Previous Session Recap

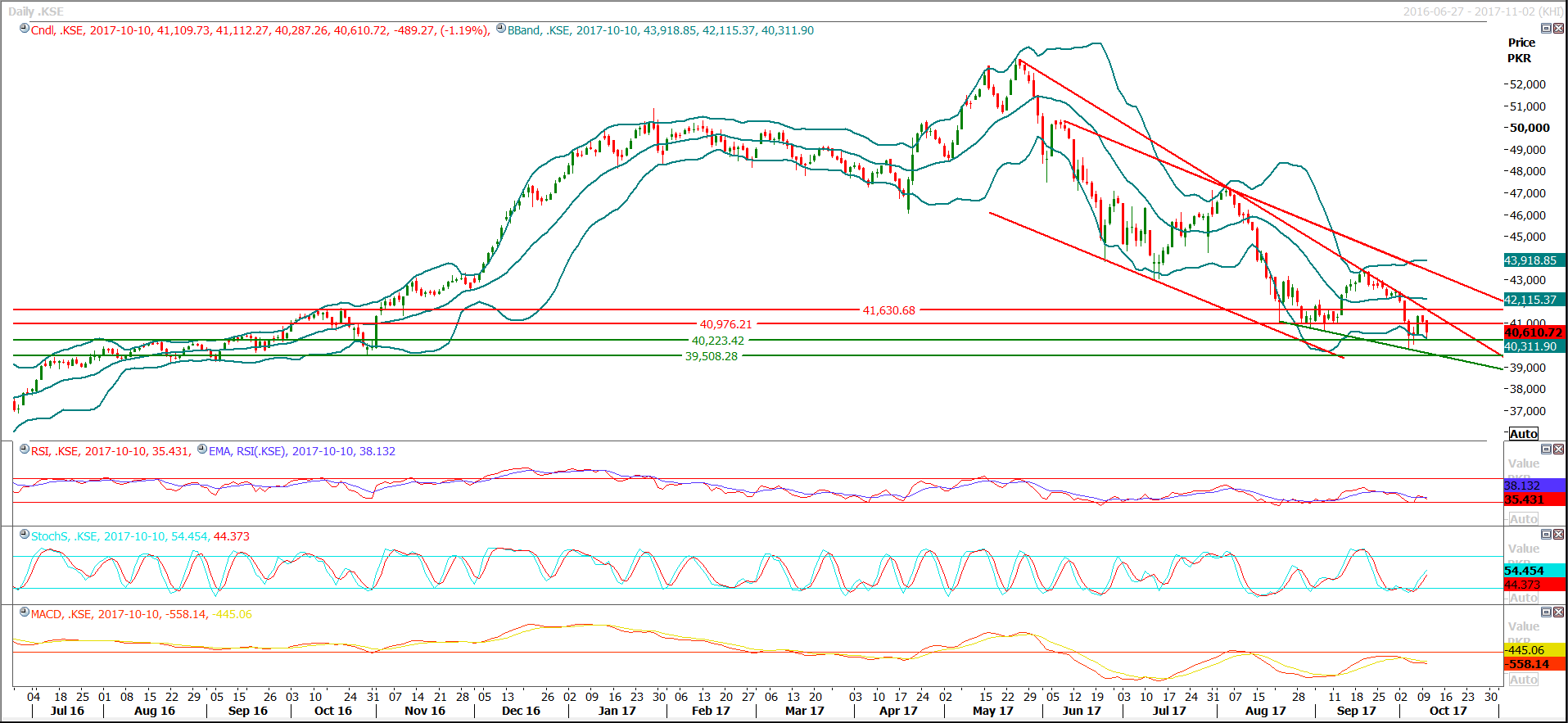

Trading volume at PSX floor increased by 60.88 million shares or 49.36% on DoD basis, whereas, the benchmark KSE100 Index opened at 41109.73, posted a day high of 41112.27 and a day low of 40287.26 during last trading session. The Session suspended at 4061.72 with net change of -489.27 points and net trading volume of 121.79 million shares. Daily trading volume of KSE100 listed companies increased by 69.61 million shares or 133.38% on DoD basis.

