Previous Session Recap

Trading volume at PSX floor dropped by 20.39 million shares or 8.29% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43533.11 with a negative gap of -146.76 points, posted a day high of 43826.60 and a day low of 43286.24 during last trading session. The session suspended at 4343808.80 with net change of 128.93 and net trading volume of 80.14 million shares. Daily trading volume of KSE100 listed companies dropped by 16.49 million shares or 17.07% on DoD basis.

Foreign Investors remained in net buying position of 2.3 million shares but net value of Foreign Inflow dropped by 1.53 million US Dollars. Categorically, Foreign Individuals and Overeas Pakistanis remained in net buying positions of 0.02 and 4.54 million shares but Foreign Corporate Investors remained in net selling position of 2.26 million shares. While on the other side Local Individuals, NBFCs, Brokers and Insurance Companies remained in net buying positions of 0.66, 0.18, 2.23 and 1.83 million shares respectively but Local Companies, Banks and Mutual Funds remained in net selling positions of 2.59, 1.76 and 4.18 million shares respectively.

Analytical Review

Asian share markets found a semblance of calm on Monday as S&P futures extended their bounce, though bond investors were still fretting about the risks from looming U.S. inflation data. MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.8 percent, having suffered a 7.3 percent drubbing last week. Both South Korea and China gained 0.8 percent, while Japan’s Nikkei was closed for a holiday. E-Mini futures for the S&P 500 rose 0.5 percent, adding to a late bounce on Friday. Yet a relatively sharp 12 tick drop in Treasury bond futures suggested it was too early to sound an all-clear on volatility. “A massive buildup in market leverage has been partially unwound in the blink of an eye and morphed into something far more broad-based,” said Chris Weston, chief market strategist at broker IG. “One could argue that it is the U.S. bond market that is the driving force, and will remain so through this coming week.”

With an addition of 300,000 gas consumers every year, the country’s gas shortage is estimated to touch four billion cubic feet per day (bcfd) — almost equal to current total supplies — in two years and will go beyond 6.6bcfd by 2030. The projection has been made by the Oil and Gas Regulatory Authority (Ogra) in its “State of the Industry Report 2016-17”. The report also noted a 16 per cent surge in petroleum consumption owing to an increase in the number of cars and motorbikes and lower oil prices as the overall oil consumption rose by 10pc. “The shortfall in gas is expected to reach 3.999bcfd by the fiscal year 2019-20 and the gap will reach 6.611bcfd without imported gas by 2029-30,” Ogra said.

The reliance of K-Electric on national grid will end in next three years as the company hopes to become self sufficient in power generation by 2021. "KE aspires to be self sufficient in power generation by 2021 with upcoming projects including 900MW RLNG based bin Qasim power station III, 700MW coal fired power project, 50MW solar project and few other IPPs, which will end the reliance of the company on the national grid," said K-Electric Chief Marketing & Communication Officer Syed Fakhar Ahmad, while talking to Islamabad based journalists here. The peak demand in K-Electric area is 3200 MW while the availability is 2900 MW and the company has a deficit of 300 MW, he said. Currently, to fill its energy gap, K-Electric is getting around 650 MW electricity from the national grid. During the media visit at KE's Bin Qasim Power Station II, Syed Fakhar Ahmad said that the power utility is committed to dealing with the growing energy challenges of Karachi.

Pakistani IT Industry has repeatedly won international awards and recognition at international forums and become world’s largest and most reputable entities among its regular clients. Pakistan has won GSMA Awards, Spectrum for Mobile Broadband(2015) and Government Leadership Award (2017).Minister of State for IT, Anusha Rehman won the United Nations’ International Telecommunication Union’s Gender Equality and mainstreaming (GEM-TECH) Award in December, 2015. Ministry of Information Technology (MoIT) has also secured a seat in the Governing Council of Asia Pacific Centre for Information and Communication Technology for Development under the UNESCAP. Managing director Pakistan Software Export Board (PSEB) Iftikhar Shah said, at yearly APICTA Awards, Pakistani IT companies had consistently won top awards and several Pakistani IT companies were ranked among the fastest growing companies in the country.

The Sensitive Price Indicator (SPI) based weekly inflation for the week ended on February 08 for the combined income groups witnessed a nominal decrease of 0.03 percent as compared to previous week. The SPI for the week under review in the above mentioned group was recorded at 222.31 points against 222.38 points last week, according to latest data released by Pakistan Bureau of Statistics (PBS). As compared to the corresponding week of last year, the SPI for the combined group in the week under review witnessed increase of 1.66 per cent. The weekly SPI has been computed with base 2007, 2008=100, covering 17 urban centers and 53 essential items for all income groups.

