Previous Session Recap

Trading volume at PSX floor dropped by 1.13 million shares or 2.77% on DoD basis, whereas the benchmark KSE100 index opened at 33,879.14, posted a day high of 33,957.79 and a day low of 33,724.98 points during last trading session while session suspended at 33,875.40 points with net change of 23.39 points and net trading volume of 23.39 million shares. Daily trading volume of KSE100 listed companies dropped by 2.45 million shares or 9.49% on DoD basis.

Foreign Investors remained in net buying positions of 3.72 million shares and net value of Foreign Inflow increased by 1.73 million US Dollars. Categorically, Foreign Individual and Corporate Investors remained in net buying positions of 0.04 and 4.03 million shares but Overseas Pakistanis remained in net selling positions of 0.34 million shares. While on the other side Local Individuals remained in net buying positions of 37.38 million shares but Local Companies, Banks, Mutual Funds and Brokers remained in net selling positions of 10.43, 2.53 and 27.53 million shares respectively.

Analytical Review

Asian shares ease as Trump rekindles Sino-U.S. trade tensions

Asian shares pulled back on Friday as worries over renewed Sino-U.S. trade tensions weighed on sentiment ahead of the release of June trade data from China, though expectations of a Federal Reserve rate cut later this month kept losses in check. Those bets remained strong despite a rise in U.S. consumer inflation in June, and helped to lift the S&P 500 index to a record closing on Thursday. S&P 500 e-mini futures ESc1 were last up 0.21% at 3,010.25. Federal Reserve Chairman Jerome Powell indicated on Thursday that a rate cut is likely at the Fed’s next meeting as businesses slow investment due to trade disputes and a global growth slowdown. On Friday, MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.05% in early deals, with Australian shares dipping 0.16% and Japan's Nikkei stock index .N225 trimming 0.11%.

FBR launches automation process for facilitation of import of raw materials

Federal Board of Revenue (FBR) has devised an improved system of issuance of Exemption Certificates under Section 148 of the Income Tax Ordinance-2001 particularly for the import of raw material and intermediaries used by industries. This intended system is to be based on Automated Risk Based Mechanism to reduce processing time and in issuance of exemption certificates thereby avoiding unnecessary delays costing the importers. The automated system will require submission of check listed information from the user. The information included material is imported by the industrial undertaking along with picture of the manufacturing factories properly geo-tagged. Material is imported for own use. Any raw material has been substituted for another raw material. Exemption has been applied in respect of raw materials specified in sub section (8) of section 148. This is not the first tax year of the taxpayer. FBR has further devised a procedure which has to be adopted for issuance of exemption under Section-148 for import of raw material.

Government, industry agree on increase in urea prices

The government and fertilizer industry are said to have agreed on increase in urea prices by Rs 110 per bag instead of Rs 210 per bag to pass on recent increase in gas prices and GIDC impact, well-informed sources told Business Recorder. This agreement was reached between the Prime Minister's Adviser on Commerce, Textile, Industries and Production and Investment, Abdul Razak Dawood and the representatives of fertilizer industry. However, a formal announcement of increase in urea prices will be made after Abdul Razak Dawood gets the nod from Prime Minister, Minister in-Charge Industries and Production. The Economic Coordination Committee (ECC) of the Cabinet, in its decision of April 3, 2019 directed Ministry of Industries and Production to review the price mechanism for urea fertilizer. A series of meetings were held with the fertilizer industry wherein the industry was urged not to pass on full impact of gas price increase, i.e. Rs 210 per bag to the farmers on account of revision in gas price. Industry has voluntary decided to absorb Rs 100 per bag on account of anticipated GIDC reduction in future. .

Car sales slide 4.2pc to 207,630 units in FY2019

Sales of passenger cars scaled back 4.22 percent to 207,630 units during the last fiscal year as soft rupee-driven price hikes weakened consumer buying power, analysts said on Thursday. Pakistan Automotive Manufacturers Association (PAMA) data showed that passenger car sales stood at 216,786 units during the preceding fiscal year. In June, car sales remained at 14,767 units, down 4.28 percent month-on-month and decreasing 5.65 percent year-on-year.

