Previous Session Recap

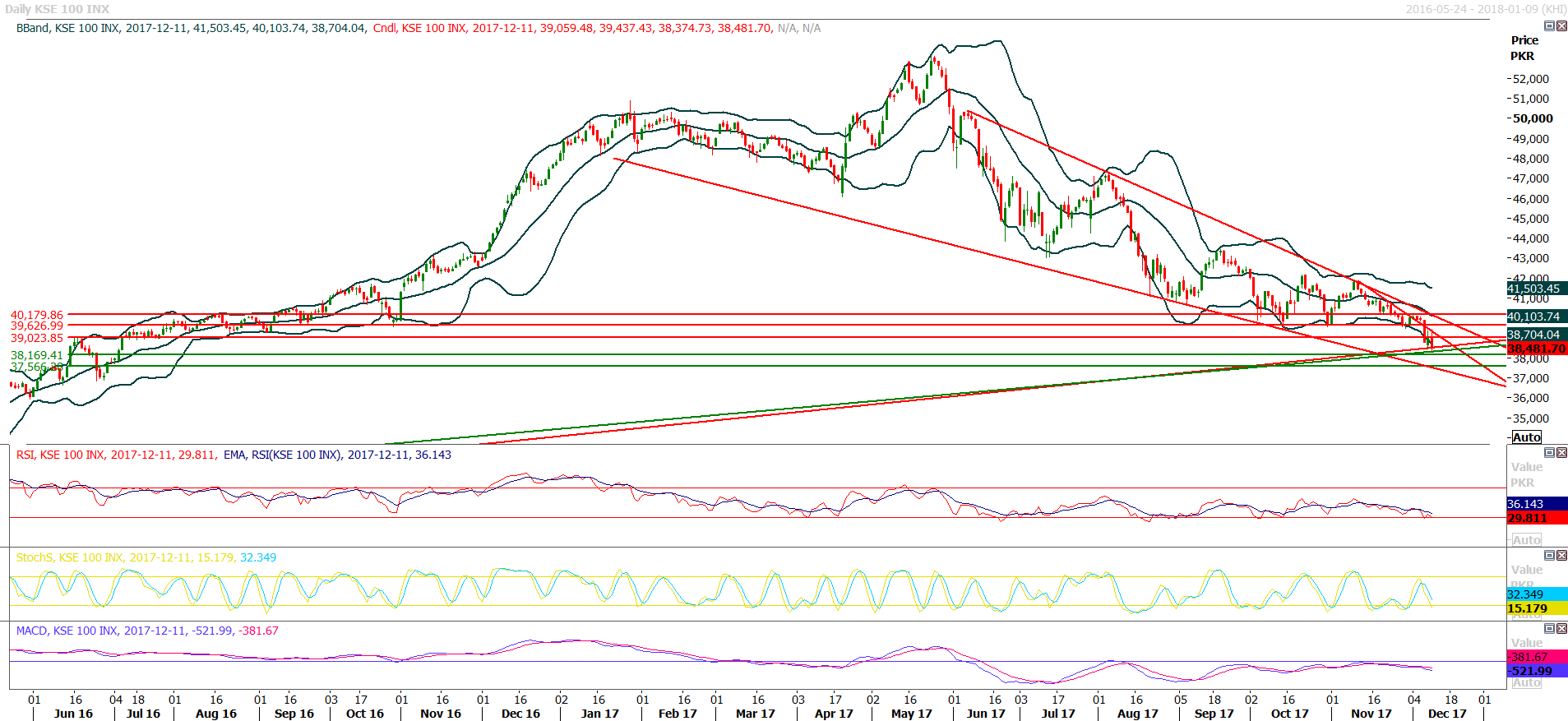

Trading volume at PSX floor dropped by 20.11 million shares or 13.45% on DoD basis, whereas, the benchmark KSE100 Index opened at 39059.48, posted a day high of 39437.43 and a day low of 38374.73 during last trading session. The session suspended at 38481.70 with net change of -598.30 and net trading volume of 57.16 million shares. Daily trading volume of KSE100 listed companies dropped by 23.49 million shares or 29.13% on DoD basis.

