Previous Session Recap

Trading volumes at PSX floor dropped by 35.5 million shares or 9.59%, DoD basis. Whereas KSE100 Index opened with a positive gap of 105.95 points at 51179.09, posted a day high of 51231.65 and a day low of 50857.50 during the last trading session. The session suspended at 51103.53 with a net change of 30.39 points and a net trading volume of 96.49 million shares. Daily trading volume of KSE100 listed companies dropped by 94.71 million shares or 49.53%, DoD basis.

Foreign Investors turned back to buying and they remained in net buying position of 5.31 million shares but net value of Foreign Inflow dropped by 0.92 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani Investors remained in the net buying positions of 1.37 and 3.94 million shares but Foreign Individuals remained in a net selling position of 7350 shares.On the other side Local Individuals, Companies and Banks remained in the net buying positions of 4.84, 0.85 and 2.02 million shares respectively, but Mutual Funds and Brokers remained in the net selling positions of 9.34 and 0.92 million shares.

Analytical Review

Asian stocks rose on Thursday, getting a lift from a record high close on MSCI global stocks benchmark after strong gains in oil prices buoyed energy shares. The New Zealand dollar plunged to its lowest level since June 2016 after the Reserve Bank of New Zealand surprised markets by keeping a neutral bias at its policy review while holding interest rates steady at a record low 1.75 percent. The New Zealand dollar slumped 1.6 percent to $0.6833, its biggest one-day loss since June 2016. Oil prices extended their 3 percent-plus overnight gains, their biggest one-day jump since Dec. 1, following a steep drop in U.S. inventories and support from Iraq and Algeria for an extension to OPEC supply cuts. U.S. crude rose 0.4 percent to $47.55 a barrel on Thursday. Global benchmark Brent crude also advanced 0.4 percent to $50.45. MSCI broadest index of Asia-Pacific shares outside Japan rose 0.3 percent early on Thursday, while Japanese Nikkei advanced 0.15 percent. Chinese shares were unchanged, while Hang Seng climbed 0.25 percent. Korean KOSPI added almost 1 percent. On Wednesday, the index hit a third consecutive all-time intraday high before ending below the previous close.

The Executive Committee of the National Economic Council (Ecnec) and Central Development Working Party (CDWP) on Wednesday cleared a total of nine development projects with an estimated cost of about Rs143 billion. In a meeting presided over by the Minister of Finance Ishaq Dar, the council approved two projects with a total estimated cost of Rs28.5bn. These include the Gwadar Airport Project worth Rs17.6bn and the World Bank-funded Financial Inclusion and Infrastructure Project worth Rs14.32bn ($137 million).

Fertilizer manufacturers have asked the government to extend the urea export deadline to December, which will help them dispose of their surplus production. “The government can comfortably allow the export of 0.5-0.6 million tonnes of surplus urea. At present, the industry has an inventory of about 1.5m tonnes,” said Engro Fertilizer CEO Ruhail Mohammad. Urea demand is expected to remain at the last year level of 5.5-5.6m tonnes. The government allowed local manufacturers to export 300,000 tonnes of urea by the end of April. At the end of the first quarter of 2017, only Engro Fertilizer had exported urea to Eastern Africa at an estimated freight-on-board (FOB) price of $230-240 per tonne.

Pakistani debt and other repayments on Chinese “Belt and Road” initiative will peak at around $5 billion in 2022, but will be more than offset by transit fees charged on the new transport corridor, says the Pakistan government’s chief economist. China has pledged to invest up to $57bn in Pakistan’s rail, road and energy infrastructure through its vast modern-day “Silk Road” network of trade routes linking Asia with Europe and Africa. Officials expect a huge uptick in trade between the two nations once Gwadar port is functional and work on motorways is finished allowing goods to cross the Himalayas to and from Chinese western Xinjiang province.

The State Bank of Pakistan (SBP) on Wednesday allowed banks to settle outstanding export loans valuing up to $50,000 (or equivalent in other foreign currencies) themselves through the inter bank market. The existing foreign exchange regulations allow authorized dealers, i.e. banks, to use foreign currency deposits for extending foreign currency trade loan facility to exporters and importers. These regulations, however, allow settlement of such loans against exports only through the realization of export proceeds or remittances from abroad

Today ATRL, EFERT, PKGI and TRG may lead the market in the positive direction.

Technical Analysis

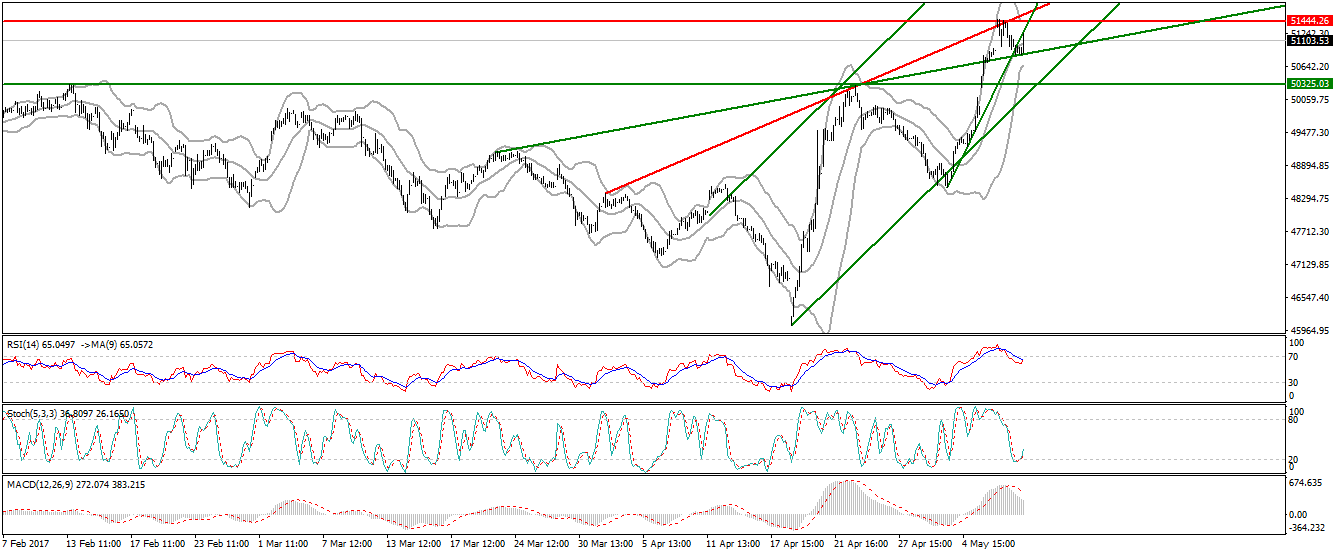

The Benchmark KSE100 Index is getting support from its previous resistant trend line and hourly stochastic and MAORSI are trying to generate a bullish crossover which can push index in slight upward direction, but its still capped by a resistant trend line along with a horizontal line, so it is recommended to sell on strength. As it has penetrated its supportive trend line in downward direction so that trend line would also react as a resistance at 51256 along with horizontal resistance at 51465. Breakout of 50870 will call for a bearish momentum towards 50330.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.