Previous Session Recap

Trading volume at PSX floor dropped by 56.85 million shares or 20.71% on DoD basis, whereas the benchmark KSE100 index opened at 37,902.29, posted a day high of 38,333.09 and a day low of 37,523.29 points during last trading session while session suspended at 37,673.25 points with net change of -22.5 points and net trading volume of 173.82 million shares. Daily trading volume of KSE100 listed companies also dropped by 52.12 million shares or 23.07% on DoD basis.

Foreign Investors remained in net selling positions of 0.35 million shares but value of Foreign Inflow dropped by -0.97 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net long positions of 0.026 and 1.05 million shares but Foreign Corporate remained in net selling positions of 1.42 million shares respectively. While on the other side Local Individuals, Banks, NBFCs and Brokers remained in net selling positions of 15.77, 0.98, 0.07 and 1.29 million shares but Local Companies, Mutual Fund and Insurance Companies remained in net long positions of 7.91, 3.99 and 6.51 million shares respectively.

Analytical Review

Stocks plummet after Trump bans travel from Europe to contain coronavirus blow

Global shares crumbled on Thursday after U.S. President Donald Trump stunned investors by announcing a temporary travel ban from Europe in an effort to curb the spread of the coronavirus, threatening more disruptions to businesses and the world economy.U.S. S&P500 futures ESc1 dived 4.7%, a day after the S&P 500 .SPX lost 4.89%, putting the index firmly in a bear market territory, defined as a 20% fall from a recent top. Euro Stoxx 50 futures STXEc1 sank 5.8% to their lowest levels since mid-2016. “The travel ban from Europe has definitely taken everyone by surprise,” said Khoon Goh, head of Asia Research at ANZ in Singapore. “Already we know the economic impact is significant, and with this additional measure on top it’s just going to multiply the impact across businesses. This is something that markets had not factored in...it’s a huge near-term economic cost.”

Govt indicates Rs100bn cut in PSDP this year

The government on Wednesday indicated about Rs100 billion (15 per cent) cut in the federal development programme this year and a major increase in emoluments of the federal bureaucracy and readjustments in fiscal transfers to the provinces in the coming budget to overcome fiscal challenges. Based on a briefing by Finance Secretary Naveed Kamran Baloch, members of the National Assembly’s Standing Committee on Finance and Revenue also gathered that the government has to take a series of steps during the current month to “complete the second review” with the International Monetary Fund (IMF) for disbursement of $450 million next tranche in April.

Pakistan’s exports to China up 1.8pc in 7 months

Pakistan’s exports of goods and services to China grew by 1.80 percent during the first seven months of financial year (2019-20) compared to the corresponding period of last year, State Bank of Pakistan (SBP) reported. The overall exports to China were recorded at $1056.773 million during July-January (2019-20) against exports of $1038.023 million during July-January (2018-19), PBS data revealed. On the other hand, the imports from China into the country during the period were recorded at $5794.114 million against $5941.554 million last year, showing negative growth of 2.48 percent in first seven months of this year.

ECC approves special relief package

The Economic Coordination Committee (ECC) of the Cabinet has approved a special relief package to further continue provision of subsidised electricity until June 2020 to five export oriented sectors. The ECC meeting, chaired by Adviser to the Prime Minister on Finance and Revenue Dr. Abdul Hafeez Shaikh, has approved the proposal of Power Division to announce relief package for providing subsidized electricity. Export industries and a ministerial committee had recently reached to an agreement over energy tariffs.

NA body defers five govt’s bills due to absence of Hafeez

The National Assembly Standing Committee on Finance and Revenue has deferred five government’s bills as protest due to the absence of Adviser to the Prime Minister on Finance and Revenue Abdul Hafeez Shaikh. The committee on February 27 had decided that it would not consider the government bills in the absence of Hafeez Shaikh who normally does not attend the meetings of parliamentary committees. The adviser has once again not attended the yesterday’s meeting. Therefore, the committee, which met under the chairmanship of Faiz Ullah, MNA, decided to defer to discuss five government’s five bills. The bills included The Tax Laws (Amendment) ordinance, the SBP banking services corporation (Amendment) bill 2019, the Post Office cash certificate (amendment) bill 2020, the Post Office National Savings certificate (amendment) and the Government Savings Bank (amendment) bill 2020.

Global shares crumbled on Thursday after U.S. President Donald Trump stunned investors by announcing a temporary travel ban from Europe in an effort to curb the spread of the coronavirus, threatening more disruptions to businesses and the world economy.U.S. S&P500 futures ESc1 dived 4.7%, a day after the S&P 500 .SPX lost 4.89%, putting the index firmly in a bear market territory, defined as a 20% fall from a recent top. Euro Stoxx 50 futures STXEc1 sank 5.8% to their lowest levels since mid-2016. “The travel ban from Europe has definitely taken everyone by surprise,” said Khoon Goh, head of Asia Research at ANZ in Singapore. “Already we know the economic impact is significant, and with this additional measure on top it’s just going to multiply the impact across businesses. This is something that markets had not factored in...it’s a huge near-term economic cost.”

The government on Wednesday indicated about Rs100 billion (15 per cent) cut in the federal development programme this year and a major increase in emoluments of the federal bureaucracy and readjustments in fiscal transfers to the provinces in the coming budget to overcome fiscal challenges. Based on a briefing by Finance Secretary Naveed Kamran Baloch, members of the National Assembly’s Standing Committee on Finance and Revenue also gathered that the government has to take a series of steps during the current month to “complete the second review” with the International Monetary Fund (IMF) for disbursement of $450 million next tranche in April.

