Previous Session Recap

Trading volume at PSX floor dropped by 67.06 million shares or 29.52% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 44,046.00, posted a day high of 44,241.99 and a day low of 43,842.54 during last trading session. The session suspended at 43,931.16 with net change of -16.95 and net trading volume of 104.45 million shares. Daily trading volume of KSE100 listed companies dropped by 65.43 million shares or 38.51% on DoD basis.

Foreign Investors remained in net buying position of 7.45 million shares but net value of Foreign Inflow dropped by 1.42 million US Dollars. Categorically, Foreign Individuals, Foreign Corporate and Overseas Pakistanis investors remained in net buying positions of 0.28, 5.46 and 1.71 million shares. While on the other side Local Individuals, Local Companies, Banks and Insurance Companies remained in net selling positions of 3.56, 2.03, 1.75 and 5.21 million shares but NBFCs, Mutual Fund and Brokers remained in net buying positions of 0.28, 3.95, and 5.21 million shares respectively.

Analytical Review

Stocks choppy, dollar rises as historic Trump-Kim summit starts

The dollar jumped to a 3-week top on Tuesday while stock markets in Asia were choppy as an historic U.S.-North Korea summit got underway in Singapore, raising some hopes it could pave the way to ending a nuclear stand-off on the Korean peninsula. U.S. President Donald Trump and North Korean leader Kim Jong Un smiled for cameras after 41-minutes of one-on-one talks, just months after they traded insults and tensions spiraled in the region over the latter’s nuclear programs. Yet, there was some unease among investors about the outcome of the talks given the tense relations between the two nations. The combatants of the 1950-53 Korean War are technically still at war, as the conflict, in which millions of people died, was concluded only with a truce.

Call to review ban on non-filers from investing in property

Islamabad Chamber of Commerce and Industry (ICCI) Monday called upon the government to review the decision of putting ban on non-filers from purchasing property of Rs5 million and above in budget 2018-19 as it would hit remittances and entail harmful consequences for the economy. Talking to a delegation of Traders Welfare Association, G-8/1 here, acting president ICCI Muhammad Naveed Malik said that every year, overseas Pakistanis were sending remittances of billions of dollars that were playing crucial role in supporting the economy. He said almost 50 percent of the remittances were finding way to property and real estate sector, but the new decision of the government would hit new investment in property sector.

Trade deficit widens to $33.9b in 11 months

Pakistan’s trade deficit swelled to $33.89 billion during eleven months (July 2017 to May 2018) of the ongoing fiscal year (FY2017-18), putting pressure on the country’s foreign exchange reserves, which are already under pressure. The country’s trade deficit went up by 13.4 percent in one year. The trade deficit was recorded at $29.9 billion during the corresponding period of the previous fiscal year (FY2016-17), according to Pakistan Bureau of Statistics (PBS). According to the latest data of Pakistan Bureau of Statistics, Pakistan’s exports enhanced by 32.35 percent to $2.14 billion in May 2018 from $1.62 billion of May 2016. Meanwhile, the imports recorded a growth of 14.77 percent and reached $5.81 billion in May 2018 from $5.1 billion in the same period of the last year. Therefore, the trade deficit was recorded at $3.67 billion in May 2018 as against $3.45 billion of May 2017, showing an increase of 6.5 percent.

Caretaker govt increases prices of petroleum products for remaining days of June

In a surprise move, the caretaker government on Monday announced a considerable increase in the prices of petroleum products for the remaining days of the month of June, DawnNewsTV reported. The price of petrol has been increased by Rs4.26 per litre (4.9%), climbing to Rs91.96, and that of kerosene by Rs4.46 per litre (5.6%), climbing to Rs84.34, read a statement issued by the Finance Division. Moreover, the price of High-Speed Diesel (HSD) has been jacked up by Rs6.55 per litre (6.6%) to reach Rs105.31. The newly announced prices will be effective from June 12 to the midnight on June 30, 2018.

