Previous Session Recap

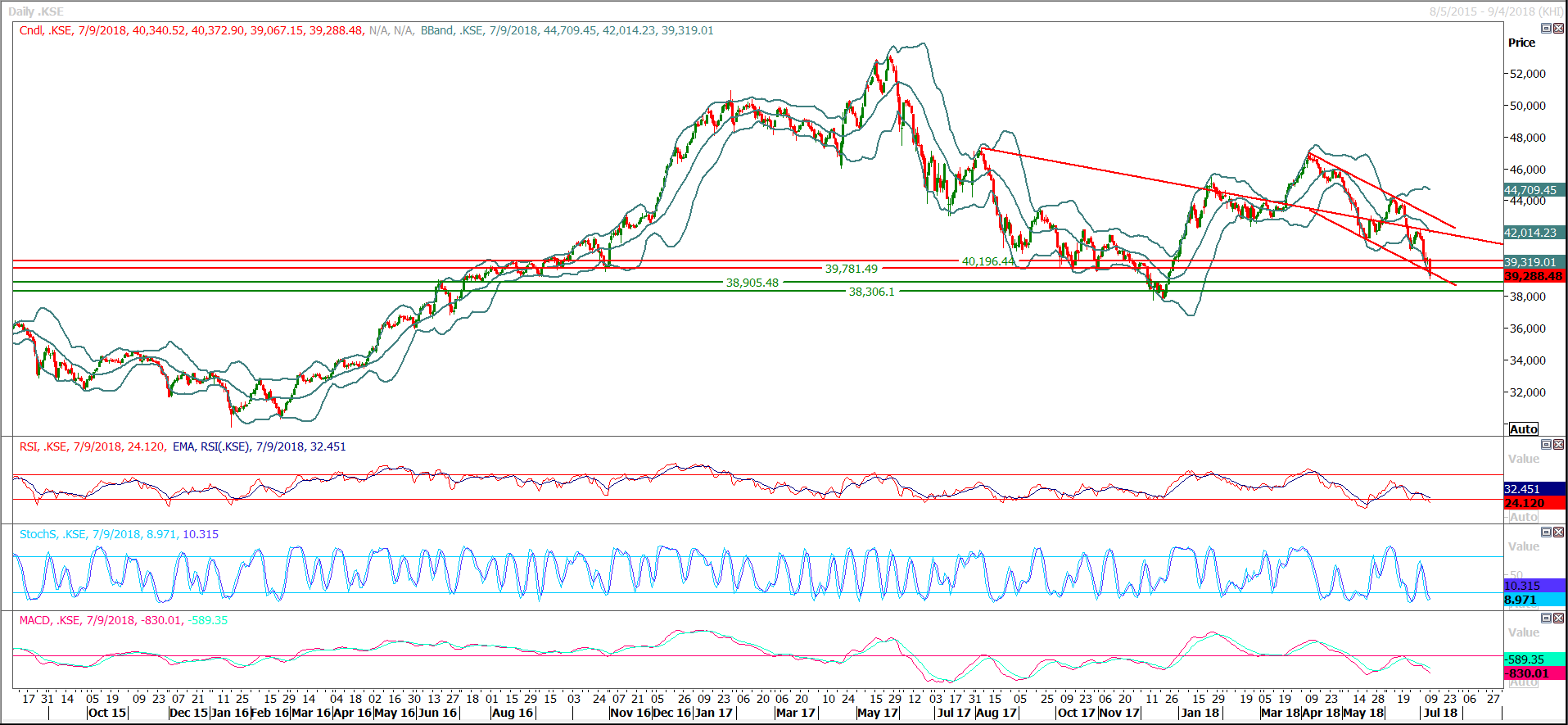

Trading volume at PSX floor increased by 19.69 million shares or 18.95% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 40,340.52, posted a day high of 40,372.90 and a day low of 39,072.67 during last trading session. The session suspended at 39,288.48 with net change of -995.66 and net trading volume of 75.60 million shares. Daily trading volume of KSE100 listed companies dropped by 0.26 million shares or 0.34% on DoD basis.