Pakistan’s exports of goods and services to China grew by 1.80 percent during the first seven months of financial year (2019-20) compared to the corresponding period of last year, State Bank of Pakistan (SBP) reported. The overall exports to China were recorded at $1056.773 million during July-January (2019-20) against exports of $1038.023 million during July-January (2018-19), PBS data revealed. On the other hand, the imports from China into the country during the period were recorded at $5794.114 million against $5941.554 million last year, showing negative growth of 2.48 percent in first seven months of this year.

The Economic Coordination Committee (ECC) of the Cabinet has approved a special relief package to further continue provision of subsidised electricity until June 2020 to five export oriented sectors. The ECC meeting, chaired by Adviser to the Prime Minister on Finance and Revenue Dr. Abdul Hafeez Shaikh, has approved the proposal of Power Division to announce relief package for providing subsidized electricity. Export industries and a ministerial committee had recently reached to an agreement over energy tariffs.

The National Assembly Standing Committee on Finance and Revenue has deferred five government’s bills as protest due to the absence of Adviser to the Prime Minister on Finance and Revenue Abdul Hafeez Shaikh. The committee on February 27 had decided that it would not consider the government bills in the absence of Hafeez Shaikh who normally does not attend the meetings of parliamentary committees. The adviser has once again not attended the yesterday’s meeting. Therefore, the committee, which met under the chairmanship of Faiz Ullah, MNA, decided to defer to discuss five government’s five bills. The bills included The Tax Laws (Amendment) ordinance, the SBP banking services corporation (Amendment) bill 2019, the Post Office cash certificate (amendment) bill 2020, the Post Office National Savings certificate (amendment) and the Government Savings Bank (amendment) bill 2020.

Market is expected to remain volatile during current trading session.

Technical Analysis

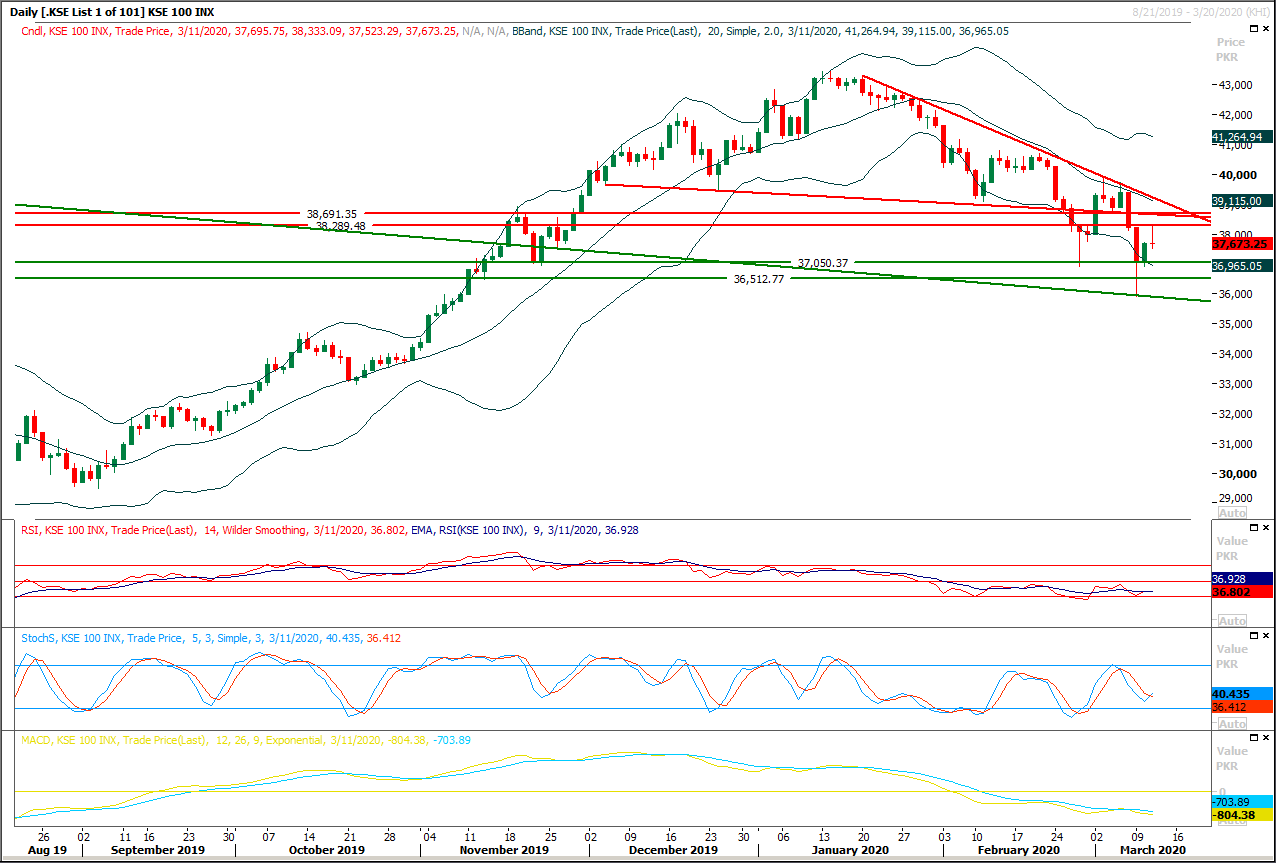

The Benchmark KSE100 index have faced rejection from 61.8% correction of its last bearish rally during last trading session and it's expected that index would now continue its bearish trend again for expansion of this correction. It's expected that index would take a dip towards 37,050 points during current trading session and breakout below that region would add pressure on index to move further downward. It's recommended to start short selling with strict stop loss of 38,280 points and targets at 36,500 points. Weekly and monthly momentum is seriously bearish and these would try to push index to post a new monthly low below 36,000 points. While on flipside in case of any bullish spike index would face strong resistances at 38,280 and 38,660 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.