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

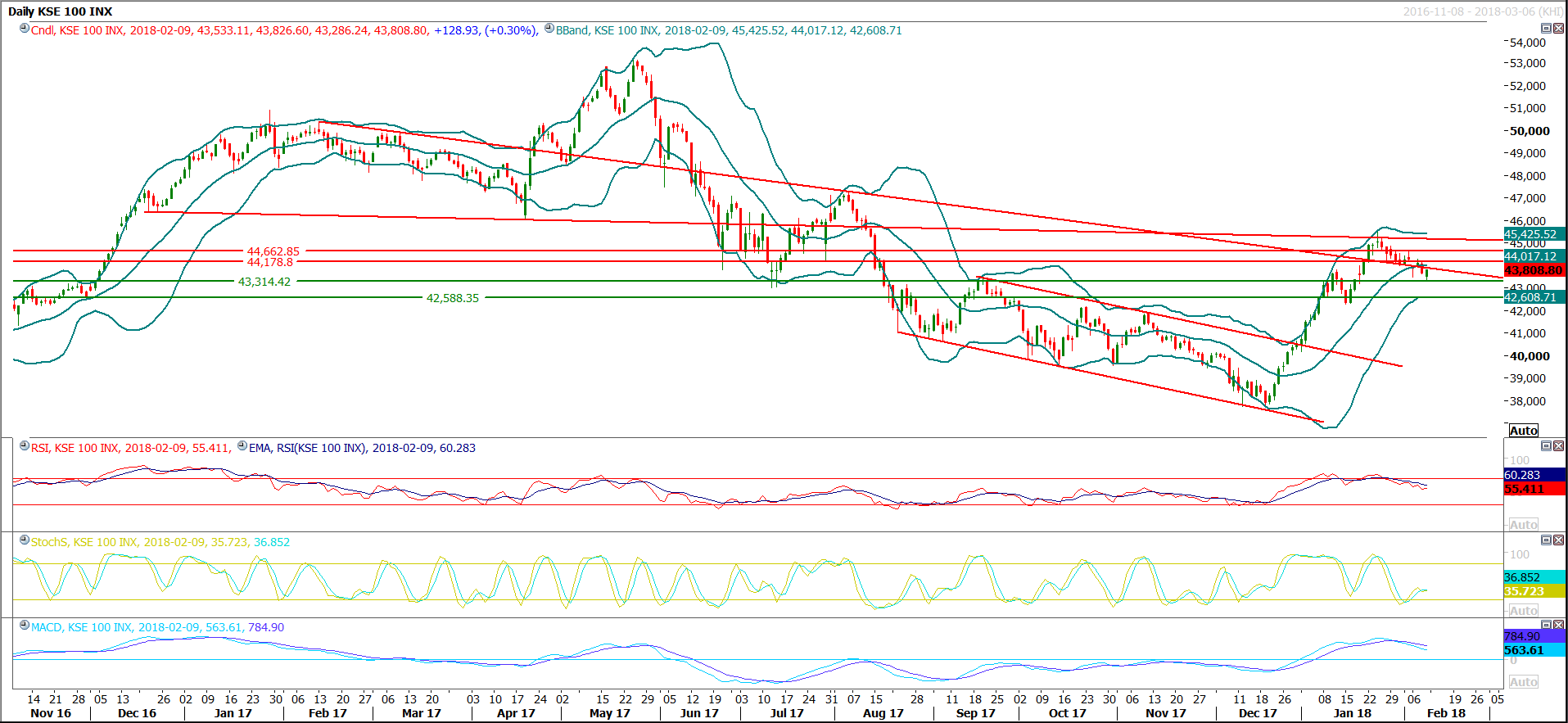

The Benchmark KSE100 Index have bounced back after getting support from a horizontal supportive region but it could not become able to close above the major resistant trend line during last trading session. As of right now index is capped by two major resistant trend lines and to maintain its bullish momentum index would need to open with a positive gap above 43860 but it would get a major resistances again at 44070 and 44178 points from a descending trend line along with a horizontal resistant region. Bullish momentum is expiring on hourly chart therefore its expected that index may take a dip after opening with a positive note during current trading session. Its recommended to initiate selling on strength with strict stop loss of 44178 for day trading. Closing above 44178 would create a space for a spike of more 500 points but its not recommended to initiate new buying until index close above 45200 points because weekly momentum have changed to bearish with closing of last week.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.