Previous Session Recap

Trading volume at PSX floor dropped by 55.39 million shares or 20.83% on DoD basis, whereas the benchmark KSE100 index opened at 35,758.52, posted a day high of 36,048.52 and a day low of 35,758.52 points during last trading session while session suspended at 35,978.16 points with net change of 219.64 points and net trading volume of 105.49 million shares. Daily trading volume of KSE100 listed companies dropped by 28.88 million shares or 21.49% on DoD basis.

Foreign Investors remained in net buying positions of 8.27 million shares and net value of Foreign Inflow increased by 5.59 million US Dollars. Categorically, Foreign Individuals, Foreign Corporate and Overseas Pakistanis investors remained in net buying positions of 0.02, 3.65 and 4.59 million shares. While on the other side Local Individuals, Companies, Banks, NBFCs, Mutual Fund and Insurance Companies remained in net selling positions of 1.91, 2.13, 0.78, 6.92, 3.90 and 2.20 million shares respectively but Brokers remained in net buying positions of 9.94 million shares respectively.

Analytical Review

Asian shares give up gains as Hong Kong chaos hits sentiment

Asian shares reversed gains on Monday, the yen ticked higher and gold jumped as fresh violence broke out in Hong Kong, while uncertainty still remained over whether the United States and China could end their damaging trade war. Hong Kong's Hang Seng index .HSI led the losses in Asia, down more than 1%, after police fired live rounds at protestors on the eastern side of Hong Kong island. Cable TV and other Hong Kong media reported at least one protester being wounded. Video footage showed a protester lying in a pool of blood. Chinese shares too started lower with the blue-chip CSI300 index .CSI300 down 0.6%. South Korea's KOSPI .KS11 lost 0.7% Japan's Nikkei .N225 gave up early gains to drift away from a recent 13-month high after data showed the country's core machinery orders fell for a third straight month. Australian shares bucked the downbeat trend, rising 0.5% to a two-week high. That left MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS down 0.5%.

Pak-Japan have huge potential for expanding trade, economic ties: Envoy

Pakistan and Japan possess huge potential for expanding the bilateral trade and economic ties , ambassador of Japan to Pakistan, Kuninori Matsuda said. Pakistan was major exporter to Japan Cotton including articles of apparel edible fruits, oil seeds, Oleagis fruits, grain seeds, fruits, products of animal origin, salt, sulphur, stone, plaster, limeand cement , articles of leather, animal gut, harness, Ambassador Kuninori Matsuda told APP here. The Ambassador said that both sides have more potential to increase bilateral trade from current volume of trade and double the figure to exploit the resources. He said Japan and Pakistan have enjoyed historical diplomatic and economic relation, where Japan has always supported Pakistan in every situation.

Govt releases Rs257.4 billion for development projects under PSDP

The Ministry of Planning, Development and Reforms has so far given authorization for the release of Rs257.436 billion including Rs53.62 billion foreign aid for various ongoing and new development projects under Public Sector Development Programme (PSDP) 2019-20 as against the total allocation of Rs701 billion. According to latest data of PSDP, released by the Planning Commission of Pakistan, the authorities concern were sanctioned to release Rs114.199 billion including Rs7.88 billion foreign aid for developmental projects of different federal ministries against the total allocation of Rs303.66 billion for current fiscal year.

Saudi Aramco's record IPO starts Nov 17, prospectus says

Saudi Aramco's much-anticipated initial public offering will begin on November 17, the company's prospectus said, without revealing the size of the stake sale or the pricing range. The 658-page document, released just before midnight on Saturday, said the final share price will be determined on December 5 — a day after the subscriptions close — in what is expected to be the world's biggest IPO. After years of delays and false starts, Aramco officials last week announced a share sale on the Riyadh stock exchange for the world's most profitable company, which pumps 10 per cent of the world's oil.

Govt plans tax documentation drive

In a large swoop to widen tax net and check evasion, the government has decided to evolve a comprehensive plan for nationwide tax assessment and documentation drive to bring affluent people and untapped sectors in the net. Prime Minister Imran Khan has tasked the tax department for coming up with a detailed plan until Nov 30, which will envisage measures to be implemented over the next two years. The documentation drive will assist in ascertaining untapped segments including businesses, real estate and industries. “The premier asked the Federal Board of Revenue that proposals in this regard should be evolved within the prescribed timeline,” a senior tax officer said.

Asian shares reversed gains on Monday, the yen ticked higher and gold jumped as fresh violence broke out in Hong Kong, while uncertainty still remained over whether the United States and China could end their damaging trade war. Hong Kong's Hang Seng index .HSI led the losses in Asia, down more than 1%, after police fired live rounds at protestors on the eastern side of Hong Kong island. Cable TV and other Hong Kong media reported at least one protester being wounded. Video footage showed a protester lying in a pool of blood. Chinese shares too started lower with the blue-chip CSI300 index .CSI300 down 0.6%. South Korea's KOSPI .KS11 lost 0.7% Japan's Nikkei .N225 gave up early gains to drift away from a recent 13-month high after data showed the country's core machinery orders fell for a third straight month. Australian shares bucked the downbeat trend, rising 0.5% to a two-week high. That left MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS down 0.5%.

Pakistan and Japan possess huge potential for expanding the bilateral trade and economic ties , ambassador of Japan to Pakistan, Kuninori Matsuda said. Pakistan was major exporter to Japan Cotton including articles of apparel edible fruits, oil seeds, Oleagis fruits, grain seeds, fruits, products of animal origin, salt, sulphur, stone, plaster, limeand cement , articles of leather, animal gut, harness, Ambassador Kuninori Matsuda told APP here. The Ambassador said that both sides have more potential to increase bilateral trade from current volume of trade and double the figure to exploit the resources. He said Japan and Pakistan have enjoyed historical diplomatic and economic relation, where Japan has always supported Pakistan in every situation.

