Previous Session Recap

Trading volume at PSX floor dropped by 5.07 million shares or 2.26% on DoD basis, whereas the Benchmark KSE100 index opened at 41,332.75, posted a day high of 41,567.19 and day low of 41,208.35 points during last trading session while session suspended at 41,388.88 with net change of 21.50 points and net trading volume of 139.98 million shares. Daily trading volume of KSE100 listed companies dropped by 6.56 million shares or 4.92% on DoD basis.

Foreign Investors remained in net selling position of 7.82 million shares and net value of Foreign Inflow dropped by 6.57 million US Dollars. Categorically, Foreign Individuals and Corporate remained in net selling positions of 0.11 and 7.78 million shares but Overseas Pakistani investors remained in net buying positions of 0.07 million shares respectively. While on the other side Local Individuals, Banks and Insurance Companies remained in net selling positions of 15.90, 0.02 and 5.26 million shares respectively but Local Companies, NBFCs, Mutual Fund and Brokers remained in net buying positions of 14.93, 0.13, 10.94 and 5.50 million shares respectively.

Analytical Review

Asia stocks pressured on global growth worries, oil woes

Asian shares fell on Monday, extending weakness in global equity markets at the end of last week as soft Chinese economic data and falling oil prices rekindled anxiety about the outlook for world growth. MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.17 percent in early trade. Australian shares were down 0.08 percent, while Japan’s Nikkei stock index eased 0.12 percent. A combination of weak factory-gate inflation data in China and low oil prices weighed on global stocks on Friday, dragging MSCI’s gauge of global stocks to its worst day in two weeks. The index was last 0.11 percent lower.

Japanese bike assemblers jack up prices up to Rs6,000

Amid rupee devaluation Japanese bike assemblers have once again raised their prices up to Rs 6,000 which have pushed up cost of imported parts. The new prices of Suzuki GR-150, GD-110 S, GS-150 and GS-150 SE are Rs 235,000, Rs 150,000, Rs 155,000 and Rs 175,000 as compared to old prices Rs 229,000, Rs 145,000, Rs 150,000 and Rs 170,000. Similarly Honda has also raised the rates of its bikes by up to Rs 4000. The new prices of Atlas Honda CD-70, CD-70 Dream, Honda Prider, CB-150 F and are Rs 65,900, Rs 69, 900, Rs 91, 400 and Rs 176, 000 as compared to Rs 65,500, Rs 68,900, Rs 90,900 and Rs 172,00. While the prices of Honda CG-125, and CB-250 F was not changed. Honda has also decided to increase its production capacity and will be spending a hefty amount of 15 million dollar in this regard. According to Pak Wheels, last three months, Suzuki Company has performed well in the local market and has sold 5,660 bikes units.

Consumer companies profitability down 16pc

Pakistan consumer companies (Staples & Discretionary) posted 16 percent YoY decline in profits, steepest in last five quarters, mainly due to poor performance of consumer staples. Staples profits fell 23 percent YoY in Sep 2018 Qtr (excluding PKGS). While overall sales grew by 4 percent YoY (staple sales flat) in Sep Qtr 2018, profits were down owing to contraction in gross margins which fell by 314bps YoY to 27 percent. Staples and discretionary GP margins fell by 259bps and 271bps to 34 percent and 15 percent, respectively.

Thar mining and power project’s 1st phase to become operational next year

The first phase of Thar mining and power project , one of the important energy projects in Pakistan, is scheduled to be put into operation next year, benefiting two million local people, according to its building contractor, China Machinery Engineering Corp (CMEC). The project was started in April 2016 and is planned to be completed in October 2019, as the first coal and power integration project under the China-Pakistan Economic Corridor (CPEC), China Daily reported.

Rs1.09 billion released for CPEC projects under PSDP 2018-19

The Federal government has released Rs 1.09 billion for the China Pakistan Economic Corridor (CPEC) projects under its Public Sector Development Programme (PSDP) 2018-19. According to latest data released by Ministry of Planning, Development and Reform, for a project of construction of KKH Phase-II Havelian-Thakot (118.057 KM) part of CPEC-revised, the government has so far released Rs 500 million out of its allocation of Rs 22.8 billion for the current fiscal year.

Asian shares fell on Monday, extending weakness in global equity markets at the end of last week as soft Chinese economic data and falling oil prices rekindled anxiety about the outlook for world growth. MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.17 percent in early trade. Australian shares were down 0.08 percent, while Japan’s Nikkei stock index eased 0.12 percent. A combination of weak factory-gate inflation data in China and low oil prices weighed on global stocks on Friday, dragging MSCI’s gauge of global stocks to its worst day in two weeks. The index was last 0.11 percent lower.

Amid rupee devaluation Japanese bike assemblers have once again raised their prices up to Rs 6,000 which have pushed up cost of imported parts. The new prices of Suzuki GR-150, GD-110 S, GS-150 and GS-150 SE are Rs 235,000, Rs 150,000, Rs 155,000 and Rs 175,000 as compared to old prices Rs 229,000, Rs 145,000, Rs 150,000 and Rs 170,000. Similarly Honda has also raised the rates of its bikes by up to Rs 4000. The new prices of Atlas Honda CD-70, CD-70 Dream, Honda Prider, CB-150 F and are Rs 65,900, Rs 69, 900, Rs 91, 400 and Rs 176, 000 as compared to Rs 65,500, Rs 68,900, Rs 90,900 and Rs 172,00. While the prices of Honda CG-125, and CB-250 F was not changed. Honda has also decided to increase its production capacity and will be spending a hefty amount of 15 million dollar in this regard. According to Pak Wheels, last three months, Suzuki Company has performed well in the local market and has sold 5,660 bikes units.

