Trading volume at PSX floor dropped by 6.55 million shares or 4.44%,DoD basis, whereas, the benchmark KSE100 Index opened at 41227.88, posted a day high of 41653.74 and a day low of 41169.97 during the last trading session. The session suspended at 41401.02 with a net change of 442.37(1.07%) points. Daily trading volume of KSE100 listed companies increased by 0.45 million shares or 0.58%, DoD basis.

Foreign Investors remained in the net selling position of 7.58 million shares and net value of Foreign Inflow dropped by 6.96 million shares. Categorically, Foreign Corporate and Overseas Pakistani investors remained in the net selling position of 6.61 and 0.99 million shares. On the other side Local Individuals and Banks remained in the net selling positions of 2.02 and 1.01 million shares but Local Companies, Mutual Funds and Brokers remained in the net buying position of 6.01, 1.57 and 2.14 million shares respectively.

The U.S. dollar won a reprieve from risk aversion on Monday after North Korean dictator Kim Jong Un decided to hold a party over the weekend rather than launch another missile, tempering safe havens like the yen and Treasuries. Investors remained cautious over the possible economic impact of Hurricane Irma as it chewed its way up the Florida coast, knocking out electricity to 3 million homes and businesses statewide. Japan's Nikkei .N225 rose 1 percent after Pyongyang held a massive celebration to congratulate the nuclear scientists and technicians who steered the country's sixth and largest nuclear test a week ago. South Korea's main index .KS11 added 0.7 percent, while MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS inched up 0.1 percent. The U.S. dollar hovered at 108.31 yen JPY=, up from Friday's 10-month trough of 107.32. Against a basket of currencies, the dollar added 0.15 percent to 91.492 .DXY but that was still uncomfortably close to last week's 2-1/2 year low of 91.011.

The federal government has urged chief ministers of the four provinces for a second time in two weeks to make up their minds about concerns over proposed reforms in the gas sector, which envisage unbundling of two major companies into several public- and private-sector companies and absorption of increasing quantities of imported liquefied natural gas (LNG). The Inter-Provincial Coordination (IPC) Committee led by IPC Minister Riaz Hussain Pirzada had on Aug 7 deferred discussion on gas sector reforms after the chief ministers had expressed their inability to firm up their positions on the matter due to late circulation of the relevant files.

The Punjab government has agreed with the World Bank to withdraw its annual practice of wheat procurement by 2021, reducing the strategic grain reserves to just 1 million metric tons in next four years, it was learnt. Under the program of ‘Strengthening Markets for Agriculture and Rural Transformation in Punjab (SMART — PforR)’, the government has also agreed with the lending agency to deregulate prices of milk and meat by that time. According to the official documents, a copy of which also available with The Nation, the Planning and Development Department (P&D) of Punjab government has agreed on 11 Disbursement Linked Indicators (DLIs) with the World Bank under a project titled ‘Strengthening Markets for Agriculture and Rural Transformation in Punjab (SMART — PforR)’ to avail the loan from the international donor.

The capacity utilization of the cement industry was high at 86.46 percent in July 2017, while the annual cement dispatch capacity of the industry has increased to 46.94 million tons. Local dispatches from units based in northern region of the country were 2.423 million tons while their export dispatches were 0.338 million tons in July 2017 as opposed to 1.516 million tons local and 0.306 million tons export dispatches in July 2016. The turnaround after a dismal performance in June 2017 took the industry by surprise and the sharp increase in dispatches in July 2017 revived hopes for the sector. The dispatches were achieved despite political turmoil in the country and unprecedented rains throughout the country which depicts the maturity of the construction sector of the country. South based mills also recorded a growth in local dispatches which increased from 0.352 million tons in July 2016 to 0.483 million tons in July 2017; whereas, exports took a hit going down to 0.138 million tons from 0.159 million tons in July 2016. A spokesman of All Pakistan Cement Manufacturers’ Association said that the dispatch figures for July are most encouraging. However, he said that this does not mean that the economic planners ignore the genuine difficulties faced by this sector.