Foreign Investors remained in net selling position of 0.18 million shares but net value of Foreign Inflow increased by 0.61 million US Dollars. Categorically, Foreign Corporate Investors remained in net buying postion of 0.76 million shares but Overseas Pakistanis remained in net selling position of 0.94 million shares. While on the other side Local Individuals, Brokers and Insurance Companies remained in net selling positions of 6.23, 0.96 and 2.06 million shares but Local Companies, Banks, NBFCs and Mutual Funds remained in net buying positions of 0.77, 3.39, 0.21 and 6.97 million shares respectively.

Analytical Review

Asian shares took a breather on Tuesday after three straight sessions of gains, with markets consolidating in the hope an upswing in global growth could outlast a likely hike in U.S. borrowing costs this week. The latest promising news came from China where banks doled out a surprisingly generous dose of credit in November, which could bode well for a pick up in retail sales and industrial output due later in the week. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dithered either side of flat having bounced 2 percent in the past three sessions. Moves were minor across the region, with blue chip Chinese shares off 0.2 percent .CSI300 and Australia up 0.1 percent . Japan's Nikkei .N225 was likewise steady, after the index scored its highest close in 25 years on Monday.

The dollar hit as high as Rs109.80 in the beginning of the Monday session in the interbank market, creating panic among importers. However, the greenback closed at Rs108.40-50, still higher than the benchmark of Rs107 provided by the State Bank of Pakistan (SBP) on Friday. In a statement on Dec 8, the central bank had justified the sudden devaluation in the exchange rate, calling it a “market-driven adjustment”. Currency dealers and bankers were not clear as to how much devaluation the SBP required. The rapid fluctuation in the dollar rate forced many dealers to stay away from the market. However, exporters found the situation beneficial. Export receipts fell from $25 billion to $20bn in the last four years.

The International Monetary Fund on Monday questioned the tax policy of the government, which has failed to enhance income tax returns despite giving many extensions in the last dates for filing returns. The visiting IMF Post Programme Monitoring Mission has visited Federal Board of Revenue. Meanwhile, Special Assistant to Prime Minister on Revenue Haroon Akhtar Khan held a meeting with IMF 's Mission regarding tax policy/administration issues. Chairman FBR Tariq Mahmood Pasha and members of the FBR were also present in the meeting held at the FBR House.

The National Transmission & Despatch Company has threatened the Sindh government to withdraw its workforce engaged on important transmission lines for coal-based Port Qasim Project under CPEC, following the registration of FIR against NTDC officials by it. The company said that the work could also be suspended on important CPEC projects due to harassing of the officers of NTDC by Sindh Police. According to details, Police Station Dhabeji has registered FIR on behalf of Govt of Sindh through Mukhtiarkar (Tehsildar) Taulqa Mirpur Sakro against the installation of towers of 500 kV Double Circuit Quad Bundle Transmission Line from Port Qasim Power Plant which was energiaed after day and night efforts of NTDC staff on 2nd Nov 2017. The recently completed transmission line will evacuate power from 1320 MW Port Qasim Coal Power Plant and will help to eliminate load shedding from interior Sindh. The spokesman said that the Govt of Sindh was fully aware of the installation of towers in the area and ongoing activities of NTDC engineers.

Contrary to the tall claims of breaking the begging bowl, Abbasi-led federal government is all set to receive mammoth $7.15 billion loan from Asian Development Bank (ADB) in the next three years. According to details, ADB has issued country operations plan for the next three years. The aforementioned loan would be spent on projects related to energy, transport, education and health sectors. ADB would also provide funds for remodeling of canal system in Punjab and uplift of educational system in Sindh.

ENGRO, PSO, ATRL, TRG and PAEL may lead the market in positive direction

Technical Analysis

The Benchmark KSE100 Index is getting support from a rising trend line on weekly and daily chart on long term basis but during last trading session index have dropped down after comleting its 61.8% correction on hourly chart therefore it needs to be very cautious while trading today as if index would drop below 38331 then it would start expansion of said correction which would lead index towards 37683 points. For current trading session its recommended to buy on dip with strict stop loss of 38331 because Stochastic and MAORSI are trying to generate bullish crossover on same time which would push index in bullish zone if succeeded on intraday basis towards 39023 and then 39478 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.