The Ministry of Planning, Development and Reforms has so far given authorization for the release of Rs257.436 billion including Rs53.62 billion foreign aid for various ongoing and new development projects under Public Sector Development Programme (PSDP) 2019-20 as against the total allocation of Rs701 billion. According to latest data of PSDP, released by the Planning Commission of Pakistan, the authorities concern were sanctioned to release Rs114.199 billion including Rs7.88 billion foreign aid for developmental projects of different federal ministries against the total allocation of Rs303.66 billion for current fiscal year.

Saudi Aramco's much-anticipated initial public offering will begin on November 17, the company's prospectus said, without revealing the size of the stake sale or the pricing range. The 658-page document, released just before midnight on Saturday, said the final share price will be determined on December 5 — a day after the subscriptions close — in what is expected to be the world's biggest IPO. After years of delays and false starts, Aramco officials last week announced a share sale on the Riyadh stock exchange for the world's most profitable company, which pumps 10 per cent of the world's oil.

In a large swoop to widen tax net and check evasion, the government has decided to evolve a comprehensive plan for nationwide tax assessment and documentation drive to bring affluent people and untapped sectors in the net. Prime Minister Imran Khan has tasked the tax department for coming up with a detailed plan until Nov 30, which will envisage measures to be implemented over the next two years. The documentation drive will assist in ascertaining untapped segments including businesses, real estate and industries. “The premier asked the Federal Board of Revenue that proposals in this regard should be evolved within the prescribed timeline,” a senior tax officer said.

Market is expected to remain volatile during current trading session.

Technical Analysis

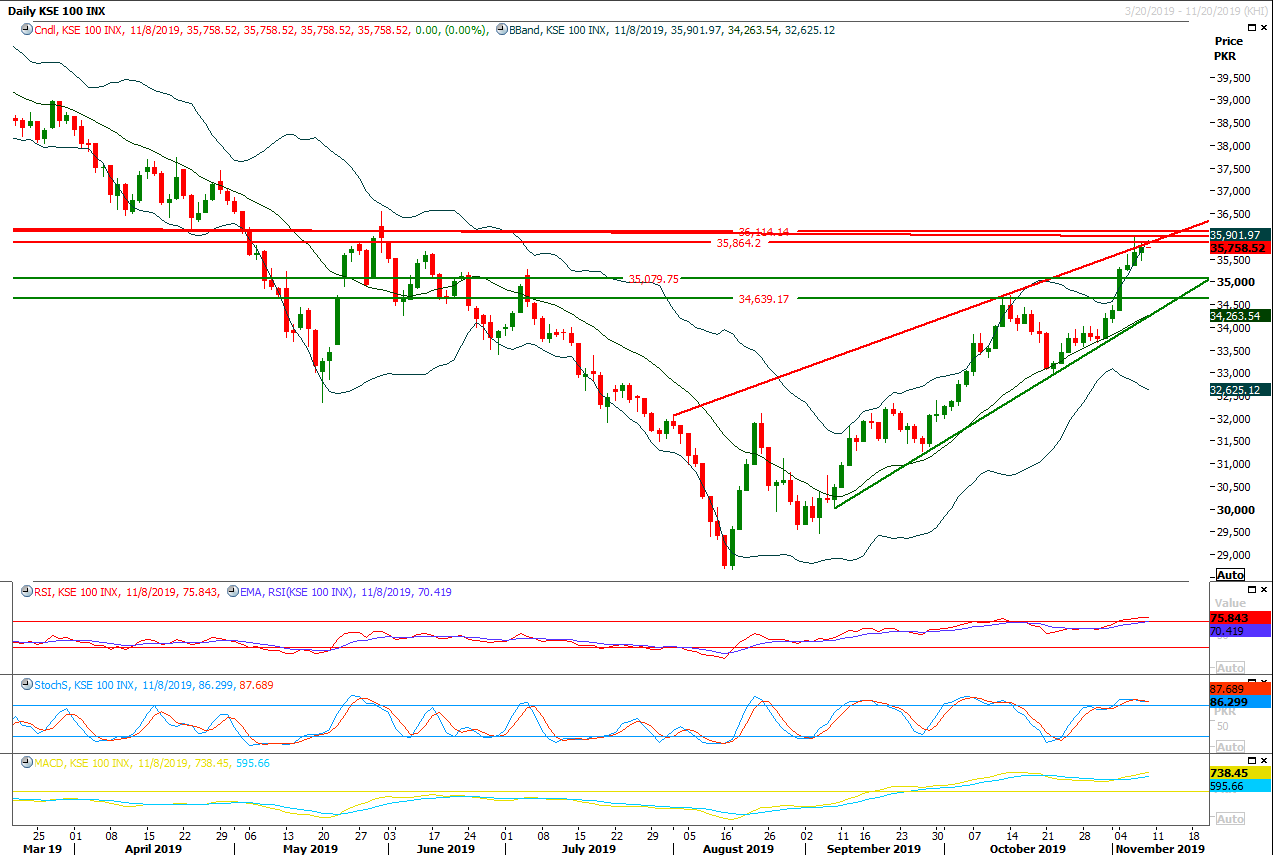

The Benchmark KSE100 index is being capped by a horizontal resistant region along with an ascending trend line at 36,000 and 36,200 points and it's expected that current bullish sentiment would start expiring around 36,200-36,700 points. It's recommended to post trailing stop loss on existing long positions and start selling on strength with strict stop loss of 36,700 points. Because if index would not succeed in breakout of 36,200 points then it would roll back to retest its supportive region at 34,500 points. On short term basis index would remain range bound between 34,500 to 36,700 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.