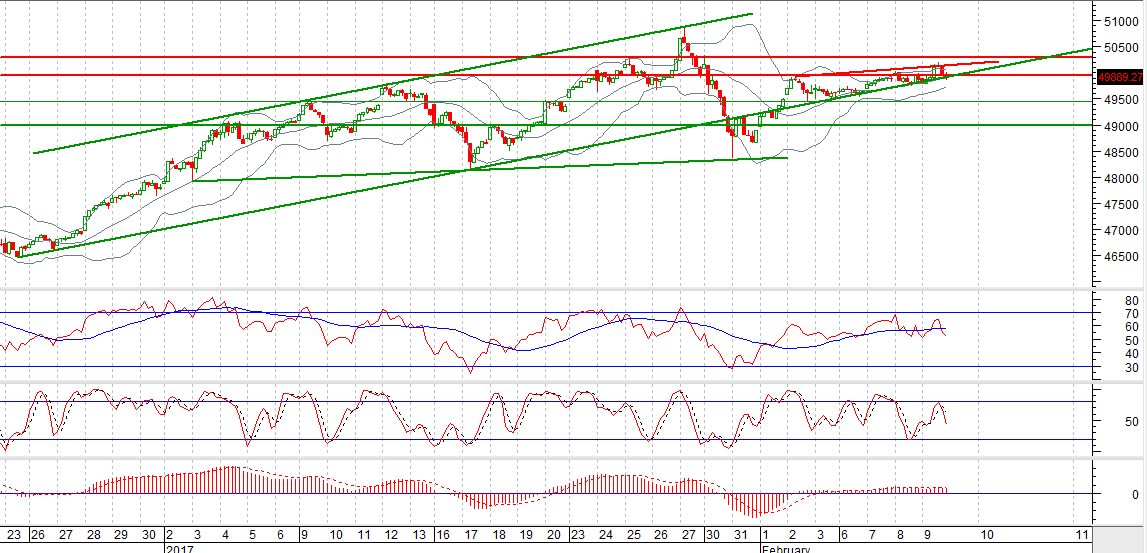

Technical Analysis

The Benchmark KSE100 Index is capped by a resistant trend line along with two horizontal resistances at its 61.8% and 74.6% correction levels inside its short term bullish trend channel. It has created a triangle on hourly chart and breakout of either side of that triangle will call for a new short term trend. For current trading session 49947 and 50147 and 50306 will react as strong resistance levels while supportive regions are standing at 49700 and 49426. On technical bases, a very cautious trading is recommended. As being last trading session of the week market may remain volatile to set its trend for upcoming week. Trading with strict stop loss of 49426 is recommended as closing below that level will call for expansion of bearish correction.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.