Previous Session Recap

Trading volume at PSX floor dropped by 19.24 million shares or 10.64% on DoD basis, whereas the benchmark KSE100 index opened at 39,296.70, posted a day high of 39,985.96 and a day low of 39,084.86 points during last trading session while session suspended at 39,714.46 points with net change of 417.76 points and net trading volume of 115.96 million shares. Daily trading volume of KSE100 listed companies also dropped by 13.88 million shares or 10.69% on DoD basis.

Foreign Investors remained in net selling positions of 5.28 million shares and and value of Foreign Inflow dropped by 0.35 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net long positions of 0.006 and 3.30 million shares but Foreign Corporate Investors remained in net selling positions of 6.06 million shares respectively. While on the other side Local Individuals, Companies and Mutual Fund remained in net selling positions of 1.75, 0.62 and 3.13 million shares but Banks, Brokers and Insurance Companies remained in net long positions of 1.85, 1.57, 1.41 and 3.43 million shares respectively.

Analytical Review

Stocks inch higher as new coronavirus cases fall

Asian shares and Wall Street futures nudged higher on Wednesday amid hopes the worst of the coronavirus in China may have passed, although prevailing uncertainty about the outbreak has kept investors wary.MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.31%. Chinese shares .CSI300 fell 0.12%, but investors in other equity markets looked past this decline. Shares in Hong Kong .HIS rose 0.57% to a three-week high. Australian shares were up 0.52%, while Japan's Nikkei stock index .N225 rose 0.6%.

Revenue target comes into focus in IMF talks

Talks with the IMF continued as discussions revolved around the need to further revise the revenue target downward. Multiple sources from within the talks confirmed to Dawn that the FBR has proposed up to Rs4.7 trillion as the maximum amount that can be collected this fiscal year whereas the IMF is asking it to aim for Rs4.9tr instead. The gap implied fresh revenue measures totaling Rs200 billion that would need to be announced in the near future if the authorities fail to convince the fund of their limitations. The revenue target for the FBR was originally set at Rs5.5tr in the budget for FY2020. It was then revised downward to Rs5.23 billion in the first review that concluded in December 2019. By the end of that year the revenue authority announced a growing shortfall of Rs287 billion in the first six months of the fiscal year.

Auto industry woes multiply as sales dip

Pakistan’s auto sector continued to show dismal performance during the first seven months of 2019-20 with cars sales plunging by 44 per cent year-on-year, reported the data released by Pakistan Automotive Manufacturers Association. The rest of the segments followed as trucks sales dipped by 44.8pc, buses 30.6pc, jeeps 49.7pc, LCVs (pickups) 47.3pc, farm tractors 37.6pc and two- and three-wheelers 11pc. However, the figures for January showed a reverse trend as car sales went up to 10,095 units, edging up 1.08pc over 9,987 units in December 2019 whereas over the seven-month period, they nosedived to 69,192, from 123,391 units in 7MFY20.

Nepra defers hearing on CPPA petition for power tariff hike

The National Power Regulatory Authority (NEPRA) has deferred its hearing on the petition of the Central Power Purchasing Agency (CPPA) for power tariff increase, under fuel price adjustment for the month of November, for ex-Wapda DISCOs as the later has withdrew its petition. During a public hearing by NEPRA on Central Power Purchasing Agency (CPPA) request for power tariff increase by Rs 0.9836, CPPA has requested the regulator not to proceed with hearing as it is working on the draft to change the mechanism for fuel price adjustment(FPA).Apparently the hearing was deferred on the request of the CPPA for making changes to the FPA mechanism but actually it is part of the government plan to keep the electricity prices unchanged for next 18 months, official source told The Nation. The source said that Pakistan has also informed the visiting IMF team about its decision of not increasing power tariff for the power consumers. Legally the government cannot issue directive to NEPRA to keep the prices unchanged but indirectly it will undertake efforts to keep the prices unchanged, the source said.

