Previous Session Recap

Trading volume at PSX floor increased by 14.70 million shares or 7.68% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,760.66, posted a day high of 42,960.94 and a day low of 42,696.35 during last trading session. The session suspended at 42,923.95 with net change of 192.09 and net trading volume of 107.40 million shares. Daily trading volume of KSE100 listed companies increased by 14.45 million shares or 15.54% on DoD basis.

Foreign Investors remained in net selling position of 13.13 million shares and net value of Foreign Inflow dropped by 9.63 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.01 million shares but Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 11.12 and 2.02 million shares. While on the other side Local Individuals and Mutual Fund remained in net buying positions of 12.76 and 11.97 million shares but Local Companies, Banks, NBFCs, Brokers and Insurance Companies remained in net selling positions of 1.47, 1.40, 5.65, 1.86 and 0.02 million shares respectively.

Analytical Review

Asian shares down on trade anxiety; lira, rouble hit by economic worries

Asian stock markets fell on Friday amid heightened global trade tensions, while currency markets were whipsawed by a searing selloff in Russia’s rouble after the United States slapped new sanctions, and as economic worries sent the Turkish lira tumbling. In equity markets, MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.3 percent. Japan’s Nikkei stock index fell 0.5 percent despite data showing that the country’s economy expanded at a faster-than-expected annualized rate of 1.9 percent in the second quarter in a sign of improving momentum. Wall Street provided little direction for markets in Asia on Friday, with the Dow Jones Industrial Average falling 0.29 percent, the S&P 500 ending 0.14 percent lower and the Nasdaq Composite adding 0.04 percent.

Investments to grow 17.2pc

The investments are targeted to grow at 17.2 percent of Gross Domestic Product (GDP) during the fiscal year 2018-19 compared to the investments of 16.1 percent during last year. The fixed investment during the year under review is expected to grow by 15.6 percent of GDP, according to official data, which added that the National Savings, as percentage of GDP are targeted at 13.1 percent. "The investment target is achievable given improvement in ease of doing business, affordable energy supply, and prospects of higher profits and enhanced capacity utilization rate," official sources said. The spillover effect from public investment under China Pakistan Economic Corridor (CPEC) is expected to catalyse private sector and foster public private partnership. The expected technology and innovation spill over from interaction of Chinese and Pakistani business would improve production in all sectors.

Forex reserves stand at $17b

Total liquid foreign reserves of the country stand at $17 billion, says State Bank of Pakistan (SBP). According to SBP's weekly statement issued on Thursday, the foreign reserves held by the State Bank on August 03, amounted to $10,369.1 million. Whereas, the net foreign reserves with commercial banks were $ 6,635.9 million. During the week ending August 03, SBP's reserves increased by $19million to $10,369 million.

PTI govt may borrow $4b from IDB

The new government of Pakistan led by Imran Khan would has to face many problems in its beginning and the most important of these challenges is the revival of economy as the reserves in national exchequer is almost touching to dead level . The country has many options in this regard to bring a hefty amount on immediate basis to run the government affairs as well as retiring foreign debts . According to Financial Times, Pakistan plans to borrow more than $4billion from the Saudi-backed Islamic Development Bank as part of its attempts to restore dangerously low stocks of foreign reserves. Two officials have told the newspaper that the Jeddah-based bank has agreed to make a formal offer to lend Islamabad the money when Imran Khan takes over as prime minister. They added that they expect Asad Umar, Khan’s proposed finance minister, to accept. “The paperwork is all in place,” said one senior adviser in Islamabad. “The IDB is waiting for the elected government to take charge before giving their approval.” The person added that the loan would not cover Pakistan’s expected financing gap of at least $25bn during this financial year but was “an important contribution”.

Genco faces Rs5m fine for breakdown

After lapse of two and a half years National Electric Power Regulatory Authority (Nepra) has finally imposed a fine of Rs5 million on M/s Central Power Generation Company Limited Genco-II for the power breakdown on January 21, 2016 in northern network of country leaving major portion of Punjab & Khyber Pakhtunkhwa in dark. The Nepra has imposed a fine of Rs5 million on a government owned Generation Company M/s Central Power Generation Company Limited Genco-II on account of negligence in maintenance of 220 kV switchyard of TPS Guddu old and non-operation of 220 kV circuit breaker which resulted in power breakdown on January 21, 2016 in northern network of country i.e. Punjab and Khyber Pakhtunkhwa, said an official spokesman for the Nepra.

