Previous Session Recap

Trading volume at PSX floor dropped by 13.74 million shares or 8.41% on DoD basis, whereas, the benchmark KSE100 Index opened at 38645.26, posted a day high of 39339.65 and a day low of 38431.78 during last trading session. The session suspended at 39080.00 with net change of 295.34 and net trading volume of 80.65 million shares. Daily trading volume of KSE100 listed companies increased by 9.54 million shares or 13.42% on DoD basis.

Foreign Investors remained in net selling position of 6.35 million share and net value of Foreign Inflow dropped by 1.74 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistanis Investors remained in net selling positions of 0.06, 2.01 and 4.28 million shares respectively. While on the other side Local Individuals and NBFCs remained in net selling positions of 22.93 and 0.46 million shares but Local Companies, Banks, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 4.8, 3.12, 2.62, 17.57 and 1.48 million shares respectively.

Analytical Review

Asian Stocks were slightly higher with MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS up 0.2 percent, staying above a recent two-month trough of 542.27 points amid optimism about global growth after the strong U.S payrolls data on Friday. Japan's Nikkei .N225 added 0.1 percent while Australian shares climbed 0.1 percent. Chinese shares opened firm following solid trade data on Friday, with the blue-chip CSI 300 index .CSI300 up 0.1 percent. Hong Kong's Hang Seng index .HSI gained 0.3 percent. China’s exports and imports accelerated last month after slowing in October in an encouraging sign for the world’s second-biggest economy.

The oil industry has raised the red flag over imminent closure of local refineries and related inability of the oil companies to provide enough fuels for smooth operations of aviation and security aircraft. In an “SOS-Rush to Desk” to the petroleum division, the Oil Companies Advisory Council (OCAC) — an umbrella body of around three dozen refineries and oil marketing companies — said the refineries had been forced to continuously scale down production now reaching a point of a complete shutdown and impacting jet fuels. The oil industry has been struggling for a sixth week to cope with setback caused by closure of oil-based power plants in October.

Local assemblers are not ready to reveal the models of cars and light commercial vehicles (LCVs) that they plan to launch in the next two years to compete with new entrants from China, South Korea and Europe. However, auto vendors said the existing car assemblers have already geared up to introduce new vehicles in 2018 and 2019. Requesting not to be named, the vendors said Pak Suzuki Motor Company is planning to introduce 660cc Alto in the first quarter of 2019. They said they have been asking the company to continue assembling the iconic Mehran and let the car die its own death following the launch of 660cc Alto. However, the company has decided to pull the plug on Mehran.

Pakistan International Airlines (PIA) has closed its Premier Service after bearing huge losses in around six months. According to the official data, total earnings for the service between August 14 2016 and February 8 2017 remained around Rs0.96 billion. The loss incurred on direct operations was Rs1.14 billion while the total loss was calculated at Rs2.88 billion. Premier Service had started on August 14, 2016, on the country’s 69th Independence Day with A330 aircraft on Islamabad/ Lahore-London-Lahore/ Islamabad sectors. Tall claims had been made at the time of its launch that PIA would be transformed into a profit making modern airline. The national flag carrier also announced better in-flight entertainment and many other features, including a complimentary limousine service for its Premier Business Class customers on their arrival at London’s Heathrow Airport.

Last Friday the exchange rate witnessed a sudden shock which jolted the market causing stakeholders, particularly importers, to panic. What was surprising was the absence of the central bank from inter-bank dollar trading in the first session on the day. Both bankers and currency dealers were unaware of what was going on as the dollar started to pick up pace and, within two hours, rose to Rs110 from Rs105.55. This sharp increase in a very short span of time created panic in the market; sellers stopped selling while importers rushed to buy more..

