Previous Session Recap

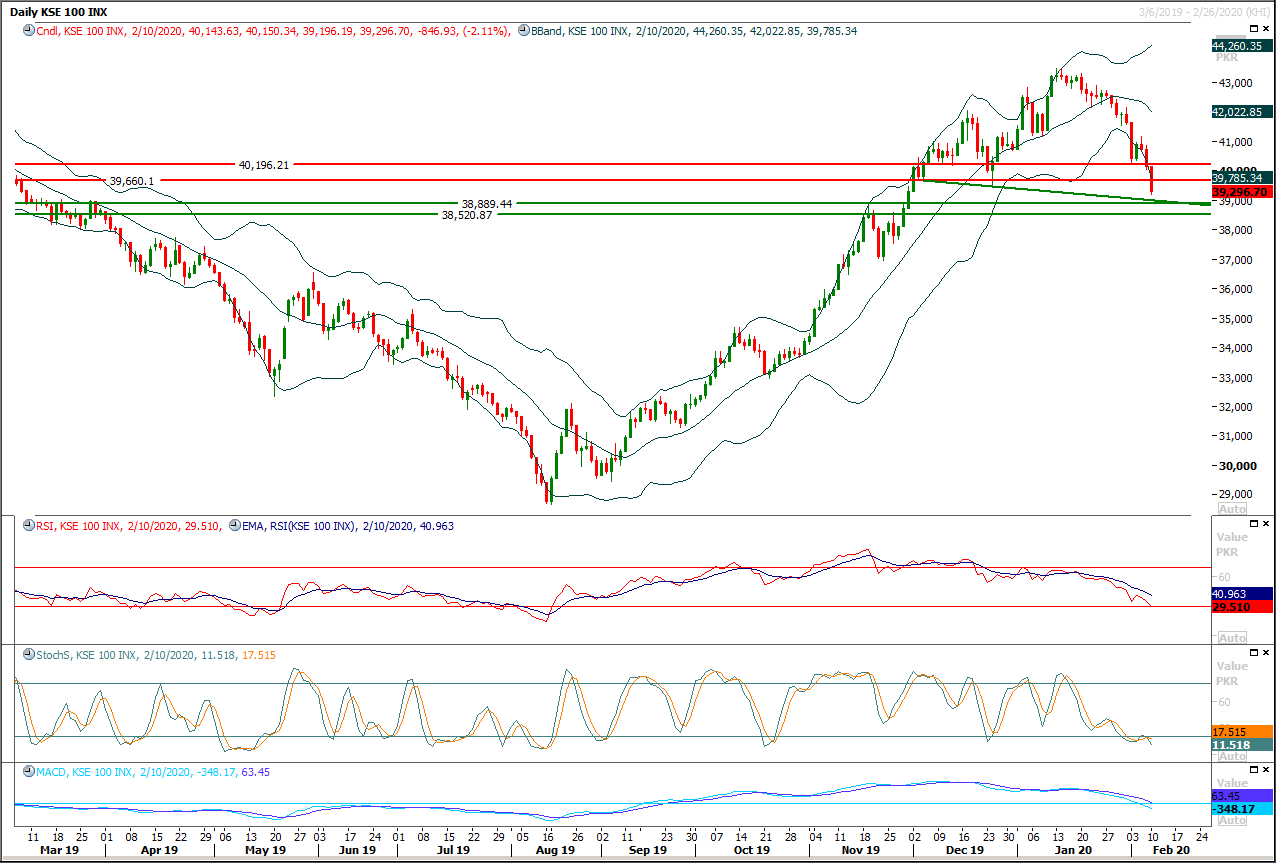

Trading volume at PSX floor dropped by 12.77 million shares or 6.60% on DoD basis, whereas the benchmark KSE100 index opened at 40,143.63, posted a day high of 40,150.34 and a day low of 39,196.19 points during last trading session while session suspended at 39,296.70 points with net change of -846.93 points and net trading volume of 129.84 million shares. Daily trading volume of KSE100 listed companies also dropped by 27.39 million shares or 17.42% on DoD basis.

Foreign Investors remained in net selling positions of 5.28 million shares but and value of Foreign Inflow dropped by 0.35 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani remained in net selling positions of 3.71 and 1.57 million shares but Foreign Individuals Investors remained in net long positions of 0.0025 million shares respectively. While on the other side Local Individuals, Banks, NBFCs, Brokers and Insurance Companies remained in net long positions of 8.18, 7.55, 0.07, 1.47 and 5.56 million shares but Local Companies and Mutual Fund remained in net selling positions of 9.43 and 8.41 million shares respectively.

Analytical Review

Asian shares bounce, China factories fight to re-start

Asian share markets followed Wall Street higher on Tuesday even as doubts grew about how quickly China’s factories could get back to work given that the coronavirus continues to spread and deaths mount. The total number of deaths in China has topped 1,000, well past the toll from Severe Acute Respiratory Syndrome, which killed nearly 800 worldwide. Investors seemed to be hoping for the best, though. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.9%, while Shanghai blue chips .CSI300 rallied 1%. Japan's Nikkei .N225 was closed for a holiday, although Nikkei futures NKc1 traded 0.7% firmer. Futures for the EUROSTOXX 50 .STXEc1 rose 0.7% and the FTSE FFIc1 0.6%.

‘Targeted’ subsidy for poor to be okayed by cabinet today

In a bid to provide some relief to the common man amid an unusual price hike in the country, the government has decided to give “targeted” subsidy to the low income group. Prime Minister Imran Khan on Monday held a meeting with his economic team and high-ups of social safety nets. The meeting discussed several plans to give relief to the poor through the targeted subsidy. The economic team and relevant officers kept finalising the “relief plan” till late in the night. The plan will be unveiled by the prime minister on Tuesday in the cabinet meeting.

