Previous Session Recap

Trading volume at PSX floor increased by 102.42 million shares or 45.45% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42888.33, posted a day high of 43659.45 and a day low of 42881.88 during last trading session. The session suspended at 43630.74 with net change of 816.4 and net trading volume of 143.75 million shares. Daily trading volume of KSE100 listed companies increased by 25.08 million shares or 21.13% on DoD basis.

Foreign Investors remained in net buying position of 4.73 million shares and net value of Foreign Inflow increased by 0.37 million US Dollars. Categorically, Foreign Indiviual, Corporate and Overseas Pakistanis remained in net buying positions of 0.1, 0.38 and 4.24 million shares respectively. While on the other side Local Individuals, NBFCs, Mutual Funds and Brokers remained in net buying positions of 3.24, 0.65, 0.6 and 5.17 million shares respectively but Local Companies, Banks and Insurance Companies remained in net selling postions of 0.61, 5.83 and 7.08 million shares respectively.

Analytical Review

The New Year rally in Asian shares ran out of steam on Thursday as concerns about the U.S. administration’s protectionist stance hit Wall Street while U.S. bonds were dented by speculation China may curtail buying. MSCI’s broadest index of Asia-Pacific shares outside Japan shed 0.1 percent in early trade, slipping further from Tuesday’s 10-year peak. Japan’s Nikkei lost 0.6 percent. U.S. shares snapped their New Year rally on Wednesday while the Canadian dollar and the Mexican peso fell after a Reuters report said Canada increasingly believes that U.S. President Donald Trump will soon announce his intention to withdraw from the North American Free Trade Agreement treaty.

Pakistan’s trade deficit swelled to $18 billion in only six months of current fiscal year due to continuous increase in imports. The country’s trade deficit was recorded at $18 billion during six months (July to December) of the current fiscal year as compared to $14.4 billion of the same period of last year. The trade imbalance recorded an increase of 24.5 percent due to faster growth in imports as against exports of the country, Pakistan Bureau of Statistics (PBS) reported on Wednesday. Pakistan’s exports were recorded at $11 billion during July-December of the year 2017-18 as compared to $9.9 billion of the corresponding period of the last year, showing a growth of 11.24 percent. Meanwhile, the imports showed an increase by 19.11 percent and were recorded at $29 billion during first six months of the current financial year as against $24.3 billion of the same period last year.

Overseas Pakistani workers remitted $9744.75 million in the first six months (July to December) of FY18, compared with $9505.11 million received during the same period in the preceding year. During December 2017, the inflow of workers’ remittances amounted to $1723.57 million, which is 9.31% higher than November 2017 and 8.72% higher than December 2016. The country-wise details for the month of December 2017 showed that inflows from Saudi Arabia, UAE, USA, UK, GCC countries (including Bahrain, Kuwait, Qatar and Oman) and EU countries amounted to $431.97 million, $396.74 million, $234.76 million, $223.3 million, $188.76 million and $54.87 million respectively compared with the inflow of $475.75 million, $339.95 million, $182.19 million, $181.85 million, $203.63 million and $35.09 million respectively in December 2016.

The World Bank has estimated Pakistan’s GDP growth at 5.5 percent for the ongoing fiscal year 2017-18, well below than the government’s target of 6 percent. “In Pakistan, growth is forecast to pick up to 5.5 percent in FY2017/18, and reach at an average 5.9 percent a year over the medium term on the back of continued robust domestic consumption, rising investment, and a recovery in exports,” the World Bank stated in its January 2018 Global Economic Prospects. Pakistan’s growth continued to accelerate in last financial year FY2016/17 (July-June) to 5.3 percent, somewhat below the government’s target of 5.7 percent as industrial sector growth was slower than expected. Activity was strong in construction and services, and there was a recovery in agricultural production with a return of normal monsoon rains.

The LPG shortage crisis is on the cards as LPG importers Wednesday warned to suspend import of LPG from next month in case government refused to withdraw regulatory duty and advance tax. In a meeting with Petroleum Division officials, LPG importers demanded to withdraw regulatory duty on imported LPG and 5.5 per cent advance tax for smooth supply of commodity to meet the local demand. Following directives of Prime Minister Shahid Khaqan Abbasi, a meeting was held in Petroleum Division to address the concerns of importers here. The meeting was attended by high officials of the Ministry of Energy (Petroleum Division), local producers of LPG and its importers . It is pertinent to mention here that at present there is no advance tax on locally produced LPG but the government had imposed petroleum levy on locally produced LPG . However, the government also imposed regulatory duty on LPG imports equal to petroleum levy on locally produced LPG which had resulted in widening price difference making imports unfeasible.