ATRL and PAEL may lead the market in positive direction

Technical Analysis

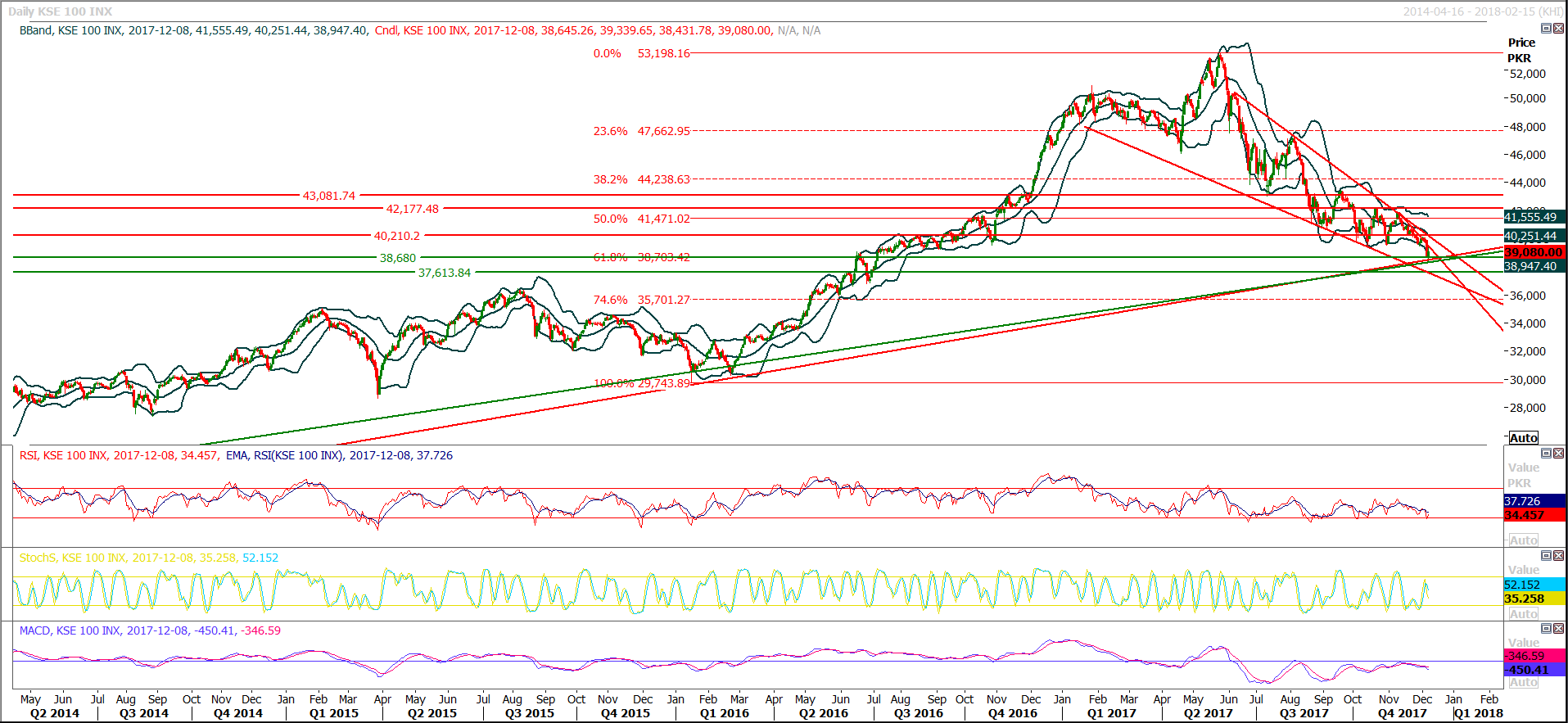

The Benchmark KSE100 Index has completed its 61.8% correction on weekly chart where it has also got support from two rising trend lines along with a horizontal supportive region. For current trading session index will have support from 38680 points. For current trading session buying on dip is recommended. If index would start reversal from these levels then next targets for index would be 39478 where index could face a resistance and closing above 39478 will call for 40150 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.