Govt softens rules to spur investment in new LNG terminals

The federal government has allowed replacement of Floating Storage & Regasification Unit (FSRU) without any taxation burden in a bid to fast-track the installation of new Liquefied Natural Gas (LNG) terminals in the country, The News has learnt on Thursday . The move, which is a part of efforts relating to increasing energy security, will pave the way for facilitating new investors in setting up LNG terminals on expeditious basis as one of their main concerns regarding early sourcing of FSRU would be alleviated.

Asian shares pulled back on Friday as worries over renewed Sino-U.S. trade tensions weighed on sentiment ahead of the release of June trade data from China, though expectations of a Federal Reserve rate cut later this month kept losses in check. Those bets remained strong despite a rise in U.S. consumer inflation in June, and helped to lift the S&P 500 index to a record closing on Thursday. S&P 500 e-mini futures ESc1 were last up 0.21% at 3,010.25. Federal Reserve Chairman Jerome Powell indicated on Thursday that a rate cut is likely at the Fed’s next meeting as businesses slow investment due to trade disputes and a global growth slowdown. On Friday, MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.05% in early deals, with Australian shares dipping 0.16% and Japan's Nikkei stock index .N225 trimming 0.11%.

Federal Board of Revenue (FBR) has devised an improved system of issuance of Exemption Certificates under Section 148 of the Income Tax Ordinance-2001 particularly for the import of raw material and intermediaries used by industries. This intended system is to be based on Automated Risk Based Mechanism to reduce processing time and in issuance of exemption certificates thereby avoiding unnecessary delays costing the importers. The automated system will require submission of check listed information from the user. The information included material is imported by the industrial undertaking along with picture of the manufacturing factories properly geo-tagged. Material is imported for own use. Any raw material has been substituted for another raw material. Exemption has been applied in respect of raw materials specified in sub section (8) of section 148. This is not the first tax year of the taxpayer. FBR has further devised a procedure which has to be adopted for issuance of exemption under Section-148 for import of raw material.

The government and fertilizer industry are said to have agreed on increase in urea prices by Rs 110 per bag instead of Rs 210 per bag to pass on recent increase in gas prices and GIDC impact, well-informed sources told Business Recorder. This agreement was reached between the Prime Minister's Adviser on Commerce, Textile, Industries and Production and Investment, Abdul Razak Dawood and the representatives of fertilizer industry. However, a formal announcement of increase in urea prices will be made after Abdul Razak Dawood gets the nod from Prime Minister, Minister in-Charge Industries and Production. The Economic Coordination Committee (ECC) of the Cabinet, in its decision of April 3, 2019 directed Ministry of Industries and Production to review the price mechanism for urea fertilizer. A series of meetings were held with the fertilizer industry wherein the industry was urged not to pass on full impact of gas price increase, i.e. Rs 210 per bag to the farmers on account of revision in gas price. Industry has voluntary decided to absorb Rs 100 per bag on account of anticipated GIDC reduction in future. .

Sales of passenger cars scaled back 4.22 percent to 207,630 units during the last fiscal year as soft rupee-driven price hikes weakened consumer buying power, analysts said on Thursday. Pakistan Automotive Manufacturers Association (PAMA) data showed that passenger car sales stood at 216,786 units during the preceding fiscal year. In June, car sales remained at 14,767 units, down 4.28 percent month-on-month and decreasing 5.65 percent year-on-year.

The federal government has allowed replacement of Floating Storage & Regasification Unit (FSRU) without any taxation burden in a bid to fast-track the installation of new Liquefied Natural Gas (LNG) terminals in the country, The News has learnt on Thursday . The move, which is a part of efforts relating to increasing energy security, will pave the way for facilitating new investors in setting up LNG terminals on expeditious basis as one of their main concerns regarding early sourcing of FSRU would be alleviated.

Market is expected to remain volatile during current trading session.

