Previous Session Recap

Trading volume at PSX floor dropped by 32.94 million shares or 19.75% on DoD basis, whereas the Benchmark KSE100 Index opened at 39,194.60, posted a day high of 39,267.53 and a day low of 38,816.50 during last trading session while session while suspended at 38,921.69 with net change -130.81 points and net trading volume of 98.86 million shares. Daily trading volume of KSE100 listed companies dropped by 8.26 million shares or 7.85% on DoD basis.

Foreign Investors remained in net buying positions of 0.35 million shares and net value of Foreign Inflow increased by 0.48 million US Dollars. Categorically, Foreign Individuals and Corporate remained in net selling positions of 0.17 and 0.26 million shares but Overseas Pakistani investors remained in net buying positions of 0.78 million shares. While on the other side Local Individuals, Companies and Mutual Fund remained in net buying positions of 2.33, 3.76 and 0.34 million shares respectively but Banks, Brokers and Insurance Companies remained in net selling positions of 1.33, 4.20 and 1.48 million shares.

Analytical Review

Asia shares check rally as US-China trade talks, Fed policy in focus

Asian shares took a breather on Thursday after an extended rally, as markets awaited more news on U.S.-China trade talks that have raised hopes of a deal to avert an all-out trade war between the economic giants. MSCI’s broadest index of Asia-Pacific shares outside Japan lost 0.2 percent, reversing course after briefly touching a near four-week high early in the session. Australian shares eased 0.3 percent, while Japan’s Nikkei was down 1.4 percent by the midday break.

PWMA urges govt to facilitate weaving industry

Former chairman and founder of Pakistan Weaving Mills Association (PWMA), Asif Siddiq has urged the government to facilitate industrialists in setting up weaving units to help boost country's exports. Asif Siddiq in a statement on Wednesday said that rise in gas, electricity costs and a ban on power connections for new weaving units has increased difficulties of the industrialists who are establishing small weaving units. He said the industrialists who have already acquired land for setting up weaving units and placed orders for machinery will face heavy losses. He appealed the textile and finance ministries to take action to pull industrialists out of this uncertain situation.

WB to provide $100m for Sindh Solar Energy Project

Government of Pakistan and World Bank signed here on Wednesday a financing agreement worth $100.0 million for “Sindh Solar Energy Project” with the objective to increase solar power generation and access to electricity in Sindh province. The project will support the deployment of solar power in Sindh spanning three market segments: utility scale, distributed generation, and at the household level.

Rs4.06b approved for clearing previous liabilities of BECS

The Executive Committee of the National Economic Council (ECNEC) on Wednesday approved Rs4.06 billion for clearing previous liabilities of Basic Education Community Schools (BECS) in the country up to December 2018. The ECNEC meeting, which was chaired by Finance Minister Asad Umar, had detailed discussion on matters pertaining to the project regarding Operation of Basic Education Community Schools (BECS) in the country. The Committee accorded approval for revised project with a total cost of Rs 4058.158 million, clearing the previous liabilities and six months expenses of the current financial year up to December 2018.

Pakistan, S. Arabia may ink $10bn MoUs this month

Pakistan and Saudi Arabia are likely to sign memoranda of understanding for more than $10 billion Saudi investment in Pakistan this month. Pakistan will also sign similar MoUs with China, the United Arab Emirates and Malaysia over the next two months. This was said in the second meeting on ease of doing business (EoDB) presided over by Prime Minister Imran Khan on Wednesday. The meeting was told that the MoU on investment framework with the UAE was expected next month.

Asian shares took a breather on Thursday after an extended rally, as markets awaited more news on U.S.-China trade talks that have raised hopes of a deal to avert an all-out trade war between the economic giants. MSCI’s broadest index of Asia-Pacific shares outside Japan lost 0.2 percent, reversing course after briefly touching a near four-week high early in the session. Australian shares eased 0.3 percent, while Japan’s Nikkei was down 1.4 percent by the midday break.

Former chairman and founder of Pakistan Weaving Mills Association (PWMA), Asif Siddiq has urged the government to facilitate industrialists in setting up weaving units to help boost country's exports. Asif Siddiq in a statement on Wednesday said that rise in gas, electricity costs and a ban on power connections for new weaving units has increased difficulties of the industrialists who are establishing small weaving units. He said the industrialists who have already acquired land for setting up weaving units and placed orders for machinery will face heavy losses. He appealed the textile and finance ministries to take action to pull industrialists out of this uncertain situation.

Government of Pakistan and World Bank signed here on Wednesday a financing agreement worth $100.0 million for “Sindh Solar Energy Project” with the objective to increase solar power generation and access to electricity in Sindh province. The project will support the deployment of solar power in Sindh spanning three market segments: utility scale, distributed generation, and at the household level.

The Executive Committee of the National Economic Council (ECNEC) on Wednesday approved Rs4.06 billion for clearing previous liabilities of Basic Education Community Schools (BECS) in the country up to December 2018. The ECNEC meeting, which was chaired by Finance Minister Asad Umar, had detailed discussion on matters pertaining to the project regarding Operation of Basic Education Community Schools (BECS) in the country. The Committee accorded approval for revised project with a total cost of Rs 4058.158 million, clearing the previous liabilities and six months expenses of the current financial year up to December 2018.