France provides € 0.5 million for PPIB

Pakistan and France on Tuesday signed grant financing agreement worth € 0.5 million for technical assistance to the Private Power & Infrastructure Board (PPIB). Dr Syed Pervaiz Abbas, Secretary Economic Affairs Division (EAD), and Marc BARÉTY, Ambassador of France to Pakistan, along with Philippe Steinmetz, Country Director of the French Agency for Development (AFD), signed the grant financing agreement worth € 0.5 million for technical assistance to the Private Power and Infrastructure Board (PPIB).

Asian shares and Wall Street futures nudged higher on Wednesday amid hopes the worst of the coronavirus in China may have passed, although prevailing uncertainty about the outbreak has kept investors wary.MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.31%. Chinese shares .CSI300 fell 0.12%, but investors in other equity markets looked past this decline. Shares in Hong Kong .HIS rose 0.57% to a three-week high. Australian shares were up 0.52%, while Japan's Nikkei stock index .N225 rose 0.6%.

Talks with the IMF continued as discussions revolved around the need to further revise the revenue target downward. Multiple sources from within the talks confirmed to Dawn that the FBR has proposed up to Rs4.7 trillion as the maximum amount that can be collected this fiscal year whereas the IMF is asking it to aim for Rs4.9tr instead. The gap implied fresh revenue measures totaling Rs200 billion that would need to be announced in the near future if the authorities fail to convince the fund of their limitations. The revenue target for the FBR was originally set at Rs5.5tr in the budget for FY2020. It was then revised downward to Rs5.23 billion in the first review that concluded in December 2019. By the end of that year the revenue authority announced a growing shortfall of Rs287 billion in the first six months of the fiscal year.

Pakistan’s auto sector continued to show dismal performance during the first seven months of 2019-20 with cars sales plunging by 44 per cent year-on-year, reported the data released by Pakistan Automotive Manufacturers Association. The rest of the segments followed as trucks sales dipped by 44.8pc, buses 30.6pc, jeeps 49.7pc, LCVs (pickups) 47.3pc, farm tractors 37.6pc and two- and three-wheelers 11pc. However, the figures for January showed a reverse trend as car sales went up to 10,095 units, edging up 1.08pc over 9,987 units in December 2019 whereas over the seven-month period, they nosedived to 69,192, from 123,391 units in 7MFY20.

The National Power Regulatory Authority (NEPRA) has deferred its hearing on the petition of the Central Power Purchasing Agency (CPPA) for power tariff increase, under fuel price adjustment for the month of November, for ex-Wapda DISCOs as the later has withdrew its petition. During a public hearing by NEPRA on Central Power Purchasing Agency (CPPA) request for power tariff increase by Rs 0.9836, CPPA has requested the regulator not to proceed with hearing as it is working on the draft to change the mechanism for fuel price adjustment(FPA).Apparently the hearing was deferred on the request of the CPPA for making changes to the FPA mechanism but actually it is part of the government plan to keep the electricity prices unchanged for next 18 months, official source told The Nation. The source said that Pakistan has also informed the visiting IMF team about its decision of not increasing power tariff for the power consumers. Legally the government cannot issue directive to NEPRA to keep the prices unchanged but indirectly it will undertake efforts to keep the prices unchanged, the source said.

Pakistan and France on Tuesday signed grant financing agreement worth € 0.5 million for technical assistance to the Private Power & Infrastructure Board (PPIB). Dr Syed Pervaiz Abbas, Secretary Economic Affairs Division (EAD), and Marc BARÉTY, Ambassador of France to Pakistan, along with Philippe Steinmetz, Country Director of the French Agency for Development (AFD), signed the grant financing agreement worth € 0.5 million for technical assistance to the Private Power and Infrastructure Board (PPIB).

Market is expected to remain volatile during current trading session.

