Previous Session Recap

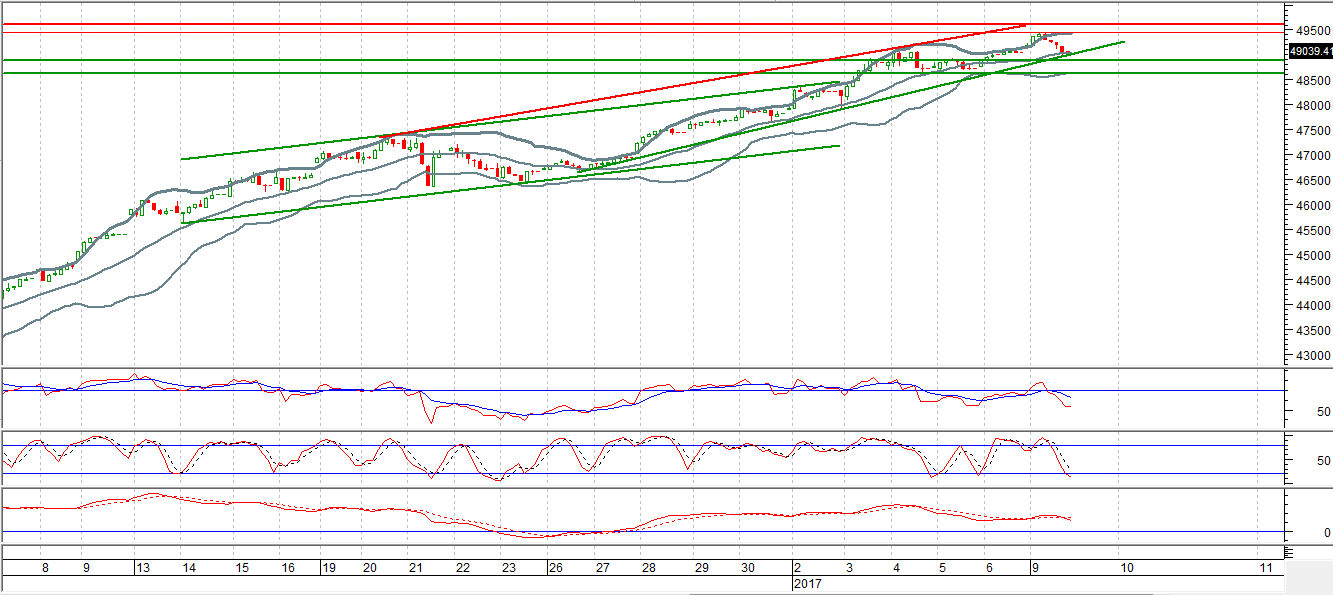

The Bench Mark KSE100 Index opened at 49143 with a gap of 105 points, posted day high of 49429.98 and day low of 48998.17 during last trading session. The session suspended at 49039.41 with net change of 1.18 points and trading volume of 178.31 million shares. Daily trading volume of KSE100 listed companies increased by 25.16 million shares or 16.43% on DOD bases.

Analytical Review

Oil markets on Tuesday were torn between production cuts by major exporters Saudi Arabia and Russia and reports that supplies from other regions including North America, Iraq, and Iran could offset any restraint aimed at curbing a global glut. Prices for Brent crude futures LCOc1, the international benchmark for oil prices, were trading at $54.99 per barrel at 0136 GMT (8.36 p.m. ET), up 5 cents from their last close. U.S. West Texas Intermediate (WTI) crude oil futures CLc1 were trading at $52.04 per barrel, up 8 cents. That came after prices fell around 4 percent the previous session on the back of concerns that rising output in Iraq and Iran and increased drilling in North America were undermining efforts led by Saudi Arabia to curb a global fuel supply glut that has weighed on markets for over two years.

Standing Committee on Petroleum and Natural Resources has sought details of MOL Pakistan, a Hungarian-based oil & gas exploration and production company, for its alleged involvement in stealing crude oil worth billions of rupees from the system. At a meeting of the committee held here under the chairmanship of Chaudhry Bilal Ahmed Virk, a member of the committee Akram Khan Durrani blamed the officials of Ministry of Petroleum and Natural Resources for concealing report of an inquiry conducted by FIA against MOL Pakistan. He requested the chairman of the committee to ensure presentation of the FIA report in the committee next meeting for discussing the same. Preliminary report of FIA pointed out that the national exchequer was facing losses to the tune of billions of rupee due to theft of crude oil through illegal extraction from the main oil transmission line, use of water bowsers and in connivance with public officials.

Pakistan has intimated its decision to China that LNG terminal and pipeline projects should be made part of the China-Pakistan Economic Corridor (CPEC). According to details, the Pakistani side wants to include the Gwadar LNG terminal and Gwadar-Nawabshah pipeline projects in the CPEC Early Harvest Programme. It was requested during the 4th and 5th Joint Energy Working Group (JEWG). The project foresees the import of 600MMCFD LNG through Gwadar port. Under the proposed project, pipeline system from Gwadar to Nawabshah will be constructed along with installation of FSRU (floating storage and re-gasification unit)-based LNG re-gasification facilities at Gwadar port for injection of RLNG into the pipeline system.

The government is following a compressive strategy to reinforce existing gas transmission network for which around Rs 3.571 billion will be spent in different phases. Rs 71 billion are being spent on up-gradation of SNGPL and SSGCL transmission network across the country during the current fiscal year, besides initiating projects worth $2 billion North-South gas pipeline and approximately $1.5 billion Gwadar-Nawabshah gas pipeline and LNG terminal at Gwadar.

Prime Minister Nawaz Sharif will announce on Tuesday the much-awaited export package worth Rs70 billion aimed at arresting the trend of falling exports in the remaining months of the current fiscal year. The package is worked out in a way to minimise the impact of the 8 per cent rebate that the Indian government gives to its exporters to compensate for falling prices of commodities in the international market. In the first half of 2016-17, export proceeds fell to $9.91bn from $10.31bn a year ago, Pakistan Bureau of Statistics (PBS) data shows. Pakistani exports fell to $19.5bn in 2015-16 from $25bn in 2013-14. The proposed Prime Minister Trade Enhancement Initiative covers raw materials used in five value-added sectors, namely textiles, leather, sports, carpets and surgical goods.

Overall Refinery Sector (specifically ATRL, BYCO), DCL and AKZO can lead market in positive direction.

Technical Analysis

The Bench Mark KSE100 has supportive regions ahead at 48986 and 48880 from a rising trend line and a horizontal support but breakout of 48880 can call for 48622. For new buying, stop loss of 48880 can be considered while trading during current trading session. If market maintains supportive region of 48880 then it will try to bounce back towards 49440 points to retest its resistant regions. Intraday RSI is trying to pullback but daily Stochastic and RSI are in breathing mode.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.