Previous Session Recap

Trading volume at PSX floor dropped by 38.81 million shares or 24.31% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 41,329.63, posted a day high of 41,416.74 and a day low of 40,793.70 during last trading session. The session suspended at 40,854.77 with net change of -411.62 and net trading volume of 70.05 million shares. Daily trading volume of KSE100 listed companies dropped by 27.29 million shares or 28.05% on DoD basis.

Foreign Investors remain in net selling positions of 0.16 million shares but net value of Foreign Inflow dropped by 1.05 million US Dollars. Categorically Foreign Individuals and Corporate remained in net selling positions of 0.15 and 2.14 million shares but Overseas Pakistanis investors remained in net buying positions of 2.13 million shares. While on the other side Banks, Brokers and Insurance Companies remained in net buying positions of 0.91, 0.06 and 1.76 million shares respectively but Local Individuals, Local Companies, and Mutual Fund remained in net selling positions of 0.35, 1.71 and 0.72 million shares.

Analytical Review

Asian shares on slippery slope as Trump ups ante in trade war

Asian shares started the week in the red on Monday, faltering for the eighth straight day while the dollar climbed as U.S. President Donald Trump raised the stakes in the heated trade dispute with China. MSCI’s broadest index of Asia-Pacific shares outside Japan was last down 0.6 percent, extending losses from last week when it dropped 3.5 percent for its worst weekly showing since mid-March. Japan’s Nikkei opened lower but quickly pared losses after revised second-quarter gross domestic product data showed the world’s third-biggest economy grew at its fastest pace since 2016. Chinese shares weakened, with the blue-chip index off 0.6 percent while Shanghai’s SSE Composite stumbled 0.4 percent. Hong Kong’s Hang Seng index slipped 0.8 percent.

Government will rationalize energy tariffs within two weeks: APTMA team meets Umar

Federal Minister for Finance, Revenue and Economic Affairs, Asad Umar has assured the textile sector of rationalizing energy cost within two weeks to implement exports-led growth policy. This was claimed by Chairman All Pakistan Textile Mills Association (APTMA) Aamir Fayyaz who led a delegation that called Finance Minister Asad Umar. Advisor to Prime Minister on Textile, Commerce, Industry & Production and Investment Abdul Razak Dawood was also present on the occasion.

Engro Polymer to invest $23m in hydrogen peroxide business

Engro Polymer and Chemicals has announced plan to invest $23 million in order to enter the hydrogen-peroxide business. the total domestic demand for hydrogen peroxide stands at 55,000-60,000 metric tons. Although, Descon Oxygen Limited and Sitara Peroxide have an installed capacity of 30,000 metric tons each, the local production does not completely satisfy the demand, due to which around 10% to 15% of hydrogen peroxide is imported."

Oil refineries ”illegally” collecting deemed duty on HSD

Oil refineries continue to collect deemed duty at the rate of 7.5 percent on total sales from consumers of High Speed Diesel (HSD) since 2002 without upgrading their plants or depositing the amount collected in an escrow account as approved by the Economic Coordination Committee (ECC) of the cabinet, informed sources told this correspondent.

Japan for reviewing ban on non-filers to purchase new vehicles

Japan has reportedly urged Islamabad at the highest level to review its stringent condition banning non-filers to purchase new vehicles. The issue, sources said, was taken up during the recent visit of Japanese Minister for State for Foreign Affairs with Pakistani officials. The sale of Japanese cars'' has declined by 30 percent since the imposition of non-filers condition in the federal budget 2018-19.

Asian shares started the week in the red on Monday, faltering for the eighth straight day while the dollar climbed as U.S. President Donald Trump raised the stakes in the heated trade dispute with China. MSCI’s broadest index of Asia-Pacific shares outside Japan was last down 0.6 percent, extending losses from last week when it dropped 3.5 percent for its worst weekly showing since mid-March. Japan’s Nikkei opened lower but quickly pared losses after revised second-quarter gross domestic product data showed the world’s third-biggest economy grew at its fastest pace since 2016. Chinese shares weakened, with the blue-chip index off 0.6 percent while Shanghai’s SSE Composite stumbled 0.4 percent. Hong Kong’s Hang Seng index slipped 0.8 percent.

Federal Minister for Finance, Revenue and Economic Affairs, Asad Umar has assured the textile sector of rationalizing energy cost within two weeks to implement exports-led growth policy. This was claimed by Chairman All Pakistan Textile Mills Association (APTMA) Aamir Fayyaz who led a delegation that called Finance Minister Asad Umar. Advisor to Prime Minister on Textile, Commerce, Industry & Production and Investment Abdul Razak Dawood was also present on the occasion.

Engro Polymer and Chemicals has announced plan to invest $23 million in order to enter the hydrogen-peroxide business. the total domestic demand for hydrogen peroxide stands at 55,000-60,000 metric tons. Although, Descon Oxygen Limited and Sitara Peroxide have an installed capacity of 30,000 metric tons each, the local production does not completely satisfy the demand, due to which around 10% to 15% of hydrogen peroxide is imported."