The federal government has approved Rs3 billion for construction of eight grid stations in Malakand Division. According to Radio Pakistan, these grid stations will be constructed in Chakdara, Thana, Madain, Matta, Kabal, Besham and Barikot. The grid stations will be completed within three years.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

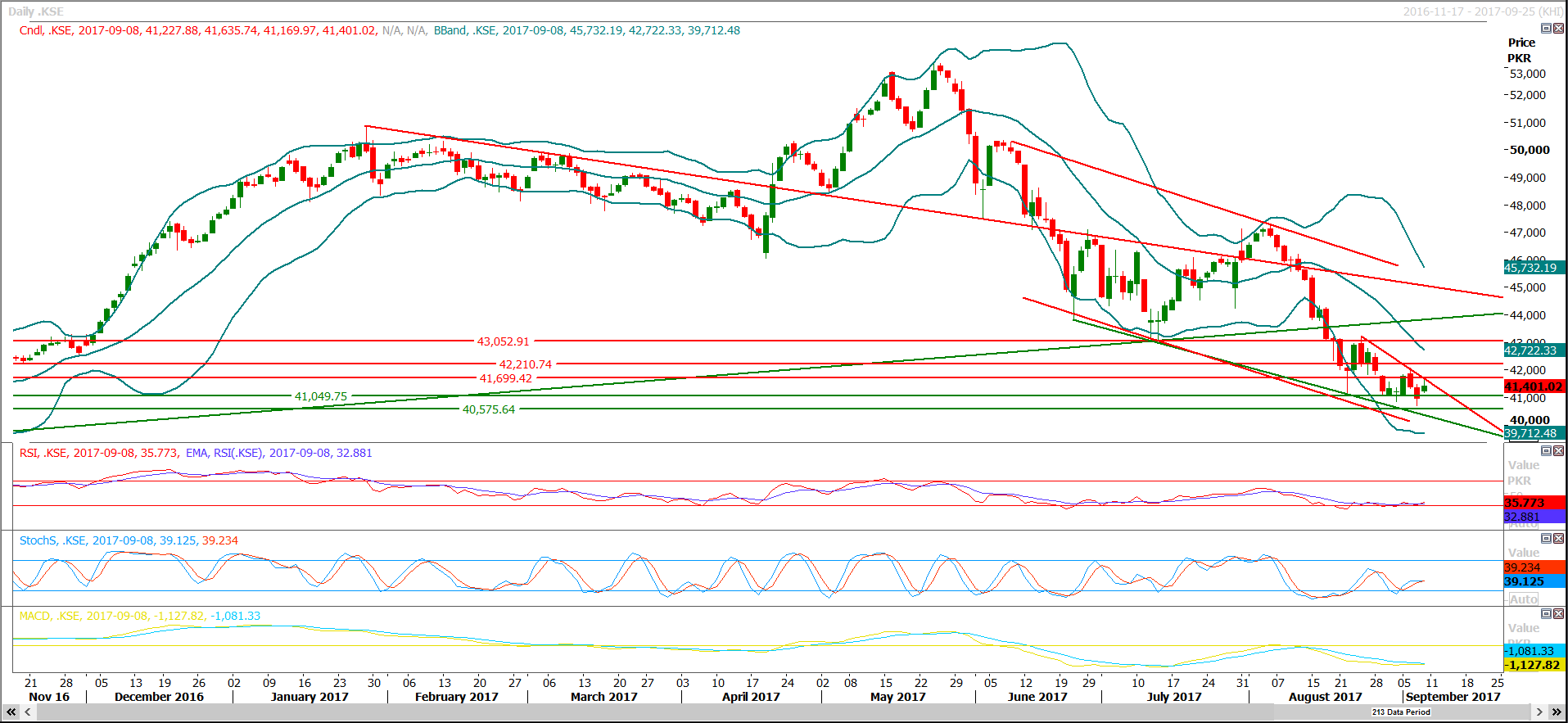

Technical Analysis

The Benchmark KSE100 Index is caged in a bearish wedge on the daily chart and right now it is coming back after getting resistance from the resistant trend line of the said wedge. Stochastic and MORSI on the daily chart are also not supporting further bullish trend right now but on the hourly chart, stochastic is trying to push index upwards which could resultant in an intraday spike. As of today index have supportive regions around 41049 and 40560, while resistant regions are standing at 41700 and 42200. A gap in the opening above 41517 might pump some fresh air in index towards 41700 and 42200.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.