Previous Session Recap

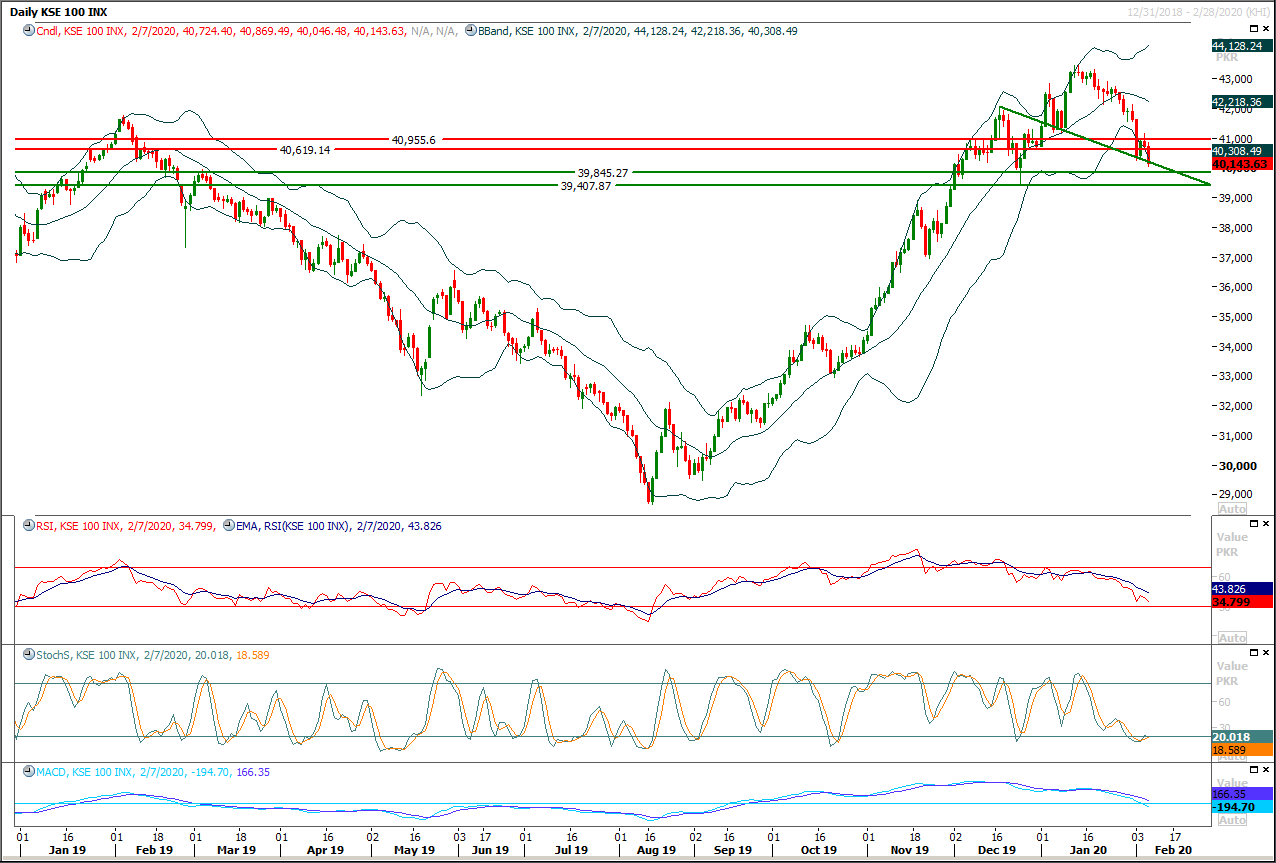

Trading volume at PSX floor increased by 65.73 million shares or 51.43% on DoD basis, whereas the benchmark KSE100 index opened at 40,724.40, posted a day high of 40,869.49 and a day low of 40,046.48 points during last trading session while session suspended at 40,143.63 points with net change of -580.77 points and net trading volume of 157.23 million shares. Daily trading volume of KSE100 listed companies also increased by 64.69 million shares or 69.91% on DoD basis.