Oil refineries continue to collect deemed duty at the rate of 7.5 percent on total sales from consumers of High Speed Diesel (HSD) since 2002 without upgrading their plants or depositing the amount collected in an escrow account as approved by the Economic Coordination Committee (ECC) of the cabinet, informed sources told this correspondent.

Japan has reportedly urged Islamabad at the highest level to review its stringent condition banning non-filers to purchase new vehicles. The issue, sources said, was taken up during the recent visit of Japanese Minister for State for Foreign Affairs with Pakistani officials. The sale of Japanese cars'' has declined by 30 percent since the imposition of non-filers condition in the federal budget 2018-19.

Market is expected to remain volatile therefore its recommended to trade cautiously.

Technical Analysis

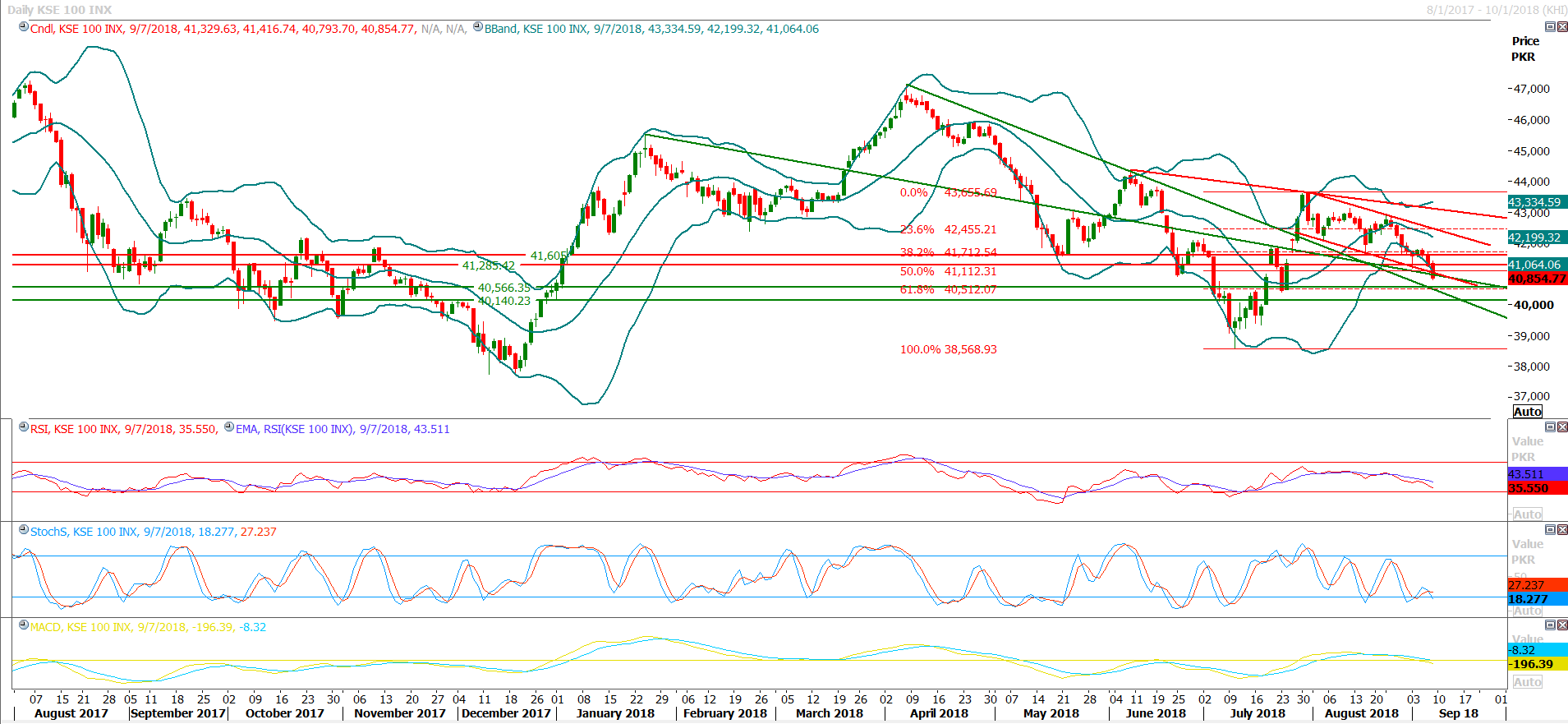

The Benchmark KSE100 Index is about to complete 61.8% correction of its last bullish rally which was started from 38,561 and continued till 43,638 points on daily and weekly chart. While at the same region where correction is being fulfilled index is being supported by two more supportive elements, initially, a descending trend line which was previously acting as a strong resistance is going to support the index along with a strong horizontal supportive region and all these supportive regions are standing around 40,566 points. Therefore it’s expected that index would find some real ground or support at this region. It’s expected that index would try to bounce back from this region towards 41,000 and 41,300 points. It’s recommended to post stop loss at 41,140 points for new buying which could be initiated for short term trading before 40,566 points. As of now index would face strong resistances at 41,300 and 41,600 points during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.