Previous Session Recap

The Bench Mark KSE100 Index Opened at 42113.91, posted day high of 42227.74 and slipped in bearish direction towards day low of 41352.52 but session suspended at 42203.63 points with net change of 89.72 points and net trading volume of 296.15 million shares. Daily trading volume of KSE100 listed companies increased by 6.91 million shares or 2.39% on DOD bases.

Foreign Investors remain in net selling of 8.67 million shares and net value of Foreign Inflow dropped by 9.33 million US Dollars on DOD bases during last trading session. Categorically Foreign Individuals and Corporates remain in net selling of 0.16 and 8.61 million shares respectively but Overseas Pakistanis remain in net buying of 0.1 million shares. While on the other hand Local Individuals, Companies and Brokers remain in net buying of 11.64, 5.01 and 3.02 million shares respectively but Banks and Mutual Funds remain in net selling of 6.86 and 1.95 million shares respectively.

Foreign Investors have changed their strategy during current week and they offloaded their positions by 30.61 million shares with this change their net trading volume at PSX remain in net buying of 39.38 million shares on month till date bases.

Analytical Review

Crude Oil Prices are trying to bounce back after getting support from strong supportive region of 43.00 USD/bbl but it could not be assumed that Crude Oil prices have changed their trend until it closes above 45.96 USD/bbl. After closing above 45.96 USD it can be expected that crude oil prices can touch 47 which will pump some fresh air in Oil sector.

International Stocks, Commodities and Currencies have bounced back from supportive regions and recover from the whole move of American Presidential Elections during intra-day trading sessions on moderate statements from Elected US President. But within a few weeks of winning the White House, President-elect Donald Trump could face another group of U.S. citizens, a federal jury in California, courtesy of a lawsuit by former students of his now-defunct Trump University who claim they were defrauded by a series of real-estate seminars so this positive momentum could burst any time.

Pakistan is making a strong presence at the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC), one of the world most influential energy sector events, which is currently taking place from 7-10 November 2016 in National Exhibition Centre.

Pakistan State Oil (PSO) has reportedly accused Ministry of Water and Power of not paying the agreed amount against furnace oil supply and Late Payment Surcharge (LPS) as well as supporting a review of the furnace oil consumption for thermal power plants due to a lower demand.

Karachi Electric (KEL) is to refund Rs. 0.84 per unit to consumers overcharged in September 2016 after approval from the National Electric Power Regulatory Authority (NEPRA) under provisional monthly fuel charges adjustment formula.

PKGS, MLCF, DGKC, and LUCK are looking attractive on Intra-day and short term bases, they can lead the market in positive direction. On the other side, ENGROand PSO,will remain under pressure.

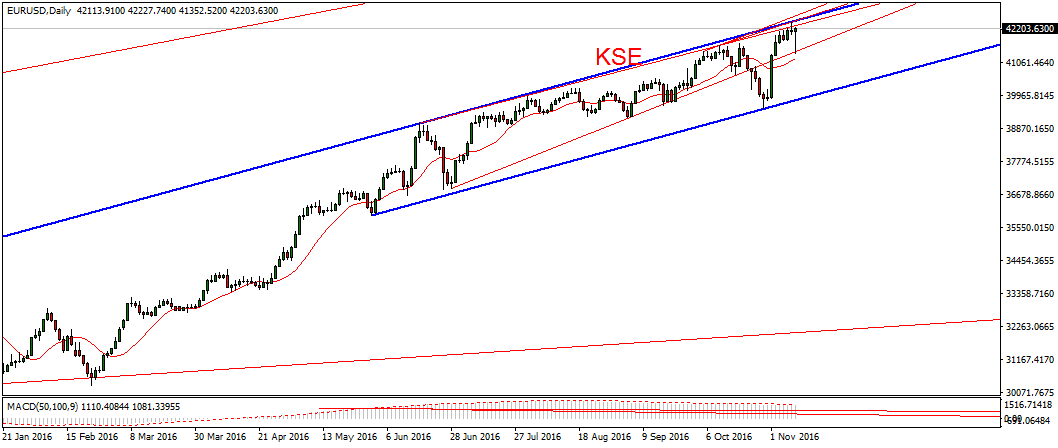

Technical Analysis

Bearish Sentiments have been tried to be over-ruled by generating a bullish hammer on daily chart but Confirmation of Resistant region is still intact as KSE100 Index has not been able to close above Resistant trend lines but has confirmed them on Daily Chart by penetrating them during trading session of 8th November 2016. For Current trading session 42301 and 42460 point regions can react to bullish sentiment while supportive regions are still intact at 41800 and 41698 points as market has still not been able to close below those levels after penetrating them on Intra-day bases. Daily Stochastic indicator has become successful in creating a Bearish Crossover so its recommended to avoid aggressive buying on current levels but selective trading based on swing strategy could be beneficial.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.