Previous Session Recap

Trading volume at PSX floor increased by 62.78 million shares or 18.76%,DoD basis, whereas the Benchmark KSE100 Index opened at 51345.27 with a positive gap of 241.74 points, posted a day high of 51506.96 and a day low of 51274.89 during the last trading session. The session suspended at 51426.01 with a net change of 322.48 points and a net trading volume of 111.85 million shares. Daily trading volume of KSE100 listed companies increased by 15.36 million shares or 15.92%, DoD basis.

Foreign Investors remained in a net buying position of 6.13 million shares but the net value of Foreign Inflow dropped by 3.99 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistani Investors remained in net buying positions of 0.039, 3.92 and 2.17 million shares, respectively. On the other side, Local Individuals, Companies, NBFCs and Brokers remained in net buying positions of 5.99, 2.34, 0.32 and 5.11 million shares respectively, but Banks and Mutual Funds remained in net selling positions of 12.22 and 6.09 million shares.

Analytical Review

Asian shares inched up Friday, hobbled by a downbeat day on Wall Street but still on track for weekly rises, while oil prices extended gains on hopes for output cuts. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.1 percent, shy of nearly two-year highs probed in the previous session but still up 1.8 percent for the week. Japanese Nikkei stock index .N225 slipped 0.4 percent in early trading. U.S. stocks fell on Thursday after several large department stores reported worse-than-expected sales drops while Macy (M.N) released results for a dismal quarter, and political drama in Washington continued to unsettle investors.

Showing signs of a popular budget ahead of the next year’s general election, the government on Thursday decided to maximize spending in 2017-18 with a six per cent growth target for the national economy. As a consequence, Prime Minister Nawaz Sharif agreed to relax the limit for the fiscal deficit for the next three years. Incentives will be provided to the farmers’ community and key investments will focus on the China-Pakistan Economic Corridor (CPEC), energy, communications and poverty reduction, according to an official announcement.

A strike being observed by intercity goods carriers has started to affect exports and industrial activity as consignments fail to reach port in time. Many exporters told Dawn that their export consignments have started to miss shipping deadlines as truckers kept their vehicles off the road for the fourth day on Thursday in protest at a Sindh High Court’s (SHC) order restricting their movement in Karachi.

Sindh Minister for Excise and Taxation & Narcotics Control Mukesh Kumar Chawla has said that Excise and Taxation department has collected Rs46,767.966 million in terms of various taxes in last ten months from July 2016 to April 2017, as compared to Rs39,457.588 millions collected in the same period of last year. The minister stated this while presiding over a departmental meeting here in his office on Thursday. Excise and Taxation & Narcotics Control Secretary Abdul Haleem Shaikh and Director General Shoaib Ahmed Siddiqui also attended the meeting.

The total liquid foreign reserves held by the country stood at $20,790.5 million on May 05. The weekly break-up of the foreign reserves position showed that foreign reserves held by the State Bank of Pakistan stood at $15,912.5 million while net foreign reserves held by commercial banks are $4,878.0 million. During the week ending 5th May, SBP’s reserves decreased by $149 million to $15,913 million. The decrease in reserves is attributed to external debt servicing.

Today ATRL, DSL, EFERT and HBL may lead the market in the positive direction.

Technical Analysis

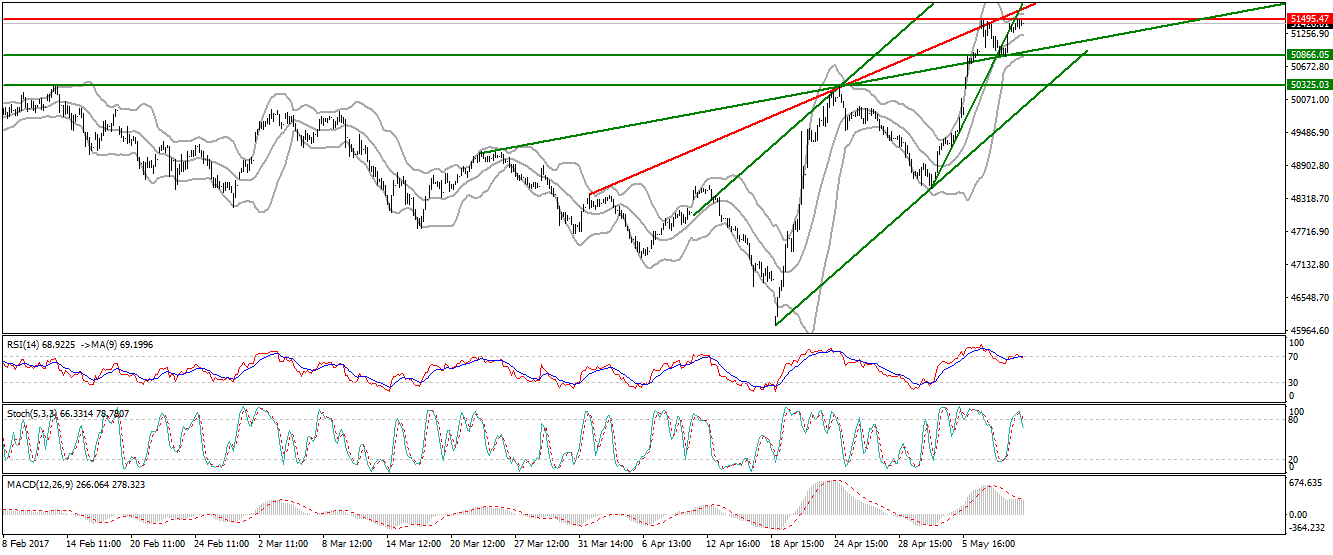

The Benchmark KSE100 Index is finding support from its previous resistant trend line but is still capped by a resistant trend line along with a horizontal line, so it is recommended to sell on strength. As it has penetrated its supportive trend line in downwards direction, hence it is likely to react as a resistance at 51256 along with horizontal resistance at 51465. Breakout of 50830 will call for a bearish momentum towards 50330.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.