Asian stock markets fell on Friday amid heightened global trade tensions, while currency markets were whipsawed by a searing selloff in Russia’s rouble after the United States slapped new sanctions, and as economic worries sent the Turkish lira tumbling. In equity markets, MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.3 percent. Japan’s Nikkei stock index fell 0.5 percent despite data showing that the country’s economy expanded at a faster-than-expected annualized rate of 1.9 percent in the second quarter in a sign of improving momentum. Wall Street provided little direction for markets in Asia on Friday, with the Dow Jones Industrial Average falling 0.29 percent, the S&P 500 ending 0.14 percent lower and the Nasdaq Composite adding 0.04 percent.

The investments are targeted to grow at 17.2 percent of Gross Domestic Product (GDP) during the fiscal year 2018-19 compared to the investments of 16.1 percent during last year. The fixed investment during the year under review is expected to grow by 15.6 percent of GDP, according to official data, which added that the National Savings, as percentage of GDP are targeted at 13.1 percent. "The investment target is achievable given improvement in ease of doing business, affordable energy supply, and prospects of higher profits and enhanced capacity utilization rate," official sources said. The spillover effect from public investment under China Pakistan Economic Corridor (CPEC) is expected to catalyse private sector and foster public private partnership. The expected technology and innovation spill over from interaction of Chinese and Pakistani business would improve production in all sectors.

Total liquid foreign reserves of the country stand at $17 billion, says State Bank of Pakistan (SBP). According to SBP's weekly statement issued on Thursday, the foreign reserves held by the State Bank on August 03, amounted to $10,369.1 million. Whereas, the net foreign reserves with commercial banks were $ 6,635.9 million. During the week ending August 03, SBP's reserves increased by $19million to $10,369 million.

The new government of Pakistan led by Imran Khan would has to face many problems in its beginning and the most important of these challenges is the revival of economy as the reserves in national exchequer is almost touching to dead level . The country has many options in this regard to bring a hefty amount on immediate basis to run the government affairs as well as retiring foreign debts . According to Financial Times, Pakistan plans to borrow more than $4billion from the Saudi-backed Islamic Development Bank as part of its attempts to restore dangerously low stocks of foreign reserves. Two officials have told the newspaper that the Jeddah-based bank has agreed to make a formal offer to lend Islamabad the money when Imran Khan takes over as prime minister. They added that they expect Asad Umar, Khan’s proposed finance minister, to accept. “The paperwork is all in place,” said one senior adviser in Islamabad. “The IDB is waiting for the elected government to take charge before giving their approval.” The person added that the loan would not cover Pakistan’s expected financing gap of at least $25bn during this financial year but was “an important contribution”.

After lapse of two and a half years National Electric Power Regulatory Authority (Nepra) has finally imposed a fine of Rs5 million on M/s Central Power Generation Company Limited Genco-II for the power breakdown on January 21, 2016 in northern network of country leaving major portion of Punjab & Khyber Pakhtunkhwa in dark. The Nepra has imposed a fine of Rs5 million on a government owned Generation Company M/s Central Power Generation Company Limited Genco-II on account of negligence in maintenance of 220 kV switchyard of TPS Guddu old and non-operation of 220 kV circuit breaker which resulted in power breakdown on January 21, 2016 in northern network of country i.e. Punjab and Khyber Pakhtunkhwa, said an official spokesman for the Nepra.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