Pakistan and Saudi Arabia are likely to sign memoranda of understanding for more than $10 billion Saudi investment in Pakistan this month. Pakistan will also sign similar MoUs with China, the United Arab Emirates and Malaysia over the next two months. This was said in the second meeting on ease of doing business (EoDB) presided over by Prime Minister Imran Khan on Wednesday. The meeting was told that the MoU on investment framework with the UAE was expected next month.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

Technical Analysis

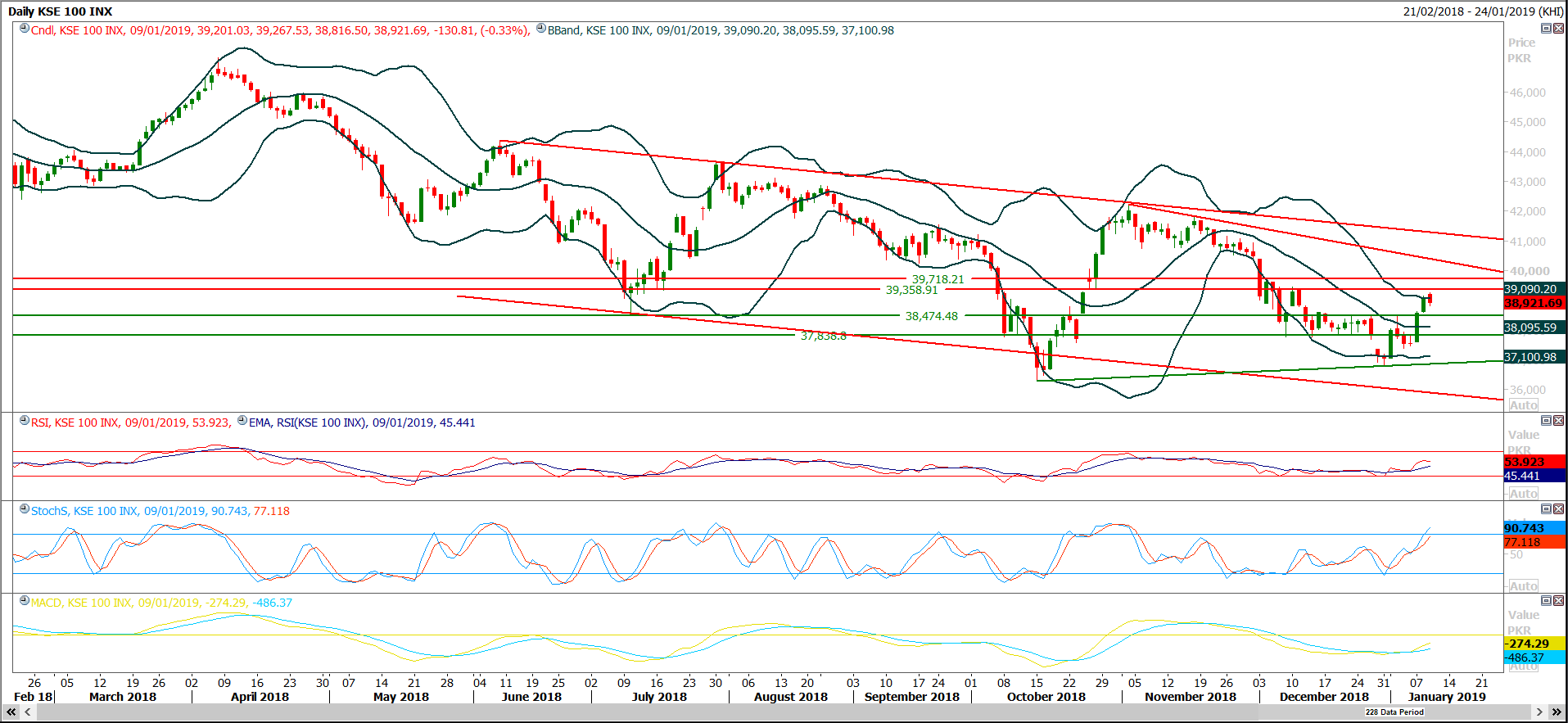

The Benchmark KSE100 index have bounced back after getting resistance from a horizontal resistant region and completing its expansion of last bullish correction during last trading session while weekly 50% correction of last bearish rally also completed on same region from where index is being pushed back. Daily momentum indicators are ready to initiate bearish trend if index would not succeed in closing above 39,230 points today and weekly chart is getting resistance from a weekly double top. It’s expected that index would try to close below 38,365 points during current week because closing above that region would create a morning star on weekly chart which would strengthen bullish sentiment but daily and hourly momentum is not supporting this stance currently therefore index would try to slide below this region before weekly closing. Daily Bollinger band is squeezing which indicates that current range bound situation is going to an end in coming days and market may witness some volatility in next week therefore it’s recommended to stay cautious and trade strict stop loss. For current trading session index would have supportive regions at 38,470 and 38,365 while resistant regions would be standing at 39,230 and 39,360 points. It’s recommended to stay on short side with strict stop loss of 39,500 points an initial target of 38,365 points where index would try to complete correction of its current bullish expansion.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.