Previous Session Recap

Trading volume at PSX floor dropped by 5.35 million shares or 2.20% on DoD basis, whereas the benchmark KSE100 index opened at 33,443.64, posted a day high of 33,604.16 and a day low of 33,339.32 points during last trading session while session suspended at 33,523.74 points with net change of 47.12 points and net trading volume of 160.19 million shares. Daily trading volume of KSE100 listed companies dropped by 9.58 million shares or 5.64% on DoD basis.

Foreign Investors remained in net selling positions of 11.23 million shares and net value of Foreign Inflow dropped by 2.56 million US Dollars. Categorically, Foreign Individual and Overseas Pakistanis remained in net buying positions of 0.01 and 11.57 million shares but Foreign Corporate investors remained in net selling positions of 22.81 million shares. While on the other side Local Individuals, Local Companies, NBFCs, Brokers and Insurance Companies remained in net buying positions of 4.27, 8.44, 0.71, 3.46 and 2.02 million shares respectively but Banks and Mutual Fund remained in net selling positions of 1.75 and 5.86 million shares respectively.

Analytical Review

China lowers expectations for U.S. trade talks after blacklist: officials

Surprised and upset by the U.S. blacklisting of Chinese companies, China has lowered expectations for significant progress from this week’s trade talks with the United States, Chinese government officials told Reuters, even as President Donald Trump on Wednesday expressed fresh optimism. While Beijing theoretically wants to end the trade war, Chinese Communist Party officials are not optimistic about the size or scope of any agreement with Washington in the short-term, the Chinese officials said.

Compliance report ready as FATF meeting approaches

The next meeting of the Financial Action Task Force (FATF) is scheduled to be held in Paris from Oct 12 to 15 and Pakistan has already prepared its compliance report, which will be presented by Minister for Economic Affairs Division Hammad Azhar. The Pakistani delegation is scheduled to leave for France on Oct 13 as Pakistan’s case will be taken up on Oct 14 and 15. Meanwhile, a report finalised by the Securities and Exchange Commission of Pakistan (SECP) on Wednesday has said that the comprehensive guideline developed by the Commission has helped financial institutions to generate 219 Suspicious Transactions Reports (STRs) in one year, as compared to 13 STRs in eight years.

Stabilisation efforts bearing fruit: SBP

The State Bank of Pakistan (SBP) Governor Dr Reza Baqir on Wednesday said that reforms introduced to address macro-economic challenges have started to bear fruit and an improvement in external sector has become visible. He made these remarks during an interactive session with the members of Overseas Investors Chamber of Commerce and Industry (OICCI). Baqir added that macroeconomic stability would promote investment in the country and trigger growth while admitting that bold measures taken in the recent past were painful. He elaborated that average monthly current account deficit, a prime concern for the economy, has halved, exports have increased, non-borrowed foreign exchange reserves have stopped falling and in fact began to grow.

ADB approves $2.4 billion lending for Pakistan

The Asian Development Bank (ADB) has recently approved Country Operations Business Plan (COBP) 2020-22 that would increase the average lending to Pakistan to $2.4 billion per year from earlier $1.4 billion a year. “ADB will provide $2.5 billion in approved financing to Pakistan in 2019, and recently approved Country Operations Business Plan (COBP) 2020-2022 will increase average lending to $2.4 billion a year - a record increase over the $1.4 billion average from 2015 to 2018,” the ADB said in a brief statement on Twitter. In addition, the ADB would leverage lending through the mobilisation of cofinancing and funding from other sources, including regional concessional resources. The new COBP will support Pakistan’s development goals and complement efforts by other development partners.

‘Global value chains can spur growth’

The ‘World Development Report 2020’ released by the World Bank has shown its optimism that developing countries can achieve better outcomes for their citizens through reforms which boost their participation in global value chains. These reforms can help them expand from commodity exports to basic manufacturing, while ensuring that economic benefits are shared more widely across society, says the report released on Tuesday. According to the publication, global value chains (GVCs) can continue to boost growth, create better jobs, and reduce poverty, provided that developing countries undertake deeper reforms and industrial countries pursue open, predictable policies. Technological change is likely to be more of a boon than a curse for trade and GVCs.

Surprised and upset by the U.S. blacklisting of Chinese companies, China has lowered expectations for significant progress from this week’s trade talks with the United States, Chinese government officials told Reuters, even as President Donald Trump on Wednesday expressed fresh optimism. While Beijing theoretically wants to end the trade war, Chinese Communist Party officials are not optimistic about the size or scope of any agreement with Washington in the short-term, the Chinese officials said.

The next meeting of the Financial Action Task Force (FATF) is scheduled to be held in Paris from Oct 12 to 15 and Pakistan has already prepared its compliance report, which will be presented by Minister for Economic Affairs Division Hammad Azhar. The Pakistani delegation is scheduled to leave for France on Oct 13 as Pakistan’s case will be taken up on Oct 14 and 15. Meanwhile, a report finalised by the Securities and Exchange Commission of Pakistan (SECP) on Wednesday has said that the comprehensive guideline developed by the Commission has helped financial institutions to generate 219 Suspicious Transactions Reports (STRs) in one year, as compared to 13 STRs in eight years.

The State Bank of Pakistan (SBP) Governor Dr Reza Baqir on Wednesday said that reforms introduced to address macro-economic challenges have started to bear fruit and an improvement in external sector has become visible. He made these remarks during an interactive session with the members of Overseas Investors Chamber of Commerce and Industry (OICCI). Baqir added that macroeconomic stability would promote investment in the country and trigger growth while admitting that bold measures taken in the recent past were painful. He elaborated that average monthly current account deficit, a prime concern for the economy, has halved, exports have increased, non-borrowed foreign exchange reserves have stopped falling and in fact began to grow.

