Previous Session Recap

Trading volume at PSX floor dropped by 45.27 million shares or 16.73% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43188.71, posted a day high of 43251.40 and a day low of 42566.51 during last trading session. The session suspended at 42814.34 with net change of -297.78 and net trading volume of 118.67 million shares. Daily trading volume of KSE100 listed companies dropped by 7.01 million shares or 5.58% on DoD basis.

Foreign Investors remained in net buying postion of 8.8 million shares and net value of Foreign Inflow increased by 6.89 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani investors remained in net buying postions of 0.39, 3.08 and 5.34 million shares respectively. While on the other side Local NBFCs and Brokers remained in net buying positons of 0.86 and 8.38 million shares but Local Individuals, Companies, Banks, Mutual Funds and Insurance Companies remained in net selling postions of 7.89, 1.95, 3.87, 1.84 and 1.31 million shares respectively.

Analytical Review

Asian shares hovered just below their 2007 record peak on Wednesday, supported by expectations of solid corporate earnings on the back of synchronized growth in the global economy. MSCI’s broadest index of Asia-Pacific shares outside Japan was little changed in early trade, sitting just 0.4 percent below the record high touched in November 2007, having risen for six straight days since the start of new year. Japan’s Nikkei was also flat in early trade, near a 26-year high hit the day before. Wall Street’s major indexes extended the New Year rally to record levels into a sixth day, on expectations of solid corporate profit growth.

Moody’s Investors Service said on Tuesday the rupee will likely face ongoing depreciation pressures against the dollar after a five per cent downward adjustment last month. If the rupee depreciates markedly further, the State Bank of Pakistan (SBP) will find it difficult to keep inflation under control, it added. However, Moody’s said if the depreciation is limited to 5pc, the weakening of the rupee will pose no significant credit implications for the sovereign. “Given the likely evolution of the current account, further depreciation pressures are likely. “In particular, Moody’s expects Pakistan’s current account deficit to remain around current levels, at 3-4pc of GDP, due to the high import intensity of domestically driven growth,” said Moody’s.

Reversing its earlier decision, the State Bank of Pakistan (SBP) is reported to have allowed dealers the import of 100 per cent cash dollars against the export of other foreign currencies. The central bank restricted the cash dollar import to 35pc through a circular on Jan 1 — a move that resulted in a shortage of the greenback in the open market. The exchange rate surged to a record high of Rs113 on Monday from Rs110.80 since the implementation of the 35pc condition. This sharp rise in the dollar price forced the SBP to call an urgent meeting with the currency dealers on Tuesday. The central bank asked them to bring down the dollar rate in the open market.

he Punjab chief minister has approved a summary for the imposition of ban on installation of new cement plants in the entire province, The Nation has learnt. As per details, a summary for the standing committee of the cabinet on legislative business was moved for imposition of ban on establishment of new cement plants . The summary said, “The Punjab Industries (Control on Establishment and Enlargement) Ordinance 1963 is the legal instrument for the organized growth of industries in the province. Under Section 3 of the Ordinance, mandatory prior permission from the government for the establishment of any industrial undertaking is required. Section 11 of the ordinance empowers the provincial government to relax any industry or class of industries from any or all provisions of the ordinance.”

The Punjab Provincial Development Working Party (PDWP) Tuesday approved two development schemes of agriculture & road sectors with an estimated cost of Rs 1884.103 million. The development schemes were approved in the 44th meeting of PDWP of current fiscal year 2017-18 held under the chair of chairman P&D Muhammad Jahanzeb Khan. The meeting was also attended by Secretary P&D Iftikhar Ali Sahoo, all members of the Planning & Development Board, provincial secretaries concerned, Assistant Chief P&D Coordination-II Hafiz Muhammad Iqbal and other senior representatives of the relevant provincial departments.

SNGP, TRG, DCL, FFC and FFBL wouldy try to lead positive momentum.