Technical Analysis

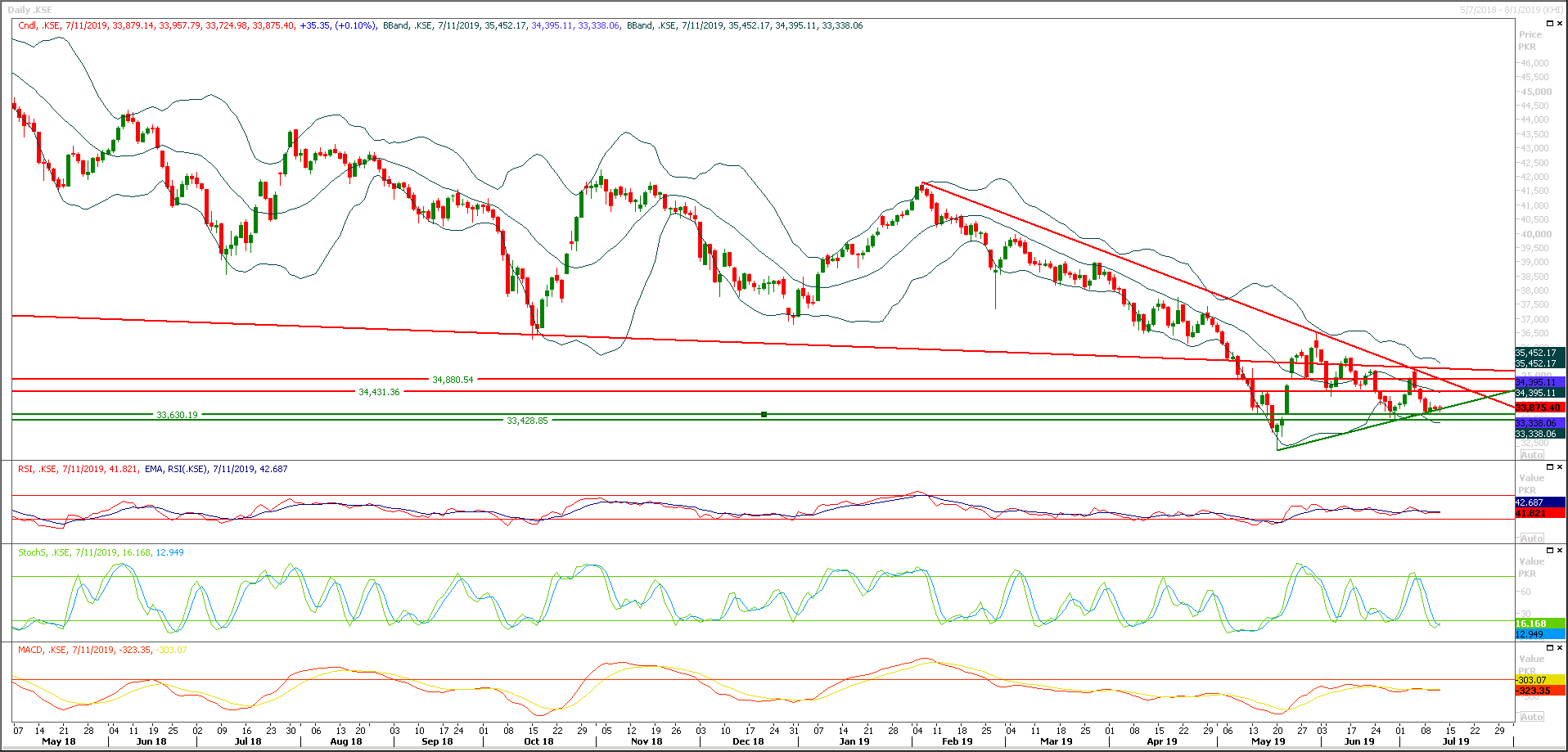

The Benchmark KSE100 Index still not have been succeeded in penetration above its major resistant region of 34,000 points during last three trading sessions and right now it's getting support from a rising trend line along with another horizontal support. Daily and hourly momentum indicators have changed their direction to bullish side as daily Stochastic and MAORSI have generated bullish crossovers. It's recommended to stay cautious during current trading session because if index would succeed in penetration below 33,600 and 33,500 points then a new low would be witnessed in coming days. As of now its recommended to post strict stop loss on long positions and avoid initiating any short positions until index would close below 33,500 points on daily chart. In case of reversal index would face resistance at 34,000 and 34,260 points. Index would remain under pressure until it would succeed in closing above 34,500 points on daily basis.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.