Foreign Investors remained in net buying positions of 1.28 million shares but net value of Foreign Inflow dropped by 1.20 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani remained in net long positions of 0.50 and 0.78 million shares but Foreign Individuals Investors remained in net selling positions of 0.009 million shares respectively. While on the other side Local Individuals, Mutual Fund and Brokers remained in net selling positions of 0.69, 5.09 and 5.91 million shares but Local Companies, Banks, NBFCs and Insurance Companies remained in net long positions of 1.34, 6.53, 0.25 and 0.99 million shares respectively.

Analytical Review

Asian markets fall as coronavirus concerns weigh on sentiment

Stocks and oil fell while safe-haven gold rose on Monday as the death toll from a coronavirus outbreak surpassed the SARS epidemic, raising alarm bells about its severity. As many as 908 people have so far died in China’s central Hubei province as of Sunday with most of the new deaths in the provincial capital of Wuhan, the epicenter of the outbreak. MSCI’s broadest index of Asia-Pacific shares outside Japan stumbled 0.7% to be on track for its second straight day of loss. Japan’s Nikkei fell 0.8% while South Korea’s KOSPI was off 1.4% and Australian shares eased 0.5%. The losses extended from Wall Street on Friday where the Dow fell 0.9%, the S&P 500 declined 0.5% while the Nasdaq dropped 0.5%. E-mini futures for S&P 500 were down 0.3% on Monday.

Power policy proposes cost recovery at every stage

The government has finalised National Electricity Policy 2020 that seeks ‘balanced development’ of power generation, transmission and distribution through full cost recoveries at every stage and to gradually bring an end to use of all imported fuels. The draft policy that would pass through the next meeting of the Council of Common Interests for approval also envisages that “the agreed upon amounts owed by Provinces and/or their departments to the power sector, shall be automatically adjusted from the NFC award and departmental budgets”. Under the policy, the National Electric Power Regulatory Authority (Nepra) would ensure liquidity of the electricity sector and facilitate the projects for which government may impose additional charge to be deemed as costs incurred by the distribution companies (Discos) or electricity suppliers. “Such additional charge may take into account the sustainability, liquidity and commercial viability of the sector, affordability for the consumers and the policy of uniform tariff,” says the policy draft seen by Dawn.

Nepra advises producers to install solar-wind hybrid plants

The National Electric Power Regulatory Authority (Nepra) has advised the wind power producers (WPPs) to explore the possibility of utilising their sites and available land to set up solar-wind hybrid power projects with an eye on augmented capacity and to make their product economical. This has been proposed by the regulator to the existing WPPs facing their load curtailments by the power operators — National Transmission & Dispatch Company (NDTC) and National Power Control Centre (NPCC) — because of their relatively higher tariff and substantial surplus capacity available in the base load and conventional power supplies — oil, gas and coal, etc.

Textile sector major tax payer: PRGMEA

Pakistan Readymade Garments Manufacturers and Exporters Association (PRGMEA) North Zone, chairman Sohail Afzal on Sunday said that value-added garments sector of the textile industry showed 3.03 percent growth in 2018-19 despite various challenges. The value-added garments sector was the major tax payer, largest employment generator in whole textile chain and exporting to US$ 5.5 billion textile products, he disclosed. Talking to APP, said the sector had a huge scope of expansion and industry comprising mostly on SMEs which needed special attention of the concerned authorities for resource allocation for developing it sound and sustainable level at par with its competitors Turkey, India and Bangladesh.

Pakistan, Iran vow to expand cooperation in communications, technology sector

Iran and Pakistan held the first ever two-day session of Joint Working Group on Information and Communications Technologies (ICTs) in Islamabad to develop cooperation on communications and technology. An official statement said that the meeting was co-chaired by Secretary Ministry of Information Technology and Telecommunication Shoaib Ahmad Siddiqui and Iranian Deputy Minister for Innovation and Technology Affairs of Ministry of Information and Communications Technology Sattar Hashemi. The discussions revolved around exploring areas of cooperation in the field of ICT and the creation of an enabling environment for harnessing the benefits of 4th Industrial Revolution and resulting digital space for the greater benefit of people especially the youth, IRNA reported Sunday.