ISL, TRG, PSO, FFC and FFBL wouldy try to lead positive momentum.

Technical Analysis

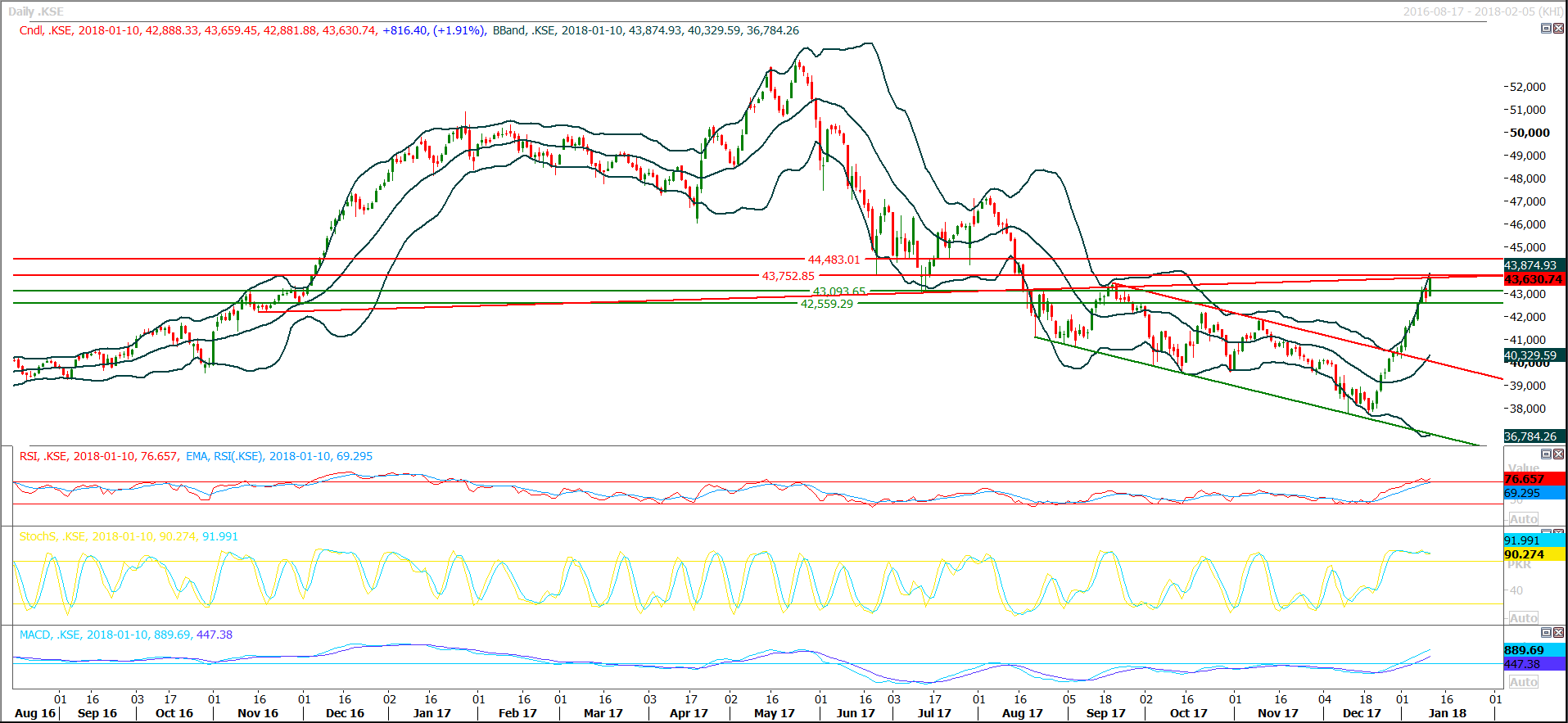

The Benchmark KSE100 Index have tried to penetrate negative momentum created during second last trading session by creating a bullish engulfing during last trading session but its still capped by crossover of a horizontal resistant line along with a trend line at 43760 which would try to cap current bullish rally. Its expected that currnent bullish rally would be capped either at 43760 or 44340 for time being and a correction could be witnessed if index would not become able to close above 44340 till this friday. Its eminent that index would fulfil the bullish rally of further 500 points which was pumped by breakout of 43300. Its recommended to book profit in coming two trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.