Previous Session Recap

The Bench Mark KSE100 Index Opened at 49752.10, posted a day high of 49857.09 and a day low of 49219.55 during last trading session whereas session suspended at 49392.44 with a net change of -362.28 and a net trading volume of 96.52 million shares. Daily trading volume of KSE100 listed companies increased by 1.1 million shares or 1.15% on DoD basis.

Analytical Review

Asian stocks edged up and the dollar rose to 1-1/2-month highs versus the yen on Friday, ahead of the closely-watched U.S. non-farm payrolls report due later in the day. MSCI broadest index of Asia-Pacific shares outside Japan added 0.2 percent, taking cues from a modest bounce in Wall Street overnight. Japanese Nikkei climbed more than 1 percent on the back of a weaker yen. Shares in South Korea rose 0.3 percent after the country Constitutional Court upheld parliament Dec. 9 vote to impeach President Park Geun-hye over an influence-peddling scandal. Wall Street was marginally higher the day before, underpinned by speculation the widely-anticipated labour market report on Friday would show U.S. payrolls growth in February was far more than economist forecast. The employment figures are drawing particular interest as chances of the Federal Reserve raising interest rates several times this year could improve if the data underlines U.S. economic strength. A robust report could give rise to speculation that the Fed could hike rates not just three but even four times this year, in turn pushing up the dollar and U.S. yields, said Shuji Shirota, head of macro-economics strategy group at HSBC in Tokyo.

Oil companies have challenged prices notified by the Oil and Gas Regulatory Authority (Ogra) for liquefied petroleum gas (LPG), stating the move lacked legal ground and market principles and would negatively affect producers and consumers. A senior government official told IDawnI that the oil companies had asked the government through Minister for Petroleum Shahid Khaqan Abbasi to revoke the prices notified by the regulator without market assessment. In fact, the oil industry has supported a pricing mechanism proposed by the petroleum ministry to Ogra, envisaging the LPG rates at Rs59,190 per tonne. However, this was rejected by the regulator. Instead, on Feb 24, Ogra notified the LPG price at Rs45,276 per tonne or Rs910 per 11.8kg of domestic cylinder. The petroleum ministry had proposed Rs1,100 per domestic cylinder.

Textiles seem to have bounced back as bank advances to the sector were record high in 2016. The textile industry is the backbone of the economy and generates the highest export earnings. Yet it appears to have failed in coping with the new challenges that emerged in the global textile and fashion industry in recent years. Under Textile Policy 2015-19, Rs64.15 billion will be spent to increase the exports of textile and clothing items from the existing $13bn to $26bn by 2019. Pakistan is the fourth largest producer of cotton in the world and holds the largest spinning capacity in Asia after China and India.

The power generation of Pakistan has registered a decline of four percent in January 2017 owing to lower electricity off-take during the winter season but this power generation grew by 2 percent if compared to the production of the same period of last year. According to National Electric Power Regulator Authority (Nepra), thermal based power fuel cost has clocked in at Rs8.6 per Kilowatt hour (KWh), up by 38 percent monthly due to increased share of high cost, while on YoY basis average fuel cost per KWh surged by 26 percent. Nuclear based generation remained the cheapest at Rs0.81/KWh followed by gas (Rs4.5/KWh), coal (Rs5.6/KWh), RLNG (Rs7.6/KWh), FO (Rs9.5/KWh), imported - Iran (Rs10.6/KWh) and HSD (Rs14.22/KWh).

The Central Development Working Party (CDWP) on Thursday approved 17 projects worth Rs99.4 billion in transport and communication, energy, water resources, physical planning and food and agriculture sectors. The biggest project, worth Rs36bn, was Gwadar-Nawabshah liquefied natural gas (LNG) terminal and pipeline project. Prime minister programme for construction of 46 new hospitals across Pakistan at the cost of Rs1.3bn was also approved. Moreover, a Rs19.9bn project to dualise and improve the Pindigheb-Kohat road was also approved.

Today market is expected to remain volatile again, Traders are advised to exercise caution, Take profit on higher levels and buy on dips.

Technical Analysis

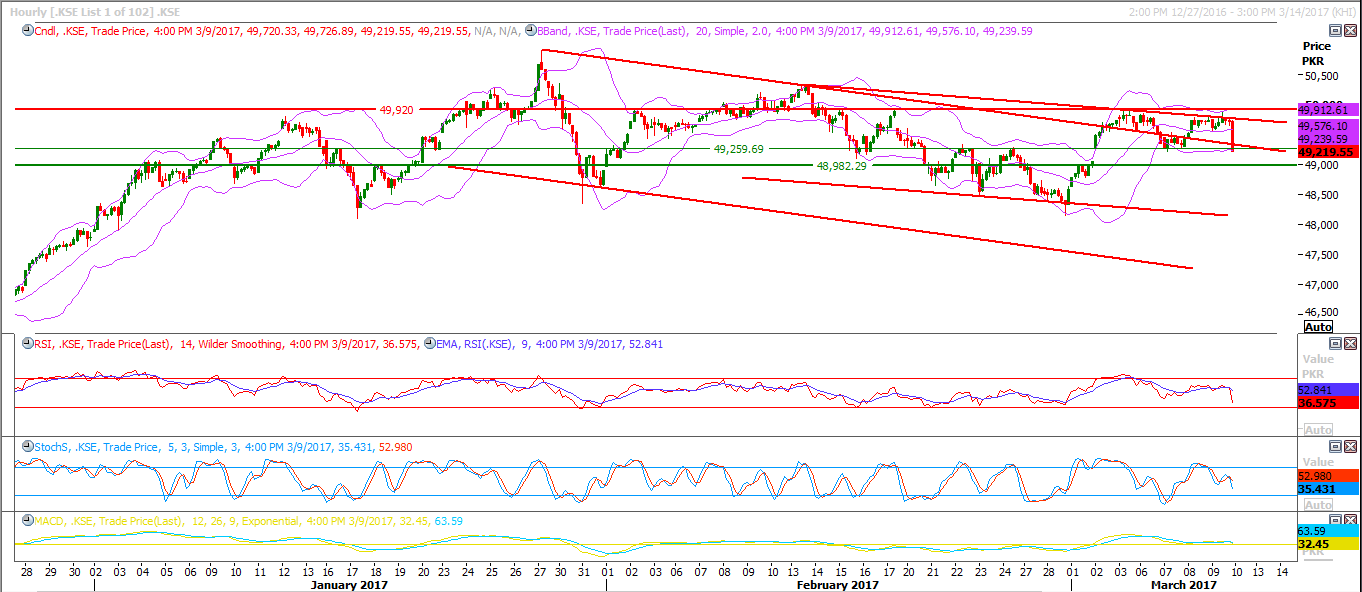

The Bench Mark KSE100 Index dropped back after retesting its major resistant region and closed below its supportive region or 49440. Now next supportive region stands around 48980 while 49440 and 49460 regions would react as resistances. Today is the last day of week and it seems that market is pushed back again from its psychological barrier of 50000 and it will again close below that level which will push index back towards new lows of this week. Trading with strict stop losses is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.