Stocks and oil fell while safe-haven gold rose on Monday as the death toll from a coronavirus outbreak surpassed the SARS epidemic, raising alarm bells about its severity. As many as 908 people have so far died in China’s central Hubei province as of Sunday with most of the new deaths in the provincial capital of Wuhan, the epicenter of the outbreak. MSCI’s broadest index of Asia-Pacific shares outside Japan stumbled 0.7% to be on track for its second straight day of loss. Japan’s Nikkei fell 0.8% while South Korea’s KOSPI was off 1.4% and Australian shares eased 0.5%. The losses extended from Wall Street on Friday where the Dow fell 0.9%, the S&P 500 declined 0.5% while the Nasdaq dropped 0.5%. E-mini futures for S&P 500 were down 0.3% on Monday.

The government has finalised National Electricity Policy 2020 that seeks ‘balanced development’ of power generation, transmission and distribution through full cost recoveries at every stage and to gradually bring an end to use of all imported fuels. The draft policy that would pass through the next meeting of the Council of Common Interests for approval also envisages that “the agreed upon amounts owed by Provinces and/or their departments to the power sector, shall be automatically adjusted from the NFC award and departmental budgets”. Under the policy, the National Electric Power Regulatory Authority (Nepra) would ensure liquidity of the electricity sector and facilitate the projects for which government may impose additional charge to be deemed as costs incurred by the distribution companies (Discos) or electricity suppliers. “Such additional charge may take into account the sustainability, liquidity and commercial viability of the sector, affordability for the consumers and the policy of uniform tariff,” says the policy draft seen by Dawn.

The National Electric Power Regulatory Authority (Nepra) has advised the wind power producers (WPPs) to explore the possibility of utilising their sites and available land to set up solar-wind hybrid power projects with an eye on augmented capacity and to make their product economical. This has been proposed by the regulator to the existing WPPs facing their load curtailments by the power operators — National Transmission & Dispatch Company (NDTC) and National Power Control Centre (NPCC) — because of their relatively higher tariff and substantial surplus capacity available in the base load and conventional power supplies — oil, gas and coal, etc.

Pakistan Readymade Garments Manufacturers and Exporters Association (PRGMEA) North Zone, chairman Sohail Afzal on Sunday said that value-added garments sector of the textile industry showed 3.03 percent growth in 2018-19 despite various challenges. The value-added garments sector was the major tax payer, largest employment generator in whole textile chain and exporting to US$ 5.5 billion textile products, he disclosed. Talking to APP, said the sector had a huge scope of expansion and industry comprising mostly on SMEs which needed special attention of the concerned authorities for resource allocation for developing it sound and sustainable level at par with its competitors Turkey, India and Bangladesh.

Iran and Pakistan held the first ever two-day session of Joint Working Group on Information and Communications Technologies (ICTs) in Islamabad to develop cooperation on communications and technology. An official statement said that the meeting was co-chaired by Secretary Ministry of Information Technology and Telecommunication Shoaib Ahmad Siddiqui and Iranian Deputy Minister for Innovation and Technology Affairs of Ministry of Information and Communications Technology Sattar Hashemi. The discussions revolved around exploring areas of cooperation in the field of ICT and the creation of an enabling environment for harnessing the benefits of 4th Industrial Revolution and resulting digital space for the greater benefit of people especially the youth, IRNA reported Sunday.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have succeeded in sliding below its major supportive trend line on daily and weekly chart and now it's expected that it would remain under pressure until it would succeed in closing above 40,500 points on daily chart. Weekly momentum indicators are strong bearish and daily momentum is also gaining pressure once again. Therefore it's recommended to stay cautious and avoid initiating long positions until index succeed in giving a clear reversal sign before 39,500 points. Breakout below 39,500 points would call for 37,500 points in coming days. While on flip side if index would succeed in find support above 39800 points or 39,500 points then it would try to take a spike towards 40,500 points which would be considered a correction therefore it's recommended to post trailing stop loss on existing short positions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.