Technical Analysis

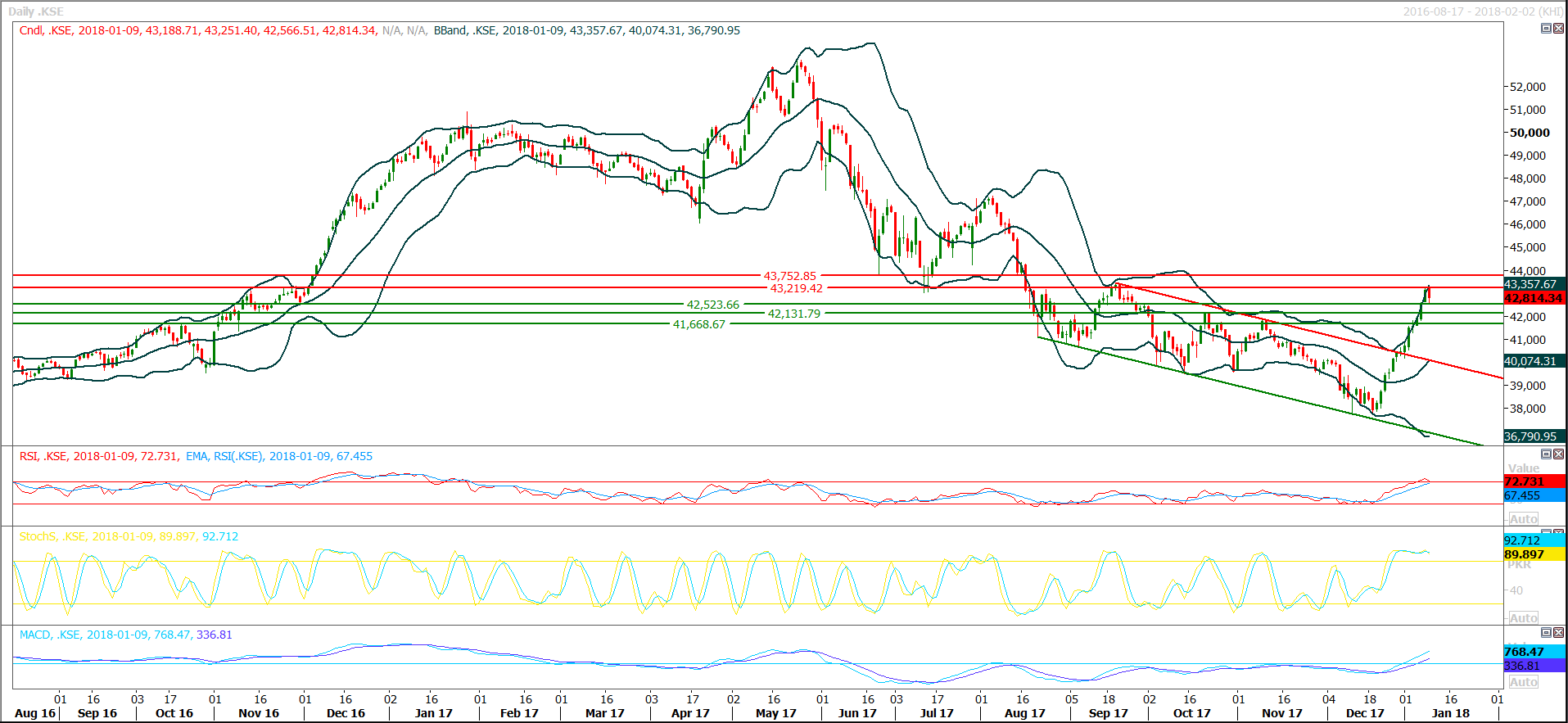

The Benchmark KSE100 Index have formatted a bearish harami formation after posting a double top on daily chart. Daily stochastic have generated a bearish crossover while MAORSI is ready for that and it would succeed in doing so if index would close today again in negative zone and all these factors would push index into a correction zone which would result in a bearish rally towards 41600 and 40500. As of right now index have supportive regions around 42500 and 42116 while resistant regions are standing at 43260 and 43700 points and breakout of either side would add 1000-1500 points in respective direction. Its recommended to stay cautious and sell on strength during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.