Previous Session Recap

The Bench Mark KSE100 Index Opened at 48957.32 with a negative gap of 82 points, posted day high of 49001.38 and day low of 48687.26 during last trading session. The session suspended at 48865.79 with net change of -173.62 points and net trading volume of 176.92 million shares. Daily trading volume of KSE100 listed companies dropped by 1.4 million shares or 0.78% on DOD bases.

Foreign Investors remained in net selling position of 20.7 million shares and net value of Foreign Inflow dropped by 5.1 million US Dollars. Categorically Foreign Corporate and Overseas Pakistani Investors remained in net selling posiition of 16.25 and 4.5 million shares but Foreign Individuals remained in net buying position of 40999 shares. While on the other side, Local Individuals, Companies, Banks and Brokers remained in net buying position of 7.43, 16.95, 7.12 and 1.43 million shares respectively but Mutual Funds remained in net selling position of 12.7 million shares during last trading session.

Analytical Review

Asian shares pulled ahead to two-month highs on Wednesday as investors looked to President-elect Donald Trump news conference later in the day for any clues to his policies on tax, fiscal spending, international trade and currencies. While his plan for tax cuts and infrastructure spending has boosted U.S. shares and the dollar, his protectionist statements during the months-long election campaign have kept many investors on edge. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.4 percent to two-month highs, essentially coming back to where it was just before the U.S. election after recovering from losses of over five percent. The gains were led by South Korean shares .KS11, which scaled a 1-1/2-year peak as Samsung Electronic (005930.KS) hit a record high, cheered by its solid earnings published last week. Japanese Nikkei .N225 ticked up 0.4 percent, snapping three days of losses.

Prime Minister Nawaz Sharif has announced incentives worth Rs180 billion in a bid to boost Pakistan sagging exports. He made the announcement at a ceremony attended by members of the domestic business community in Islamabad Tuesday afternoon. The package includes the removal of customs duty and sales tax on the import of cotton. Customs duty on man-made fibres other than polyester and sales tax levied on the import of textile machinery has also been scrapped. Under the package, the new duty drawback rates for textile garments will be 7%; textile made-ups 6%; processed fabric 5%; yarn and grey fabric 4%; while sports goods, leather and footwear will be taxed at 7%. The PM expressed confidence that the package will help achieve the objective of export-led growth.

The government is expected to withdraw general sales tax (GST) on construction of hydropower projects being developed by Chinese companies under the China-Pakistan Economic Corridor (CPEC) on the pattern of tax exemptions given to mass transits like Lahore Orange Line Metro Train last week.

Overseas Pakistanis sent home $9.46 billion in the first half of 2016-17, down 2.37 per cent from a year ago. According to data released by the State Bank of Pakistan (SBP) on Tuesday, remittances received in December alone amounted to $1.58bn, which reflects a decline of 2pc on both monthly and annual bases.

The Punjab government has decided to install Solar Energy System in Basic Health Units (BHUs) across the province of Punjab with a sum of Rs 1304.351 million. Under the scheme, the government will complete the project in 16 months. Punjab Health Department will be responsible for overall operation and maintenance after the contract period, while Energy Department will provide requisite technical support, to ensure smooth functioning of solar system. Maximum life of UPS, already installed in BHUs, is calculated for two years, while the solar energy system is now replacing the slow backup system.

Overall Textile Sector (specifically NCL, ANL), Overall Refineries (specifically ATRL, NRL) and MCB can lead market in positive direction.

Technical Analysis

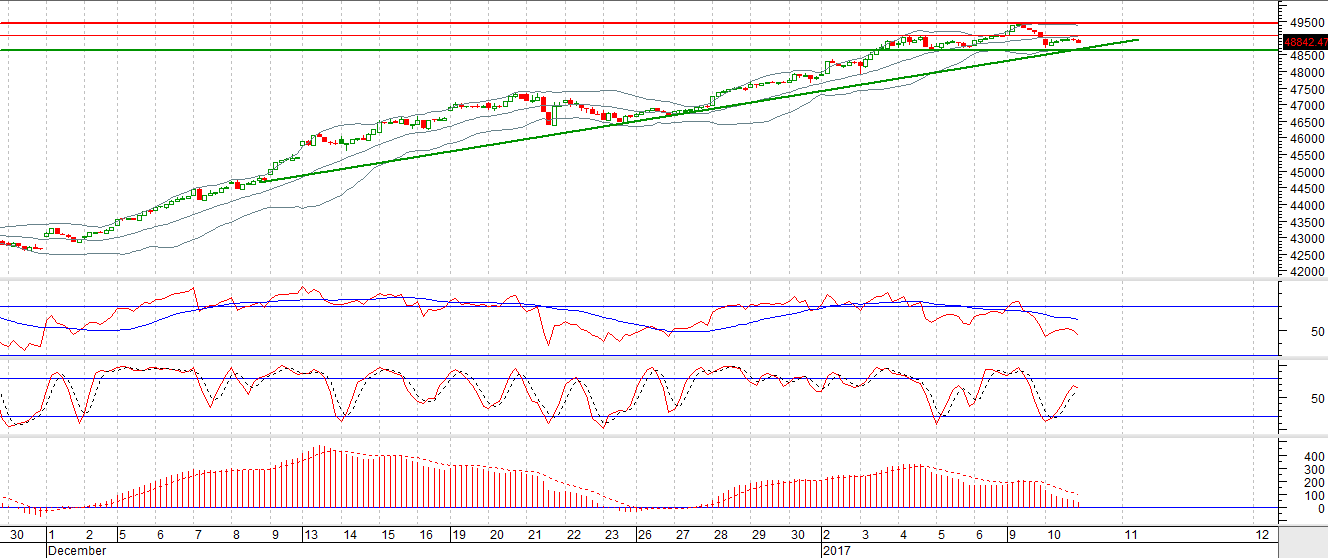

The Bench Mark KSE100 Index has penetrated its supportive trend line on daily chart but it is still getting support from a horizontal supportive region at 48622. Daily Stochastic and MAORSI are in bearish mode as bearish crossovers are generated in both indicators. But hourly chart has generated a hope for a pull back as long as 48622 region is maintained as support. Trading with strict stop loss in selective shares is recommended as breakout of 48622 will call for a short term correction in PSX. Right now 49090 is resistant on intraday bases if Index would be able to close above that region then it can pullback towards 49400.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.