Previous Session Recap

Trading volume at PSX floor dropped by 24.42 million shares or 16.53%, DoD basis, whereas, the benchmark KSE100 Index opened at 41334.50, posted a day high of 41336.43 and a day low of 41004.66 during the last trading session. The session suspeneded at 41099.99 with a net change of -212.6 points and net trading volume of 52.19 million shares. Daily trading volume of KSE100 listed companies dropped by 29.59 million shares or 36.18%,DoD basis.

Foreign Investors remained in a net buying position of 1.63 million shares and net value of Foreign Inflow increased by 3.49 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani Investors remained in net buying position of 1.03 and 0.61 million shares. On the other side Local Individuals, Banks, Mutual Funds and Insurance companies remained in net buying positions of 1.32, 431, 2.64 and 0.83 million shares respectively but Local Companies and Brokers remained in net selling positions of 2.41 and 8.29 million shares.

Analytical Review

Asian shares rose on Tuesday, shrugging off modest losses on Wall Street, while expectations of another U.S. interest rate increase this year continued to underpin the dollar. MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.5 percent. Japan’s Nikkei stock index reversed early losses and gained 0.4 percent, as markets reopened after a public holiday on Monday. Korean shares rallied 2 percent on their first day of trading this month, on expectations that tensions with Pyongyang could ease, and as tech shares led by Samsung Electronics Co Ltd caught up with gains made by global stock markets after a long break. Seoul markets were closed last week and on Monday for public holidays.

The State Bank of Pakistan (SBP) is planning to conduct Business Confidence Survey (BCS) in current month and obtain opinion of firms about current and expected business conditions in the country that would help it to formulate effective monetary policies. The BCS would be a telephonic survey lasting between 7 to 10 minutes with a senior executive of participating firms requiring them to answer some quick questions, according to SBP statement received here. This survey would be conducted all over the country during October 2017, and will be repeated periodically and all the information collected through the survey would be treated as strictly confidential and would not be shared with any other person or entity.

The World Bank (WB) on Monday warned that upcoming national elections in 2018 would deteriorate Pakistan’s fiscal position that would affect debt trends and maintain debt at the current high level. “Macroeconomic risks have increased substantially during FY2017. The external balance is particularly vulnerable given the persistent current account deficit, affecting the country’s reserve position. Improving the external balance hinges upon a revival in exports, a slowdown in imports, and stable remittance flows. In absence of any of these factors, the persistent current account deficit will put further pressure on already dwindling reserves,” the World Bank stated in its report, South Asia Economic Focus (SAEF), Growth out of the Blue.

Pakistan’s budget deficit was recorded at Rs324 billion during first quarter (July-September) of the current fiscal year as against Rs438 billion in the same period of the last year due to robust tax collections and lower expenditure. In terms of GDP, the overall deficit decreased to 0.9 percent in the first quarter of current financial year as compared to 1.3 percent recorded in the first quarter of last year. Reduced fiscal deficit means lower public debt accumulation which supports alignment to targets defined in the amended Fiscal Responsibility and Debt Limitations Act.

The cement export continued to register a huge decline, which was down by over 23 percent in September 2017 as compared to September 2016. According to the data released by All Pakistan Cement Manufacturers’ Association (APCMA), exports from the region dropped considerably to 0.093 million tons only in September 2017 from 0.155 million tons in the same month last year, registering a decline of 39.63 percent. Of the 10.348 million tons despatched in the first quarter the North Zone despatched 7.522 million tons locally that was 22.83 percent higher than corresponding quarter of last year. The region during this period exported 0.953 million tons of cement that was 7.41 percent less than the exports during same period last year ie 1.029 million tons. The mills located in South Zone despatched 1.539 million tons cement in the first quarter of this fiscal that was 17.76 percent higher than the corresponding period of last fiscal ie 1.307 million tons. Its exports during the same period were 0.334 million tons that were whopping 35.22 percent less than last year ie 0.516 million tons.

Today Overall Auto Sector, SNGP and TRG may lead the market in the positive direction.