Foreign Investors remained in net selling position of 6.84 million shares and net value of Foreign Inflow dropped by 1.04 million US Dollars. Categorically, Foreign Individual and Foreign Corporate remained in net buying positions of 0.04 and 0.75 million shares but Overseas Pakistani investors remained in net selling positions of 7.63 million shares. While on the other side Local Individuals, Companies, Banks, NBFCs and Insurance Companies remained in net buying positions of 16.18, 1.42, 2.65, 0.45 and 0.23 million shares but Mutual Funds and Brokers remained in net selling positions of 4.34 and 8.39 million shares respectively.

Analytical Review

Asia shares extend rally, pound bewildered by politics

Asian shares sought to rally for a third session on Tuesday as hopes for upbeat corporate earnings buoyed Wall Street, while several high-profile resignations from Britain’s government kept sterling on the defensive. MSCI’s broadest index of Asia-Pacific shares outside Japan put on 0.2 percent in early trade, adding to a 1.3 percent rise on Monday. Japan’s Nikkei climbed 0.8 percent and South Korea 0.6 percent, while E-mini futures for the S&P 500 firmed 0.1 percent. Sentiment has been soothed by a bounce in Chinese shares which saw Shanghai blue chips climb 2.8 percent on Monday for the biggest daily jump since August 2016. Both the Dow and S&P 500 boasted their biggest gains in more than a month overnight, as bank shares jumped ahead of earnings reports later this week. The S&P banks index posted its sharpest rise since March 26.

FBR misses target by Rs94b despite tax amnesty scheme

The Federal Board of Revenue (FBR) collected Rs3841 billion during previous fiscal year (2017-18), missing the revised tax collection target by Rs94 billion despite tax amnesty scheme that generated additional revenue. “Federal Board of Revenue during 2017-18 recorded a provisional net revenue collection of over Rs 3751 billion as against Rs 3368 billion collected during previous fiscal year, excluding collection on account of book adjustments for June 2018,” the FBR said in official handout on Monday. However, after adding Rs90 billion received on account of foreign and domestic amnesty schemes, the tax collection reached Rs3841 billion.

CAA cancels Shaheen Air's Isb-Dubai flight

Civil Aviation Authority (CAA) has canceled the permission for scheduled international flight NL 221/224 of Shaheeh Air of Islamabad-Dubai-Islamabad sector with effect from July 13. According to a letter served on Shaheen Air Monday, CAA directed the airline to intimate the affected passengers accordingly to avoid any inconvenience. It may be mentioned here that Shaheen Air is defaulter of more than Rs1.25 billion of CAA with regard to various charges.

Need stressed to upgrade textile industry

There is a dire need to make sincere efforts to upgrade textile industry on modern lines, promote value-addition in textile sector, besides providing level playing field to the businessmen engaged with textile sector. This was stated by Caretaker Provincial Minister for Industry and Commerce Punjab Mian Anjum Nisar and Caretaker Provincial Minister for Labour and Transport Punjab Mian Nouman Kabir while addressing the participants of an interaction session held at PRGMEA House here on Monday. The session was organised under the supervision of Pakistan Readymade Garments Manufacturers and Exporters Association (PRGMEA). Central Chairman PRGMEA Ejaz A. Khokhar presided over the event.

SBP, PPAF working together to develop microfinance industry

Tariq Bajwa, governor of State Bank of Pakistan (SBP), has said that central bank is working with Pakistan Poverty Alleviation Fund (PPAF) to lead the sustainable development of microfinance industry in the country. “This is based on a shared vision to promote inclusive growth by creating livelihood opportunities for low income segments thus enabling them to contribute effectively towards socioeconomic development of their households, communities and of course of Pakistan," said governor SBP while addressing the Citi – PPAF Microentrepreneurship Awards (CMA) ceremony. He congratulated PPAF and the Citi Foundation for their continued support to address the multidimensional issues of poverty in the marginalized segments of the society.