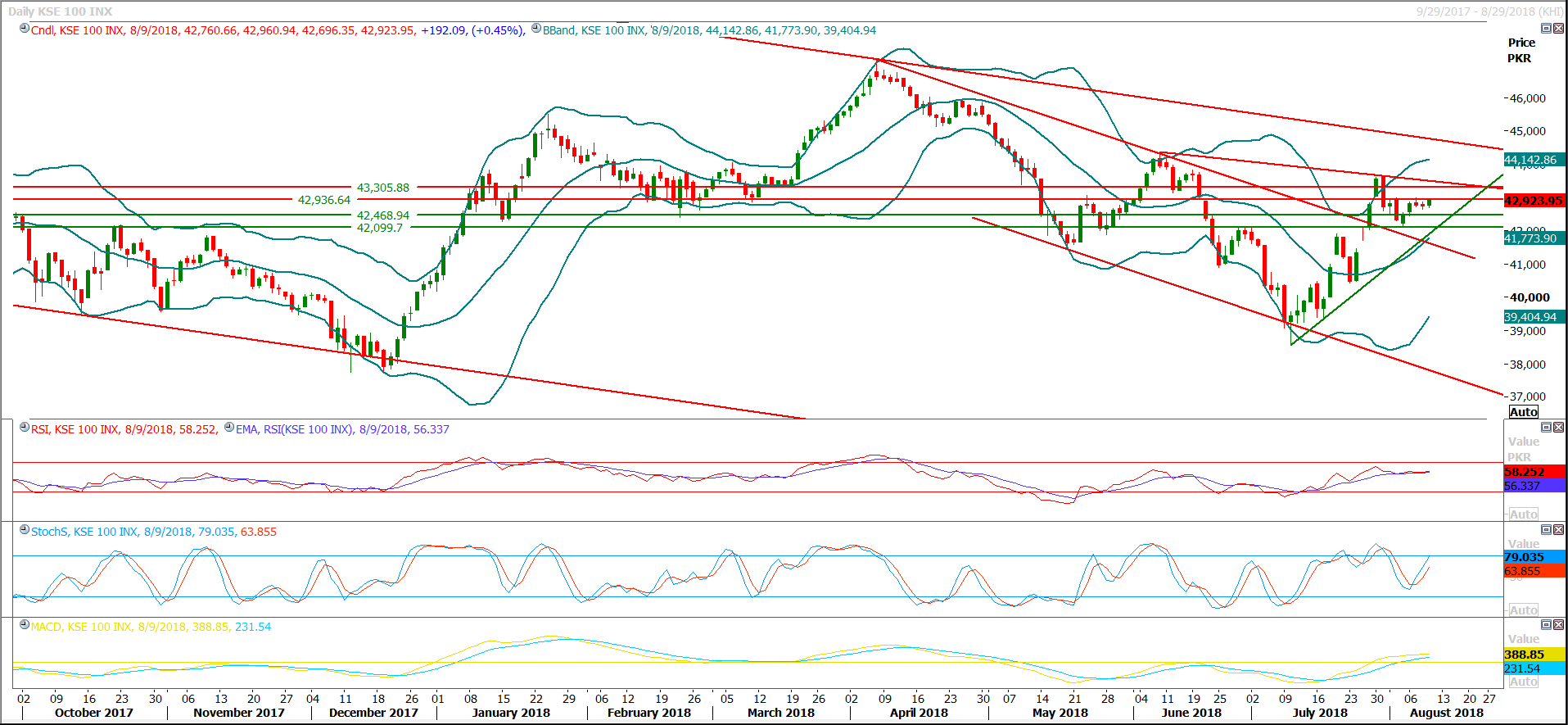

Technical Analysis

The Benchmark KSE100 Index have once again tried to penetrate its resistant regions during last trading session but have not succeeded to close above psychological region of 43,000 points on daily chart, as of now index would try to open with a positive gap above that region to add some positive momentum. Index is being capped by 50% and 61.8% corrections of last bearish move and if it would not succeed in closing above these regions during current trading session then a new bearish rally could be witnessed in coming week. If index would succeed in closing above 43,090 points on hourly chart then a spike towards 43,330 points could be witnessed and it’s recommended to wait for penetration of 43,090 points before initiating new long positions.

Being last trading session of the week current session is very important and today’s closing above 43,330 and 43,550 points would call for spike towards 44,660 points in coming days, but if index would not succeed in maintaining positive momentum till day end then 42,460 and 42,089 points would provide some ground against bearish pressure. It’s recommended to adopt swing trading strategy until a clear breakout of either side happens. Major market scripts like, PSO, ATRL, DGKC, MLCF, SNGP, TRG, ISL, PPL and ENGRO are standing at their correction levels of last bearish rallies and these correction levels would play a vital role in price actions, if these scripts would succeed in closing above these resistant regions then a new bullish trend would be witnessed otherwise these scripts would start expansions of their respective corrections which would result in a serious bearish slide in index, therefore its recommended to stay cautious while trading during current trading session and two or three coming sessions as well.

Being last trading session of the week current session is very important and today’s closing above 43,330 and 43,550 points would call for spike towards 44,660 points in coming days, but if index would not succeed in maintaining positive momentum till day end then 42,460 and 42,089 points would provide some ground against bearish pressure. It’s recommended to adopt swing trading strategy until a clear breakout of either side happens. Major market scripts like, PSO, ATRL, DGKC, MLCF, SNGP, TRG, ISL, PPL and ENGRO are standing at their correction levels of last bearish rallies and these correction levels would play a vital role in price actions, if these scripts would succeed in closing above these resistant regions then a new bullish trend would be witnessed otherwise these scripts would start expansions of their respective corrections which would result in a serious bearish slide in index, therefore its recommended to stay cautious while trading during current trading session and two or three coming sessions as well.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.