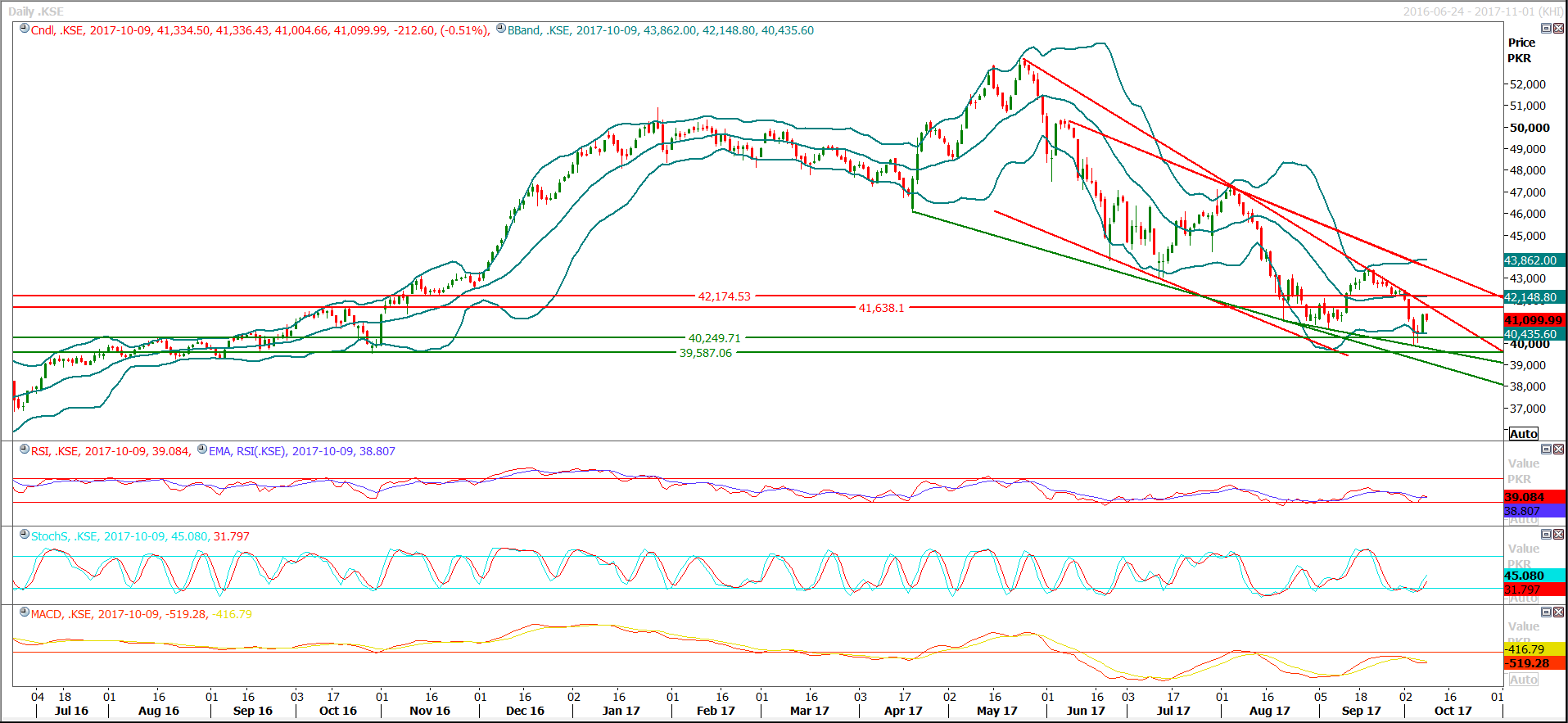

Technical Analysis

The Benchmark KSE100 Index has created a double top on the daily chart right after the appearance of a morning star which might try to dismiss the bullish momentum but Stochastic is still in the bullish mode which may try to push the index towards 41700 where it is capped by a crossover of a horizontal resistance and a resistant trend line. For the current trading session index has resistances ahead at 41630 and 417800. Index has closed slightly above its supportive regions of 40973. Breakout of either side might call for a further move of 400-500 points, therefore trading with strict stop loss is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.