Pakistan keeps its options open

The political blow-back from the news that the interim caretakers are approaching the International Monetary Fund (IMF) for a bailout forced the government to clarify that contact had been made for a routine annual Article IV review and that no decision has yet been taken to return to the Fund’s fold to ease external sector pressures. The caretaker government of Prime Minister Nasirul Mulk has two very challenging tasks for its limited tenure. Besides holding elections it will have to navigate the economy out of a tight corner to ensure future stability. The inclusion of Dr Shamshad Akhtar, an economist and former State Bank of Pakistan (SBP) governor, in the cabinet may help but the situation, in the opinion of experts, is too dire and complex for a quick fix with or without foreign agency involvement.

The dollar jumped to a 3-week top on Tuesday while stock markets in Asia were choppy as an historic U.S.-North Korea summit got underway in Singapore, raising some hopes it could pave the way to ending a nuclear stand-off on the Korean peninsula. U.S. President Donald Trump and North Korean leader Kim Jong Un smiled for cameras after 41-minutes of one-on-one talks, just months after they traded insults and tensions spiraled in the region over the latter’s nuclear programs. Yet, there was some unease among investors about the outcome of the talks given the tense relations between the two nations. The combatants of the 1950-53 Korean War are technically still at war, as the conflict, in which millions of people died, was concluded only with a truce.

Islamabad Chamber of Commerce and Industry (ICCI) Monday called upon the government to review the decision of putting ban on non-filers from purchasing property of Rs5 million and above in budget 2018-19 as it would hit remittances and entail harmful consequences for the economy. Talking to a delegation of Traders Welfare Association, G-8/1 here, acting president ICCI Muhammad Naveed Malik said that every year, overseas Pakistanis were sending remittances of billions of dollars that were playing crucial role in supporting the economy. He said almost 50 percent of the remittances were finding way to property and real estate sector, but the new decision of the government would hit new investment in property sector.

Pakistan’s trade deficit swelled to $33.89 billion during eleven months (July 2017 to May 2018) of the ongoing fiscal year (FY2017-18), putting pressure on the country’s foreign exchange reserves, which are already under pressure. The country’s trade deficit went up by 13.4 percent in one year. The trade deficit was recorded at $29.9 billion during the corresponding period of the previous fiscal year (FY2016-17), according to Pakistan Bureau of Statistics (PBS). According to the latest data of Pakistan Bureau of Statistics, Pakistan’s exports enhanced by 32.35 percent to $2.14 billion in May 2018 from $1.62 billion of May 2016. Meanwhile, the imports recorded a growth of 14.77 percent and reached $5.81 billion in May 2018 from $5.1 billion in the same period of the last year. Therefore, the trade deficit was recorded at $3.67 billion in May 2018 as against $3.45 billion of May 2017, showing an increase of 6.5 percent.

In a surprise move, the caretaker government on Monday announced a considerable increase in the prices of petroleum products for the remaining days of the month of June, DawnNewsTV reported. The price of petrol has been increased by Rs4.26 per litre (4.9%), climbing to Rs91.96, and that of kerosene by Rs4.46 per litre (5.6%), climbing to Rs84.34, read a statement issued by the Finance Division. Moreover, the price of High-Speed Diesel (HSD) has been jacked up by Rs6.55 per litre (6.6%) to reach Rs105.31. The newly announced prices will be effective from June 12 to the midnight on June 30, 2018.

The political blow-back from the news that the interim caretakers are approaching the International Monetary Fund (IMF) for a bailout forced the government to clarify that contact had been made for a routine annual Article IV review and that no decision has yet been taken to return to the Fund’s fold to ease external sector pressures. The caretaker government of Prime Minister Nasirul Mulk has two very challenging tasks for its limited tenure. Besides holding elections it will have to navigate the economy out of a tight corner to ensure future stability. The inclusion of Dr Shamshad Akhtar, an economist and former State Bank of Pakistan (SBP) governor, in the cabinet may help but the situation, in the opinion of experts, is too dire and complex for a quick fix with or without foreign agency involvement.

Market is expected to remain volatile therefore it's recommended to stay cautious while trading today.