Asian shares sought to rally for a third session on Tuesday as hopes for upbeat corporate earnings buoyed Wall Street, while several high-profile resignations from Britain’s government kept sterling on the defensive. MSCI’s broadest index of Asia-Pacific shares outside Japan put on 0.2 percent in early trade, adding to a 1.3 percent rise on Monday. Japan’s Nikkei climbed 0.8 percent and South Korea 0.6 percent, while E-mini futures for the S&P 500 firmed 0.1 percent. Sentiment has been soothed by a bounce in Chinese shares which saw Shanghai blue chips climb 2.8 percent on Monday for the biggest daily jump since August 2016. Both the Dow and S&P 500 boasted their biggest gains in more than a month overnight, as bank shares jumped ahead of earnings reports later this week. The S&P banks index posted its sharpest rise since March 26.

The Federal Board of Revenue (FBR) collected Rs3841 billion during previous fiscal year (2017-18), missing the revised tax collection target by Rs94 billion despite tax amnesty scheme that generated additional revenue. “Federal Board of Revenue during 2017-18 recorded a provisional net revenue collection of over Rs 3751 billion as against Rs 3368 billion collected during previous fiscal year, excluding collection on account of book adjustments for June 2018,” the FBR said in official handout on Monday. However, after adding Rs90 billion received on account of foreign and domestic amnesty schemes, the tax collection reached Rs3841 billion.

Civil Aviation Authority (CAA) has canceled the permission for scheduled international flight NL 221/224 of Shaheeh Air of Islamabad-Dubai-Islamabad sector with effect from July 13. According to a letter served on Shaheen Air Monday, CAA directed the airline to intimate the affected passengers accordingly to avoid any inconvenience. It may be mentioned here that Shaheen Air is defaulter of more than Rs1.25 billion of CAA with regard to various charges.

There is a dire need to make sincere efforts to upgrade textile industry on modern lines, promote value-addition in textile sector, besides providing level playing field to the businessmen engaged with textile sector. This was stated by Caretaker Provincial Minister for Industry and Commerce Punjab Mian Anjum Nisar and Caretaker Provincial Minister for Labour and Transport Punjab Mian Nouman Kabir while addressing the participants of an interaction session held at PRGMEA House here on Monday. The session was organised under the supervision of Pakistan Readymade Garments Manufacturers and Exporters Association (PRGMEA). Central Chairman PRGMEA Ejaz A. Khokhar presided over the event.

Tariq Bajwa, governor of State Bank of Pakistan (SBP), has said that central bank is working with Pakistan Poverty Alleviation Fund (PPAF) to lead the sustainable development of microfinance industry in the country. “This is based on a shared vision to promote inclusive growth by creating livelihood opportunities for low income segments thus enabling them to contribute effectively towards socioeconomic development of their households, communities and of course of Pakistan," said governor SBP while addressing the Citi – PPAF Microentrepreneurship Awards (CMA) ceremony. He congratulated PPAF and the Citi Foundation for their continued support to address the multidimensional issues of poverty in the marginalized segments of the society.

PAEL, SSGC, ASL and MLCF may lead the index in positive zone.

Technical Analysis

The Benchmark KSE100 Index has extended its low during last trading session and have posted day low at supportive trend line of a descending trend line. Index is formatting an Elliot wave on daily chart and right now third wave of said Elliot wave is under way, for completion of this wave index have completed its 100% expansion of last correction. As of now index have supportive regions ahead at 38,900 and 38,300 points, while resistant regions are standing at 39,800 and 40,200 points. Daily and hourly momentum indicators are trying to pull back and if Stochastic and MAORSI would succeed in creating bullish crossovers then a spike could be witnessed in coming days. Its recommended to practice swing trading strategy during currnet trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.