Pakistan consumer companies (Staples & Discretionary) posted 16 percent YoY decline in profits, steepest in last five quarters, mainly due to poor performance of consumer staples. Staples profits fell 23 percent YoY in Sep 2018 Qtr (excluding PKGS). While overall sales grew by 4 percent YoY (staple sales flat) in Sep Qtr 2018, profits were down owing to contraction in gross margins which fell by 314bps YoY to 27 percent. Staples and discretionary GP margins fell by 259bps and 271bps to 34 percent and 15 percent, respectively.

The first phase of Thar mining and power project , one of the important energy projects in Pakistan, is scheduled to be put into operation next year, benefiting two million local people, according to its building contractor, China Machinery Engineering Corp (CMEC). The project was started in April 2016 and is planned to be completed in October 2019, as the first coal and power integration project under the China-Pakistan Economic Corridor (CPEC), China Daily reported.

The Federal government has released Rs 1.09 billion for the China Pakistan Economic Corridor (CPEC) projects under its Public Sector Development Programme (PSDP) 2018-19. According to latest data released by Ministry of Planning, Development and Reform, for a project of construction of KKH Phase-II Havelian-Thakot (118.057 KM) part of CPEC-revised, the government has so far released Rs 500 million out of its allocation of Rs 22.8 billion for the current fiscal year.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

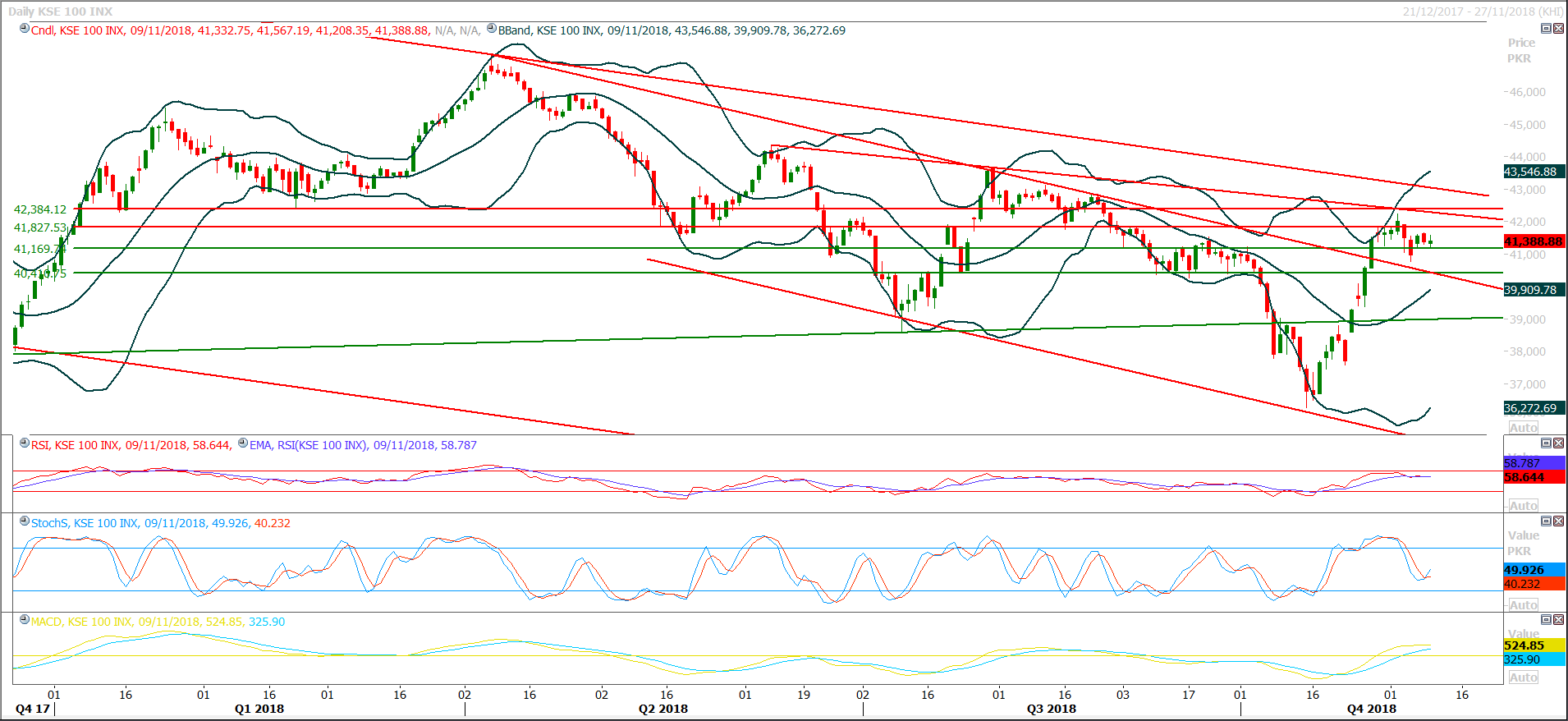

Technical Analysis

The Benchmark KSE100 Index is caged between 40,500 and 42,300 points since last week and these regions are gaining strength with every passing day. As of now it’s expected that index would try to find support above 41,000 points if it would not become able to open below 41,160 points with a negative gap during current trading session. In case of any bullish pull back index would face strong resistances at 41,830 and 42,300 points during current trading session. It’s recommended to start profit taking or selling on strength with strict stop loss of 41,830 points during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.