Technical Analysis

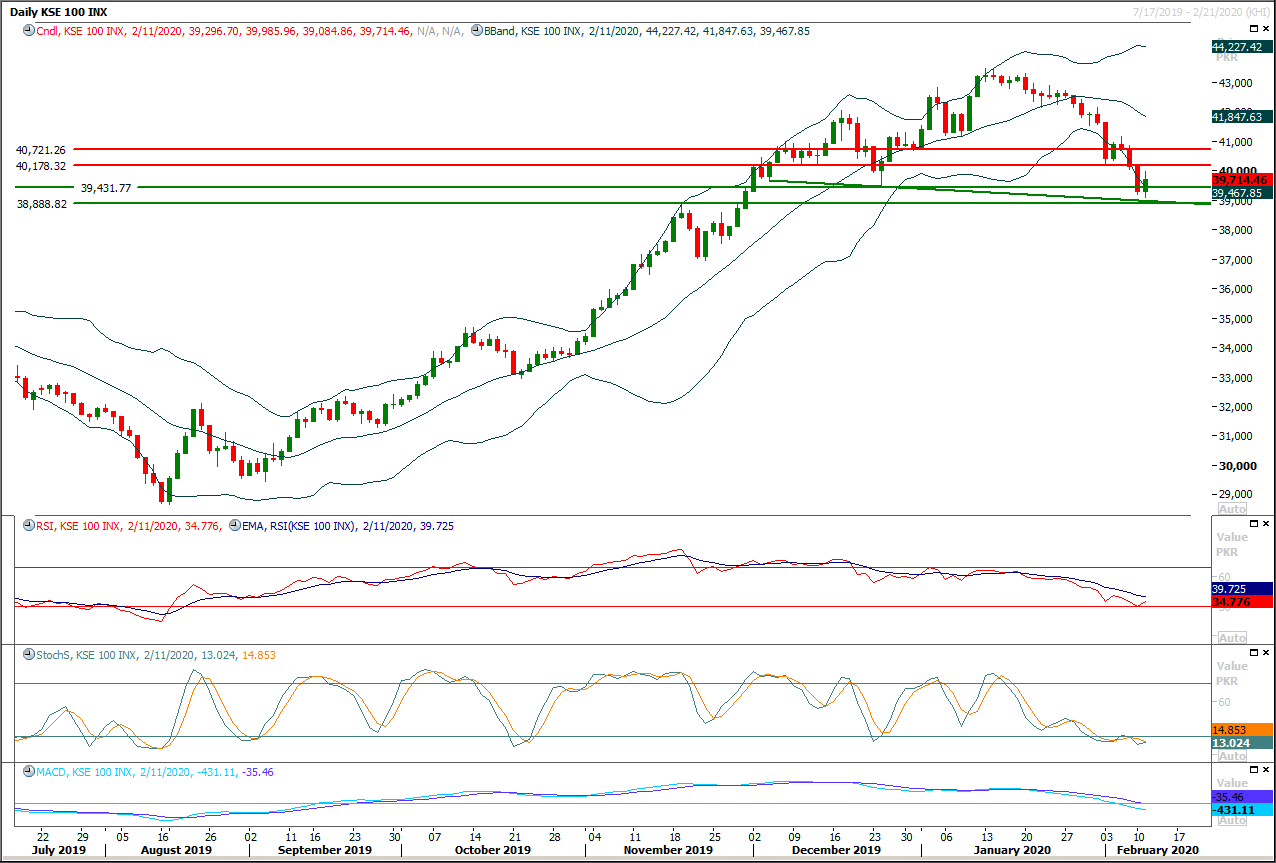

The Benchmark KSE100 index is trying to bounce back after getting support from a descending trend line and have tried to create a piercing line formation on daily chart during last trading session but during averaging mechanism this formation was ruled out. As of now it would face strong resistances at 40,180 points and 40,500 point. Daily momentum indicators are still in bearish mode and if index would not succeed in closing above 40,350 points today than current bullish pull back would be considered a correction of its last bearish run therefore it's recommended to trade cautiously with trailing stop loss. While if index would face rejection from its resistant regions then on intraday it would try to find some ground at 39,450 points and breakout below that region would call for 38,880 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.