ECC ratifies PM Imran's ban on sugar exports to 'stabilise domestic prices'

The Economic Coordination Committee (ECC) of the cabinet on Monday greenlighted Prime Minister Imran Khan's decision to slap a ban on the export of sugar in order to "stabilise domestic prices" that have been on the rise for the past couple of months. However, the ECC meeting chaired by Adviser to the Prime Minister on Finance Dr Abdul Hafeez Sheikh did not approve the premier's decision to import sugar through the private sector, noting that "adequate stocks" of the commodity are available in the country, according to a press release issued by the Finance Division. Prime Minister Imran had on Friday approved a summary to ban sugar exports and to allow the import of 300,000 tonnes sugar through the private sector in a bid to control price hike. His go-ahead came months after the country exported 141,447 metric tonnes of sugar, according to the Pakistan Bureau of Statistics.

Pak-Iran signs MoU on electronic exchange of data

Pakistan and Iran on Monday signed Memorandum of Understanding (MoU) on electronic exchange of data. A ceremony was held in Federal Board of Revenue for signing MoU on electronic exchange of dafa between Iran Customs and Federal Board of Revenue. The signing Cermony was chaired Muhammad Javed Ghani, Member (Customs-Policy/Operation), FBR and subsequently presided over by the acting Chairperson, FBR, Ms. Nausheen Javaid Amjad.

Trade with African region to be doubled: Secy Commerce

Secretary Commerce, Ahmed Nawaz Sukhera on Monday said that Pakistan wanted to double its trade with African region from $4 billion to $8 billion by tapping the huge potential existing in the region. He said that the government was focusing to enhance production of goods in all priority sectors to exploit new potential markets and increase the country’s exports. Talking to APP, he said that Pakistan-Africa trade was well below its true potential. The both sides wanted to enter into long-term partnerships, which would be proved mutually beneficial, he added. He stressed that there was a need to enhance Pakistan-Africa trade and develop banking and transportation channels. Pakistan was on a path of economic growth and had attracted Foreign Direct Investment (FDI) from leading investors in the last year, he said.

Asian share markets followed Wall Street higher on Tuesday even as doubts grew about how quickly China’s factories could get back to work given that the coronavirus continues to spread and deaths mount. The total number of deaths in China has topped 1,000, well past the toll from Severe Acute Respiratory Syndrome, which killed nearly 800 worldwide. Investors seemed to be hoping for the best, though. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.9%, while Shanghai blue chips .CSI300 rallied 1%. Japan's Nikkei .N225 was closed for a holiday, although Nikkei futures NKc1 traded 0.7% firmer. Futures for the EUROSTOXX 50 .STXEc1 rose 0.7% and the FTSE FFIc1 0.6%.

In a bid to provide some relief to the common man amid an unusual price hike in the country, the government has decided to give “targeted” subsidy to the low income group. Prime Minister Imran Khan on Monday held a meeting with his economic team and high-ups of social safety nets. The meeting discussed several plans to give relief to the poor through the targeted subsidy. The economic team and relevant officers kept finalising the “relief plan” till late in the night. The plan will be unveiled by the prime minister on Tuesday in the cabinet meeting.

The Economic Coordination Committee (ECC) of the cabinet on Monday greenlighted Prime Minister Imran Khan's decision to slap a ban on the export of sugar in order to "stabilise domestic prices" that have been on the rise for the past couple of months. However, the ECC meeting chaired by Adviser to the Prime Minister on Finance Dr Abdul Hafeez Sheikh did not approve the premier's decision to import sugar through the private sector, noting that "adequate stocks" of the commodity are available in the country, according to a press release issued by the Finance Division. Prime Minister Imran had on Friday approved a summary to ban sugar exports and to allow the import of 300,000 tonnes sugar through the private sector in a bid to control price hike. His go-ahead came months after the country exported 141,447 metric tonnes of sugar, according to the Pakistan Bureau of Statistics.

Pakistan and Iran on Monday signed Memorandum of Understanding (MoU) on electronic exchange of data. A ceremony was held in Federal Board of Revenue for signing MoU on electronic exchange of dafa between Iran Customs and Federal Board of Revenue. The signing Cermony was chaired Muhammad Javed Ghani, Member (Customs-Policy/Operation), FBR and subsequently presided over by the acting Chairperson, FBR, Ms. Nausheen Javaid Amjad.

Secretary Commerce, Ahmed Nawaz Sukhera on Monday said that Pakistan wanted to double its trade with African region from $4 billion to $8 billion by tapping the huge potential existing in the region. He said that the government was focusing to enhance production of goods in all priority sectors to exploit new potential markets and increase the country’s exports. Talking to APP, he said that Pakistan-Africa trade was well below its true potential. The both sides wanted to enter into long-term partnerships, which would be proved mutually beneficial, he added. He stressed that there was a need to enhance Pakistan-Africa trade and develop banking and transportation channels. Pakistan was on a path of economic growth and had attracted Foreign Direct Investment (FDI) from leading investors in the last year, he said.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index is moving downward aggressively after breakout of 40,500 points and momentum would remain bearish on short term basis if index would not succeed in finding support at 38,900 points or 38,500 points. Breakout below 38,500 points would call for a further downward move towards 37,500 points and 37,000 points. For current trading session it's recommended to start profit taking from short positions and wait for an intraday spike to initiate them again. It's expected that index would try to pull back on intraday basis towards 39,660 points and breakout above that region would call for 39,860 points. Index would remain bearish until it would not succeed in closing above 40,500 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.