Technical Analysis

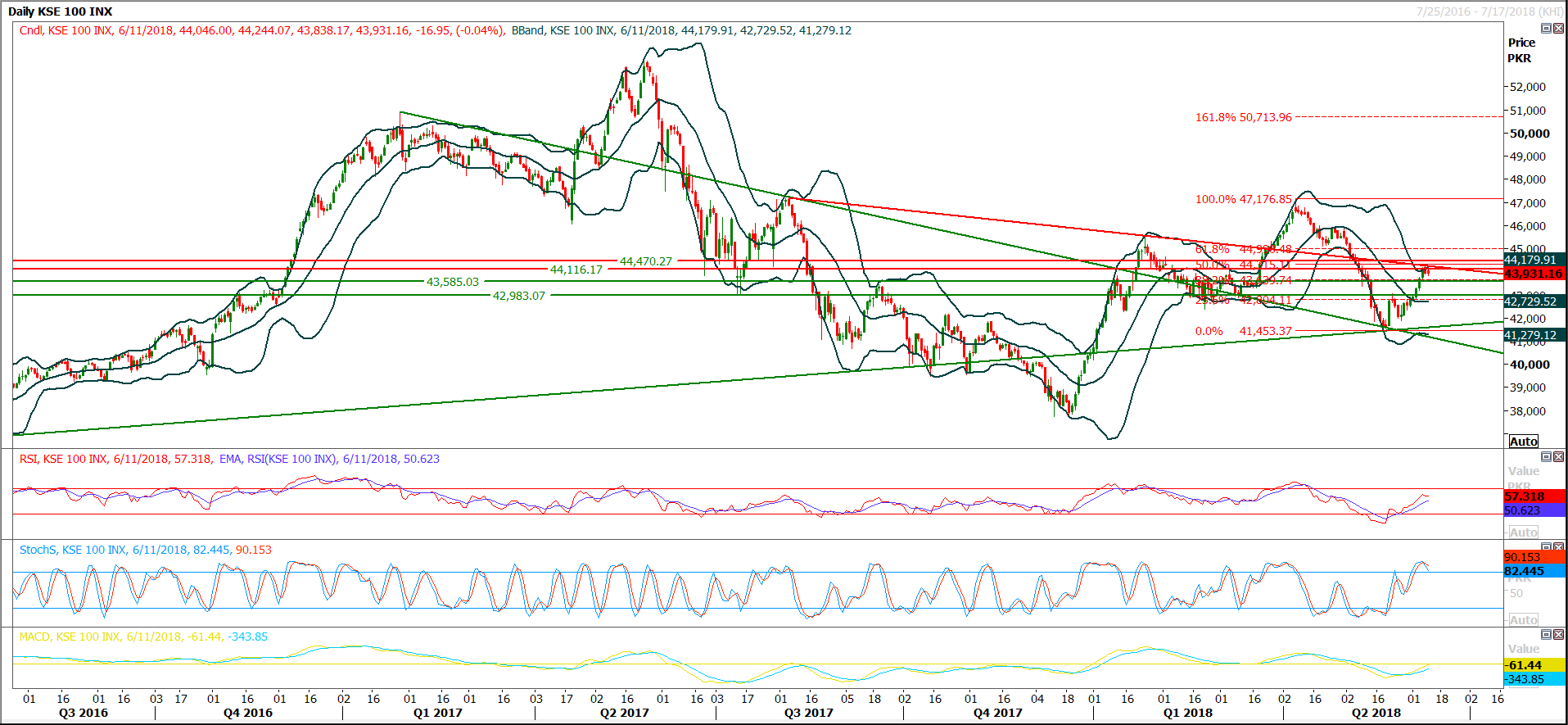

The Benchmark KSE100 Index has completed its 50% correction on daily chart and right now it’s getting resistances from a horizontal resistant region which is falling on said correction level. Daily Momentum indicators are ready to start a new bearish journey because Stochastic have generated a bearish crossover over while MAORSI is ready for that. This week 44,116 and 44,460 points would react as crucial levels and these both levels would try to push index towards 43,580 points where index could find support from a horizontal supportive region, but daily closing below 43,585 would call for a negative trend towards 42,900 points, mean while if index would succeed in penetrating 44,460 points then next targets could be 44,950 and 45,016 points. For current trading session its recommended to initiate selling on strength with strict stop loss.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.