Foreign Investors remain in net buying of 20.94 million shares and net value of Foreign Inflow increased by 5.18 million US Dollars. Categorically, Foreign Coporate investors remain in net buying of 20.02 million shares but Overseas Pakistanis remain in net selling of 1.03 million shares. While on the other side Local Individuals, Companies, Banks and Insurance Companies remain in net buying of 5.81, 11.44, 1.57 and 1.02 million shares respectively but Mutual Funds and Brokers remain in net selling of 36.47 and 4.03 million shares.

Analytical Review

Asian shares rose on Wednesday, tracking Wall Street’s rally to all-time highs, while the euro hovered near a 10-day peak after Catalonia’s leader talked down immediate plans to secede from Spain, easing near-term concerns about euro zone instability. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS nudged 0.24 percent higher to test a recent decade peak of 545.56. Australian stocks jumped 0.6 percent to one-month highs and New Zealand's index .NZ50 climbed to a record. South Korea's KOSPI .KS11 added 0.3 percent to a 2-1/2 month peak. Sentiment was boosted after the International Monetary Fund upgraded its global economic growth forecast for 2017 and 2018, driven by a pickup in trade, investment, and consumer confidence.

The National Electric Power Regulatory Authority (Nepra) on Tuesday allowed 70 paisa per unit increase in the proposed seven-year tariff it had determined for K-Electric in March this year, apparently to facilitate the sale of majority stakes from Abraaj Capital to Shanghai Electric of China. In its determination released on Tuesday, the regulator determined average tariff for KE at Rs12.77 per unit, up from Rs12.07 it allowed in March this year. Once notified by the government, the tariff will remain valid until 2023.

Growing traffic of ships, particularly vessels loaded with Liquefied Natural Gas (LNG), warranted the need for an additional channel which the authority is now planning to develop, Port Qasim Authority Chairman Agha Jan Akhtar said on Tuesday. As a safety measure, currently PQA stops general movement of all ships when a vessel loaded with LNG arrives or leaves the port, causing delays, he said. At present, a vessel loaded with LNG calls at the port every five days and after the operation of another LNG terminal by the end of this year, this cycle could be reduced to every third day, he added. So far 109 LNG vessels have called at the port and the traffic would increase after the opening of another terminal by end of the year.

Remittances increased one per cent to $4.79 billion in July-September on a year-on-year basis, the State Bank of Pakistan (SBP) reported on Tuesday. However, inflows amounted to $1.29bn in September, down 33.8pc from August. The nominal growth recorded in the first quarter of 2017-18 is in sharp contrast with an increase of 13pc registered in July-August. Remittances from the Arab countries, which are the largest source of remittances, showed no positive sign.

Sales of cars and light commercial vehicles (LCVs), jeeps and vans increased 27 per cent year-on-year to 60,469 units in July-September. According to data released by the Pakistan Automotive Manufacturers Association (Pama) on Tuesday, car sales rose 22.3pc to 50,640 units from 41,405 units a year ago. Sales of LCVs climbed 57.5pc to 9,829 units from 6,240 units last year. Assemblers of local vehicles, including LCVs, vans and jeeps, managed to sell 18,798 units in September, up 17pc year-on-year. However, a contraction of 15pc was noted in sales on a month-on-month basis because of fewer working days in September on account of Eid holidays.

Today Overall Auto Sector, SNGP and TRG may lead the market in the positive direction.

Technical Analysis

The Benchmark KSE100 Index have pulled back after getting support from a horizontal support during last trading session and completing its 74.6% correction on hourly chart. Right now index is bullish on daily and hourly chart as Stochastic and MAORSI are bullish on both timeframes. For current tarding session index have supports at 40220 and 39872 points while resistant regions are standing at 40980 points and 41630, buying around 40000 points is recommended with strict stop loss of 39660 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.