The Asian Development Bank (ADB) has recently approved Country Operations Business Plan (COBP) 2020-22 that would increase the average lending to Pakistan to $2.4 billion per year from earlier $1.4 billion a year. “ADB will provide $2.5 billion in approved financing to Pakistan in 2019, and recently approved Country Operations Business Plan (COBP) 2020-2022 will increase average lending to $2.4 billion a year - a record increase over the $1.4 billion average from 2015 to 2018,” the ADB said in a brief statement on Twitter. In addition, the ADB would leverage lending through the mobilisation of cofinancing and funding from other sources, including regional concessional resources. The new COBP will support Pakistan’s development goals and complement efforts by other development partners.

The ‘World Development Report 2020’ released by the World Bank has shown its optimism that developing countries can achieve better outcomes for their citizens through reforms which boost their participation in global value chains. These reforms can help them expand from commodity exports to basic manufacturing, while ensuring that economic benefits are shared more widely across society, says the report released on Tuesday. According to the publication, global value chains (GVCs) can continue to boost growth, create better jobs, and reduce poverty, provided that developing countries undertake deeper reforms and industrial countries pursue open, predictable policies. Technological change is likely to be more of a boon than a curse for trade and GVCs.

Market is expected to remain volatile during current trading session.

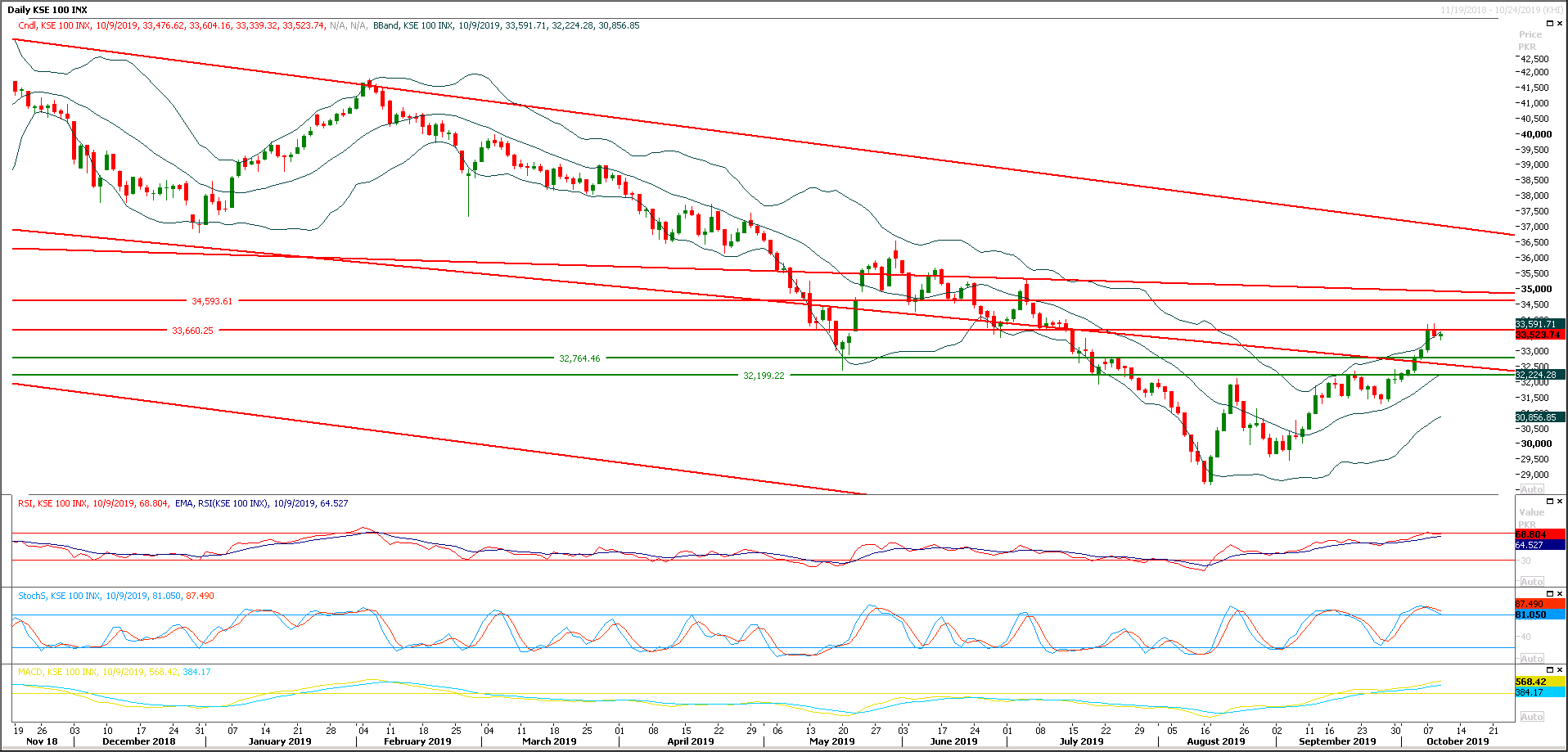

Technical Analysis

The Benchmark KSE100 index is getting resistance from a horizontal resistant region since last three trading session and right now daily momentum indicators have succeeded in changing their direction to bearish side and it's expected that index would try to start a correction which may lead index towards 33,200 points initially and then towards 32,500 points. While on flip side in case of any bullish spike index would face strong resistances at 33,760 & 34,200 points while on 34,500 points current rally is being capped by a strong horizontal resistance. It's recommended to stay on selling side with strict stop loss because if index would start a downward rally this or next week then may be a new low would be witnessed in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.